Automotive Industry Growth

The automotive sector plays a crucial role in shaping the dynamics of the Sheet Metal Market. With the increasing production of vehicles, the demand for high-quality sheet metal components is expected to rise. In 2025, the automotive industry is anticipated to witness a growth rate of around 4%, which will likely lead to an uptick in the consumption of sheet metal for manufacturing body panels, chassis, and other critical components. The shift towards electric vehicles also presents new opportunities, as these vehicles often require specialized sheet metal for lightweight construction. This evolving landscape suggests that the automotive industry's growth will significantly impact the Sheet Metal Market, driving innovation and production capabilities.

Growing Demand for HVAC Systems

The rising demand for heating, ventilation, and air conditioning (HVAC) systems is a significant driver for the Sheet Metal Market. As climate control becomes a priority in residential and commercial buildings, the need for efficient and durable ductwork and components is increasing. In 2025, the HVAC market is projected to grow at a rate of about 6%, which will likely lead to a corresponding rise in the demand for sheet metal used in these systems. The material's ability to withstand varying temperatures and its ease of fabrication make it an ideal choice for HVAC applications. Consequently, the growing demand for HVAC systems is expected to bolster the Sheet Metal Market, providing opportunities for manufacturers to expand their product offerings.

Increased Focus on Renewable Energy

The Sheet Metal Market is poised to benefit from the heightened focus on renewable energy sources. As nations strive to reduce carbon emissions and transition to sustainable energy solutions, the demand for solar panels and wind turbines is on the rise. Sheet metal is a critical component in the manufacturing of these renewable energy systems, particularly in the frames and support structures. In 2025, the renewable energy sector is projected to grow by approximately 8%, which will likely drive the demand for sheet metal. This trend indicates that the increased focus on renewable energy will not only contribute to environmental sustainability but also serve as a catalyst for growth within the Sheet Metal Market.

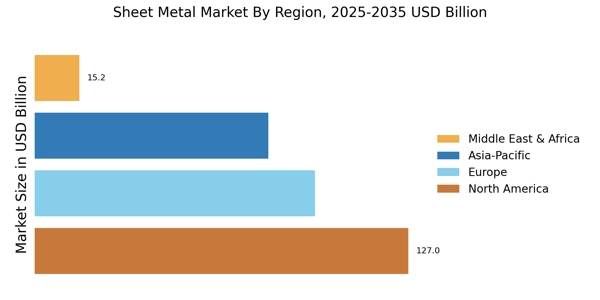

Rising Demand in Construction Sector

The Sheet Metal Market is experiencing a notable surge in demand, primarily driven by the construction sector. As urbanization accelerates, the need for durable and lightweight materials in building projects becomes increasingly critical. In 2025, the construction industry is projected to grow at a rate of approximately 5.5% annually, which directly influences the consumption of sheet metal. This material is favored for its versatility, strength, and cost-effectiveness, making it an essential component in various applications, including roofing, siding, and structural frameworks. Furthermore, the trend towards sustainable building practices is likely to enhance the appeal of sheet metal, as it is often recyclable and energy-efficient. Consequently, the rising demand in the construction sector is a pivotal driver for the Sheet Metal Market.

Technological Innovations in Manufacturing

Technological advancements are reshaping the Sheet Metal Market, enhancing production efficiency and product quality. Innovations such as laser cutting, CNC machining, and automated welding are revolutionizing how sheet metal is processed and fabricated. These technologies not only reduce waste but also improve precision, allowing manufacturers to meet the increasing demands for customized solutions. In 2025, it is estimated that the adoption of advanced manufacturing technologies will increase productivity in the sheet metal sector by approximately 20%. This shift towards automation and smart manufacturing is likely to attract investments and drive growth within the Sheet Metal Market, as companies seek to remain competitive in a rapidly evolving landscape.