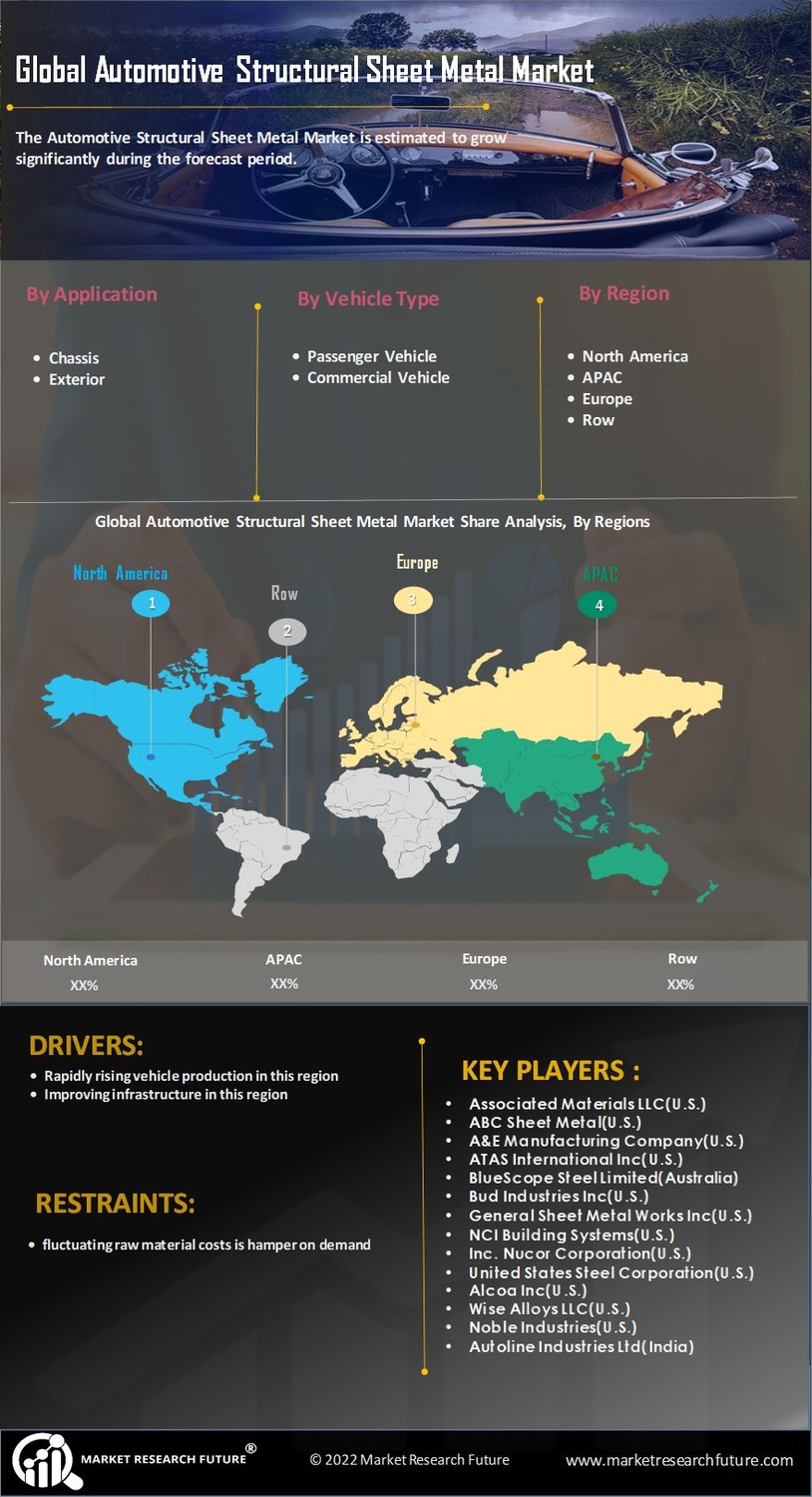

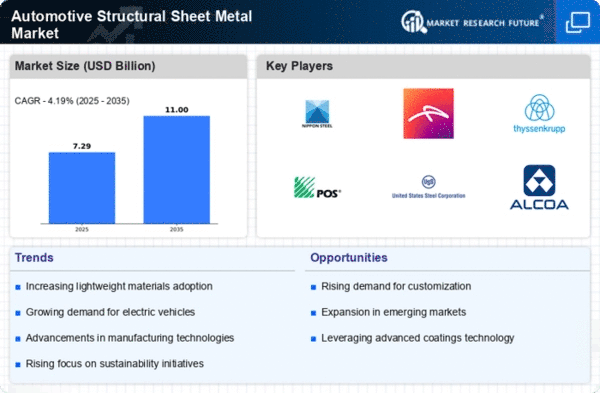

Market Growth Projections

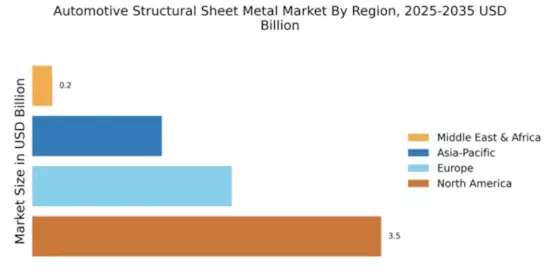

The Global Automotive Structural Sheet Metal Market Industry is projected to experience substantial growth, with forecasts indicating a rise from 17.4 USD Billion in 2024 to 26.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 3.83% from 2025 to 2035, reflecting the industry's adaptability to changing market dynamics and consumer preferences. The increasing integration of advanced materials and manufacturing technologies is likely to drive this expansion, as automotive manufacturers seek to enhance vehicle performance while adhering to regulatory standards. The market's evolution will be closely monitored as it responds to emerging trends and challenges.

Increasing Electric Vehicle Production

The surge in electric vehicle (EV) production is a pivotal driver for the Global Automotive Structural Sheet Metal Market Industry. As automakers pivot towards electrification, the demand for structural components that support battery systems and lightweight designs intensifies. EVs require specialized sheet metal solutions to accommodate unique structural requirements, which presents opportunities for manufacturers. The expected compound annual growth rate of 3.83% from 2025 to 2035 indicates a robust market response to this shift, as companies invest in innovative materials and designs to meet the evolving needs of the automotive landscape.

Rising Demand for Lightweight Materials

The Global Automotive Structural Sheet Metal Market Industry experiences a notable increase in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting advanced high-strength steel and aluminum alloys, which contribute to weight reduction without compromising structural integrity. This trend aligns with global regulatory pressures aimed at lowering carbon footprints, as seen in regions such as Europe and North America. The market is projected to reach 17.4 USD Billion in 2024, reflecting the industry's shift towards sustainable practices and innovative material solutions.

Global Infrastructure Development Initiatives

