Growing Focus on Sustainability

Sustainability is becoming an increasingly important consideration within the US Aviation MRO Software Market. As environmental regulations tighten, aviation companies are seeking software solutions that help reduce their carbon footprint. Mro software can facilitate more efficient resource management, waste reduction, and energy conservation. This shift towards sustainable practices is not only driven by regulatory requirements but also by consumer demand for greener operations. Companies that adopt sustainable Mro practices are likely to gain a competitive edge, thereby propelling the growth of the market as they invest in software that supports these initiatives.

Expansion of the Aviation Sector

The expansion of the aviation sector in the United States is a significant driver for the US Aviation MRO Software Market. With increasing passenger traffic and the growth of cargo operations, there is a heightened need for efficient maintenance solutions. The Federal Aviation Administration has reported a steady increase in the number of registered aircraft, which correlates with a growing demand for Mro services. This expansion necessitates the implementation of robust software solutions to manage maintenance operations effectively. As the aviation sector continues to grow, the demand for Mro software is expected to rise correspondingly, creating opportunities for software providers.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the US Aviation MRO Software Market. These technologies enable predictive maintenance, allowing organizations to anticipate equipment failures before they occur. By leveraging data analytics, Mro software can optimize maintenance schedules and reduce downtime, which is critical in a highly competitive market. The potential for cost savings and improved operational efficiency is driving the adoption of these technologies. As airlines and maintenance providers seek to enhance their service offerings, the incorporation of advanced technologies into Mro software solutions is expected to be a key market driver.

Increasing Demand for Efficient Operations

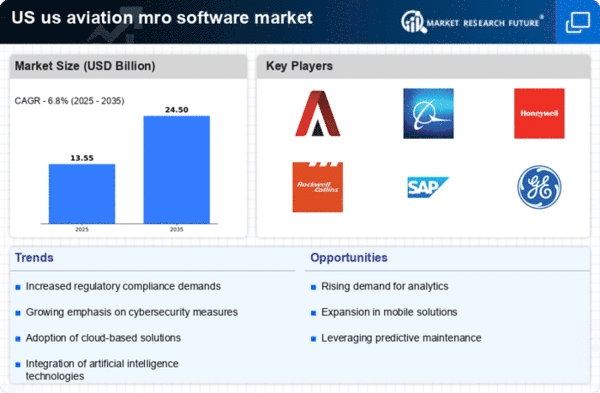

The US Aviation MRO Software Market is experiencing a surge in demand for efficient operational processes. Airlines and maintenance organizations are increasingly adopting software solutions that streamline maintenance, repair, and overhaul operations. This trend is driven by the need to reduce operational costs and improve turnaround times. According to industry reports, the market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is indicative of a broader shift towards digital transformation within the aviation sector, where software solutions are seen as essential for enhancing productivity and ensuring compliance with regulatory standards.

Regulatory Compliance and Safety Standards

In the US Aviation MRO Software Market, adherence to stringent regulatory compliance and safety standards is paramount. The Federal Aviation Administration (FAA) mandates rigorous maintenance protocols, which necessitate the use of advanced software solutions to ensure compliance. Mro software assists organizations in tracking maintenance schedules, documenting repairs, and managing safety audits. As regulations evolve, the demand for software that can adapt to these changes is likely to increase. This focus on compliance not only enhances safety but also mitigates the risk of costly penalties associated with non-compliance, thereby driving the market forward.