Focus on Safety Features

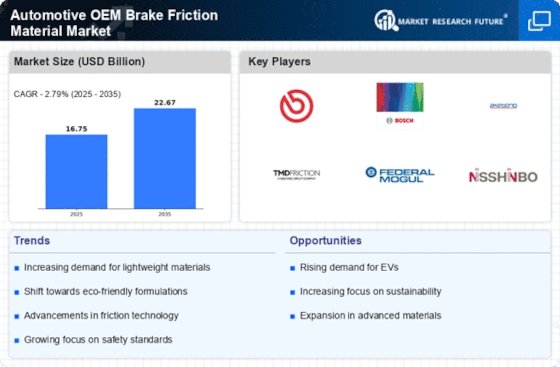

The Automotive OEM Brake Friction Material Market is increasingly driven by a heightened focus on safety features in vehicles. Consumers are becoming more aware of the importance of safety, leading automakers to prioritize the integration of advanced braking systems. This trend is reflected in the growing demand for high-performance brake friction materials that can provide superior stopping power and reliability. As safety regulations become more stringent, manufacturers are compelled to enhance their products to meet these expectations. The emphasis on safety not only influences consumer purchasing decisions but also shapes the competitive landscape of the Automotive OEM Brake Friction Material Market.

Increasing Vehicle Production

The Automotive OEM Brake Friction Material Market is experiencing growth due to the rising production of vehicles worldwide. As manufacturers ramp up production to meet consumer demand, the need for high-quality brake friction materials becomes paramount. In 2025, vehicle production is projected to reach approximately 90 million units, which directly correlates with the demand for brake components. This surge in production not only drives the need for OEM brake friction materials but also encourages manufacturers to innovate and improve their offerings. Consequently, the Automotive OEM Brake Friction Material Market is likely to witness a significant uptick in sales as automakers prioritize safety and performance in their vehicles.

Growing Electric Vehicle Adoption

The Automotive OEM Brake Friction Material Market is poised for transformation due to the increasing adoption of electric vehicles (EVs). As more consumers opt for EVs, the demand for specialized brake friction materials tailored to the unique requirements of electric drivetrains is likely to grow. EVs often require different braking technologies, such as regenerative braking systems, which can influence the types of materials used. The projected growth of the EV market, with estimates suggesting that EV sales could reach 30% of total vehicle sales by 2030, presents a significant opportunity for manufacturers in the Automotive OEM Brake Friction Material Market to innovate and adapt their product offerings.

Regulatory Compliance and Standards

The Automotive OEM Brake Friction Material Market is significantly influenced by stringent regulations and standards imposed by various governments. These regulations aim to enhance vehicle safety and reduce environmental impact. For instance, regulations regarding the reduction of harmful emissions from brake materials are becoming increasingly common. As a result, manufacturers are compelled to develop brake friction materials that comply with these standards, which may lead to increased research and development expenditures. The need for compliance not only drives innovation but also creates opportunities for companies that can effectively meet these regulatory requirements, thereby shaping the Automotive OEM Brake Friction Material Market.

Technological Innovations in Materials

Technological advancements in materials science are playing a crucial role in the Automotive OEM Brake Friction Material Market. Innovations such as the development of advanced composite materials and the integration of smart technologies into brake systems are enhancing the performance and durability of brake friction materials. For example, the introduction of lightweight materials can improve fuel efficiency while maintaining safety standards. As automakers increasingly adopt these technologies, the demand for high-performance brake friction materials is expected to rise. This trend indicates a shift towards more sophisticated and efficient braking solutions within the Automotive OEM Brake Friction Material Market.