Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the UK Oem Patient Monitoring Vital Sign Oem Module Market. The UK government has been actively investing in healthcare technology to improve patient care and streamline operations within the National Health Service (NHS). For example, the NHS Long Term Plan emphasizes the adoption of digital health technologies, including advanced monitoring systems. This commitment is supported by funding programs aimed at enhancing the capabilities of healthcare providers. As a result, manufacturers in the patient monitoring sector are likely to benefit from increased opportunities for collaboration and innovation, ultimately driving market growth.

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in the UK is a significant driver for the Oem Patient Monitoring Vital Sign Oem Module Market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders are becoming increasingly common, necessitating continuous monitoring of patients' vital signs. According to health reports, nearly 15 million people in the UK are living with a chronic condition, which underscores the urgent need for effective monitoring solutions. This growing patient population creates a substantial market opportunity for OEMs specializing in vital sign monitoring modules. As healthcare providers seek to enhance their monitoring capabilities, the demand for innovative and reliable monitoring solutions is expected to rise correspondingly.

Focus on Integrated Healthcare Solutions

The UK Oem Patient Monitoring Vital Sign Oem Module Market is increasingly focusing on integrated healthcare solutions that combine various aspects of patient care. This trend is driven by the need for seamless communication between different healthcare providers and systems. Integrated solutions facilitate the sharing of vital sign data across platforms, enabling a more holistic approach to patient management. Recent developments indicate that healthcare organizations in the UK are prioritizing interoperability in their technology investments. This focus on integration not only enhances the efficiency of care delivery but also improves patient outcomes, as healthcare professionals can make more informed decisions based on comprehensive data.

Increasing Demand for Remote Patient Monitoring

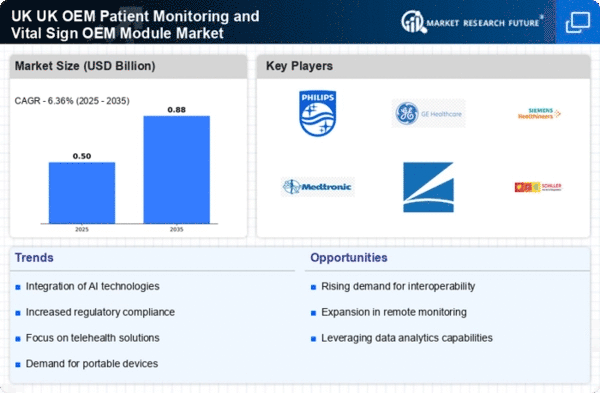

The UK Oem Patient Monitoring Vital Sign Oem Module Market is witnessing a notable increase in demand for remote patient monitoring solutions. This shift is largely driven by the need for healthcare providers to manage chronic conditions effectively while minimizing hospital visits. Remote monitoring technologies enable healthcare professionals to track patients' vital signs in real-time, facilitating timely interventions. Recent statistics suggest that the remote patient monitoring market in the UK is expected to expand at a compound annual growth rate of over 20% in the coming years. This growth reflects a broader trend towards telehealth services, which are becoming integral to the UK's healthcare delivery model, particularly in rural and underserved areas.

Technological Innovations in Patient Monitoring

The UK OEM Patient Monitoring Vital Sign Module Market is experiencing a surge in technological innovations, particularly in the development of advanced monitoring devices. These innovations include the integration of artificial intelligence and machine learning algorithms, which enhance the accuracy and efficiency of vital sign monitoring. For instance, the introduction of wearable devices that continuously track heart rate, blood pressure, and oxygen saturation is becoming increasingly prevalent. According to recent data, the market for wearable health technology in the UK is projected to grow significantly, indicating a robust demand for sophisticated monitoring solutions. This trend not only improves patient outcomes but also aligns with the healthcare sector's shift towards more proactive and preventive care models.