Global infrastructure development initiatives play a crucial role in shaping the Global Automotive Structural Sheet Metal Market Industry. Governments worldwide are investing in transportation infrastructure, which includes the expansion of road networks and public transit systems. This investment stimulates demand for vehicles, consequently increasing the need for structural sheet metal components. Regions such as Asia-Pacific and North America are particularly active in these initiatives, fostering a conducive environment for automotive manufacturers. As infrastructure projects progress, the market is likely to see sustained growth, driven by the rising demand for vehicles and their components.

Consumer Preferences for Safety and Durability

Consumer preferences for safety and durability significantly impact the Global Automotive Structural Sheet Metal Market Industry. As vehicle safety standards become more stringent, manufacturers are compelled to enhance the structural integrity of their products. This trend is evident in the growing use of high-strength steel and advanced alloys, which provide superior crash protection and longevity. The increasing awareness among consumers regarding vehicle safety features further drives this demand. Consequently, automotive manufacturers are likely to prioritize investments in high-quality structural sheet metal solutions to align with consumer expectations and regulatory requirements.

Technological Advancements in Manufacturing Processes

Technological advancements in manufacturing processes significantly influence the Global Automotive Structural Sheet Metal Market Industry. Innovations such as laser cutting, robotic welding, and automated assembly lines enhance production efficiency and precision. These technologies not only reduce waste but also improve the overall quality of automotive components. As manufacturers strive to meet increasing consumer expectations for durability and performance, the integration of advanced manufacturing techniques becomes essential. The anticipated growth of the market to 26.3 USD Billion by 2035 underscores the importance of these advancements in shaping the future of automotive production.