Market Trends

Key Emerging Trends in the Aviation MRO Software Market

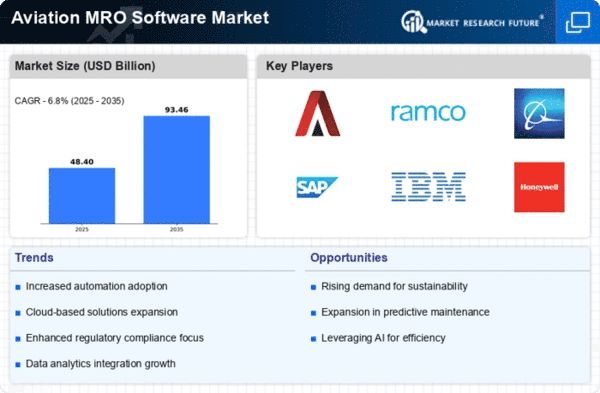

In the aviation MRO software industry, there are a number of significant trends that reflect how aircraft maintenance operations evolve. One major occurrence is the increased implementation of cloud-based MRO software solutions. Cloud computing provides superior accessibility, scalability and flexibility that allow aviation MRO companies to have their operations streamlined more efficiently. The use of cloud-based solutions enables real time collaboration, data sharing and remote access to crucial information that contributes greatly in matters pertaining to decision making processes as well the overall operational efficiency. Predictive maintenance using Internet of Things (IoT) technologies is another important trend in the aviation MRO software market. IoT sensors that have been placed on aircraft and many other components are always collecting data about equipment health and performance. The MRO software that uses IoT analytics can foresee potential problems and allow maintenance teams to respond in a proactive manner before the issues escalate. This tendency not only improves the safety and reliability of aircrafts, but also it helps to save costs at the same time as reducing unplanned maintenance events reduces associated downtime. The industry is moving towards more overall, integrated MRO software solutions that cover a wide range of functions. Modern MRO software systems are developed to perform the maintenance operations of several areas such as inventory control, tracking work orders and meeting regulations. This trend indicates that the industry requires integrated systems that present a comprehensive perspective of maintenance processes, simplifying management for managing independent software solutions and aligning various aspects of MRO operations effectively. Another major trend that is taking shape in the Aviation MRO Software market involves the integration of Artificial Intelligence (AI) and Machine Learning (ML). AI and ML algorithms are used to analyse historical maintenance data for revealing patterns and trends that facilitate more precise predictive analytics. These technologies provide MRO organizations with the ability to optimize maintenance schedules, predict component failures and improve overall fleet reliability. The use of AI and ML in MRO software is consistent with the industry’s mission to make decisions based on data, increase efficiency. As cybersecurity issues are on the rise, increased attention is being paid to data security and compliance in the Aviation MRO Software market. MRO software plays an important role in that sensitive information and critical systems depend on it, which is why the industry spends considerable resources to build solid cybersecurity infrastructure against possible attacks.

Leave a Comment