Market Trends

Key Emerging Trends in the Automotive Structural Sheet Metal Market

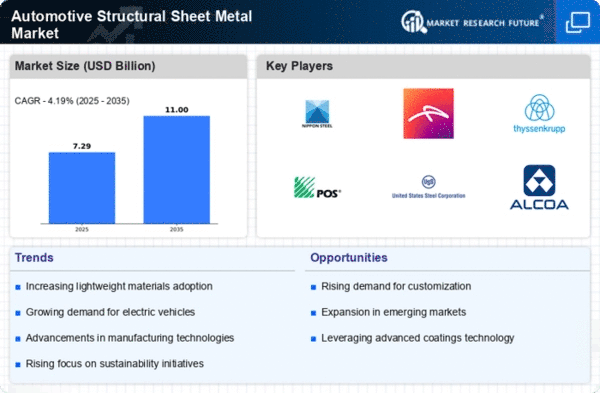

The Automotive Structural Sheet Metal Market uses many methods to gain market share in the ever-changing automotive sector. An important tactic is product innovation. Advanced structural sheet metal solutions are developed by companies in this industry through extensive research. High-strength materials, lightweight designs, and precision production may improve vehicle safety, fuel efficiency, and performance. Companies may differentiate their goods, attract clients seeking contemporary and efficient solutions, and strengthen their position in the Automotive Structural Sheet Metal Market by delivering cutting-edge technologies.

Strategic partnerships and collaborations are key to Automotive Structural Sheet Metal Market positioning. Companies may exchange resources and knowledge with automobile manufacturers, material suppliers, and technology providers by collaborating. Joint ventures or cooperation on certain car models improve market reach and boost company reputation. Businesses become well-connected and capable automotive structural sheet metal providers by associating with industry leaders.

Cost leadership is key to winning the Automotive Structural Sheet Metal Market. Manufacturing process optimization, cost reduction, and economies of scale are company priorities. Companies may gain market share by offering high-quality structural sheet metal at reasonable costs to cost-conscious clients. Cost efficiency allows organizations to offer new solutions at affordable prices, making them marketable.

Geographical growth is crucial for Automotive Structural Sheet Metal Market share positions. Companies adjust their goods to regional norms and vehicle specifications to gain market share in important automobile markets. This technique requires understanding market demands and modifying offerings. Businesses can diversify their client base and lessen sensitivity to regional economic or regulatory changes by carefully expanding into new regions.

Customer-centricity is key to increasing Automotive Structural Sheet Metal Market share. Excellent customer service, customization possibilities, and compatibility with many car types improve client satisfaction. Brand loyalty and favorable word-of-mouth boost market share for customer-focused companies. Sustainable structural sheet metal design, such as recyclability and decreased environmental effect, appeals to environmentally concerned clients, enhancing market positioning.

Leave a Comment