Market Trends and Forecasts

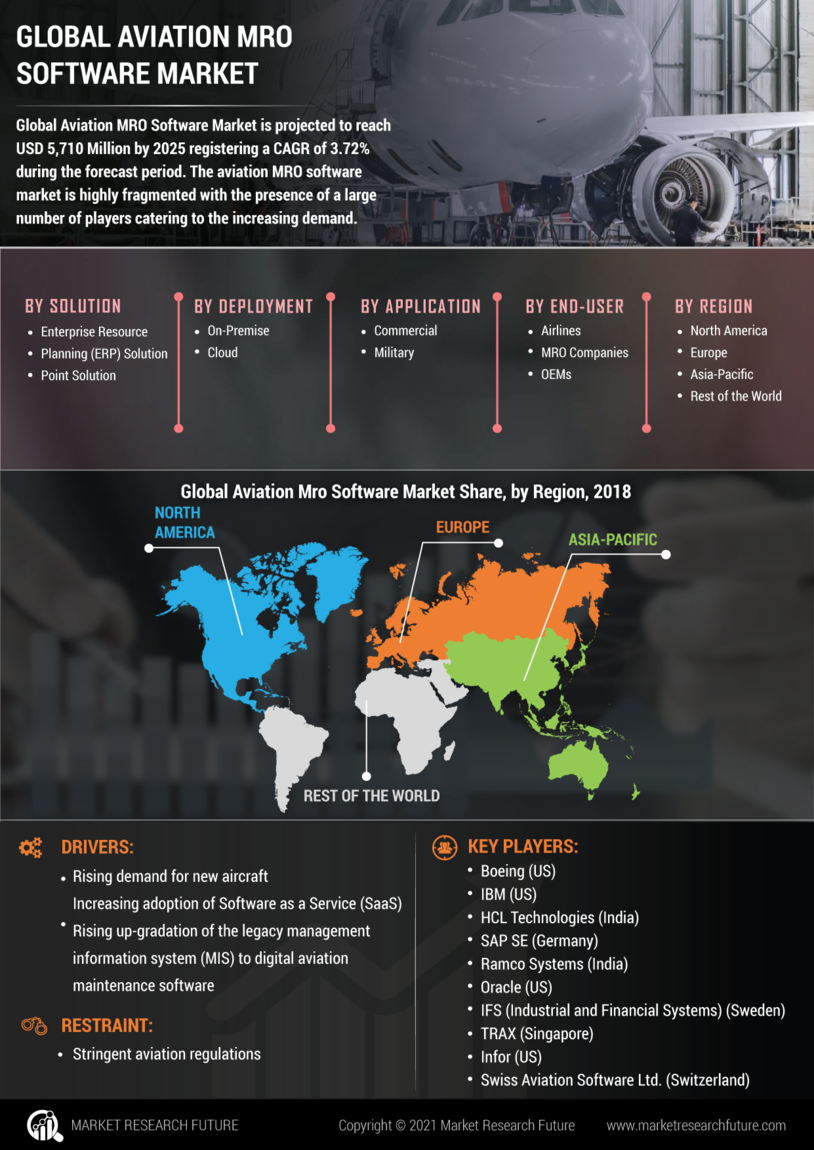

The Global Aviation MRO Software Industry is characterized by various trends and forecasts that shape its future landscape. Key trends include the increasing adoption of cloud-based solutions, the integration of advanced analytics, and the growing emphasis on sustainability in aviation operations. These trends are expected to influence market dynamics significantly, with projections indicating a compound annual growth rate of 4.87% from 2025 to 2035. As the industry adapts to these changes, stakeholders must remain vigilant in monitoring emerging trends to capitalize on new opportunities and navigate potential challenges.

Growing Focus on Cost Efficiency

Cost efficiency remains a paramount concern for airlines and aviation operators, significantly influencing the Global Aviation MRO Software Industry. With rising operational costs, organizations are increasingly turning to MRO software solutions to optimize maintenance processes and reduce expenditures. By streamlining workflows and improving resource allocation, these software solutions enable companies to achieve substantial cost savings. As the market evolves, the emphasis on cost-effective maintenance strategies is likely to drive further adoption of MRO software, fostering a competitive landscape that prioritizes efficiency and profitability.

Expansion of the Global Aviation Market

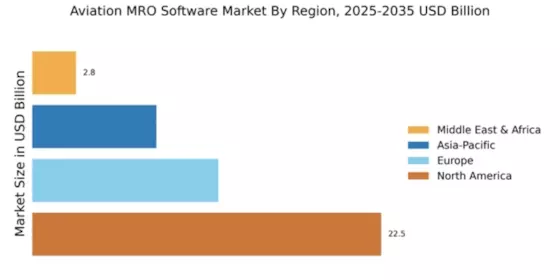

The expansion of the global aviation market serves as a significant catalyst for the Global Aviation MRO Software Industry. As emerging economies invest in their aviation infrastructure and the demand for air travel continues to rise, the need for efficient maintenance solutions becomes increasingly apparent. This growth is reflected in the projected increase in market size from 7.49 USD Billion in 2024 to 12.6 USD Billion by 2035. The burgeoning aviation sector necessitates robust MRO software to manage the complexities of maintenance operations, thereby driving market growth and innovation.

Increasing Demand for Aircraft Maintenance

The Global Aviation MRO Software Industry experiences a notable surge in demand for aircraft maintenance services. As the global fleet of commercial and cargo aircraft expands, airlines and operators are increasingly investing in advanced MRO software solutions to enhance operational efficiency and ensure compliance with safety regulations. In 2024, the market is projected to reach 7.49 USD Billion, reflecting the industry's commitment to maintaining high safety standards. This trend is likely to continue, with the market expected to grow to 12.6 USD Billion by 2035, indicating a robust growth trajectory driven by the need for reliable maintenance solutions.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers of the Global Aviation MRO Software Industry. Governments and aviation authorities worldwide impose stringent regulations to ensure the safety and reliability of aircraft operations. MRO software solutions assist organizations in adhering to these regulations by providing tools for tracking maintenance schedules, documenting repairs, and ensuring compliance with safety protocols. As the aviation industry continues to prioritize safety, the demand for MRO software that facilitates compliance is expected to rise. This trend not only enhances operational safety but also contributes to the overall growth of the market.

Technological Advancements in MRO Solutions

Technological advancements play a pivotal role in shaping the Global Aviation MRO Software Industry. Innovations such as predictive maintenance, artificial intelligence, and the Internet of Things are revolutionizing how maintenance operations are conducted. These technologies enable airlines to anticipate maintenance needs, thereby reducing downtime and operational costs. As a result, MRO software solutions are becoming increasingly sophisticated, allowing for real-time data analysis and improved decision-making. The integration of these technologies is expected to contribute to a compound annual growth rate of 4.87% from 2025 to 2035, underscoring the importance of technology in driving market growth.