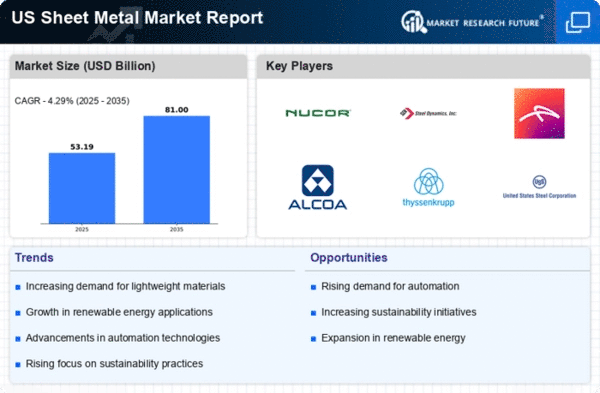

The sheet metal market exhibits a dynamic competitive landscape characterized by a blend of innovation, strategic partnerships, and regional expansion. Key players such as Nucor Corporation (US), Steel Dynamics Inc (US), and Alcoa Corporation (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Nucor Corporation (US) emphasizes sustainability and technological advancements in its operations, aiming to reduce carbon emissions while increasing production efficiency. Steel Dynamics Inc (US) focuses on expanding its manufacturing capabilities through strategic acquisitions, thereby enhancing its competitive edge. Alcoa Corporation (US) is investing heavily in research and development to innovate its product offerings, particularly in lightweight materials for the automotive sector. Collectively, these strategies contribute to a competitive environment that is increasingly focused on sustainability and technological integration.The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The market structure appears moderately fragmented, with several players vying for market share while also collaborating on sustainability initiatives. This competitive structure allows for a diverse range of products and services, catering to various industries, including automotive, construction, and aerospace.

In September Nucor Corporation (US) announced a partnership with a leading technology firm to develop advanced manufacturing processes aimed at reducing energy consumption by 30% over the next five years. This strategic move underscores Nucor's commitment to sustainability and positions it as a leader in environmentally friendly practices within the sheet metal sector. The anticipated reduction in energy costs could enhance profitability while appealing to environmentally conscious consumers.

In August Steel Dynamics Inc (US) completed the acquisition of a regional competitor, significantly expanding its production capacity and market reach. This acquisition is expected to bolster Steel Dynamics' position in the market, allowing for greater economies of scale and improved supply chain efficiencies. The integration of the acquired company’s operations is likely to enhance overall competitiveness and provide a broader product portfolio to customers.

In October Alcoa Corporation (US) launched a new line of aluminum alloys specifically designed for electric vehicle applications. This strategic initiative not only aligns with the growing demand for lightweight materials in the automotive industry but also positions Alcoa as a key player in the transition towards sustainable transportation solutions. The introduction of these innovative products is expected to capture a significant share of the burgeoning electric vehicle market.

As of November the competitive trends within the sheet metal market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering innovation and enhancing operational efficiencies. The shift from price-based competition to a focus on technological advancements and supply chain reliability is evident. Companies that prioritize innovation and sustainability are likely to differentiate themselves in this evolving market, suggesting a future where competitive advantage hinges on the ability to adapt to changing consumer preferences and regulatory demands.