Regulatory Support for Safety Standards

Regulatory support for safety standards is emerging as a significant driver in the Automotive LiDAR Sensors Market. Governments worldwide are implementing stringent safety regulations that mandate the inclusion of advanced safety features in vehicles. This regulatory landscape is fostering the adoption of LiDAR technology, as it is essential for meeting these safety requirements. For example, the European Union has proposed regulations that require all new vehicles to be equipped with advanced safety systems by 2024. Such mandates are likely to accelerate the integration of LiDAR sensors in vehicles, thereby propelling growth in the Automotive LiDAR Sensors Market.

Growth of Electric and Autonomous Vehicles

The Automotive LiDAR Sensors Market is significantly influenced by the growth of electric and autonomous vehicles. As manufacturers pivot towards electrification and automation, the demand for sophisticated sensing technologies, such as LiDAR, is expected to rise. The autonomous vehicle market is projected to reach USD 556 billion by 2026, with LiDAR playing a crucial role in enabling safe navigation and obstacle detection. This technology allows vehicles to perceive their surroundings in real-time, which is essential for the development of fully autonomous systems. Thus, the increasing adoption of electric and autonomous vehicles serves as a vital driver for the Automotive LiDAR Sensors Market.

Technological Innovations in LiDAR Systems

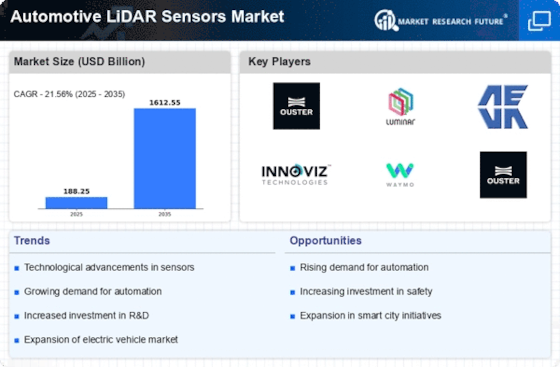

Technological innovations are propelling the Automotive LiDAR Sensors Market forward. Recent advancements in LiDAR technology, such as solid-state LiDAR and miniaturization, are enhancing the performance and reducing the costs of these sensors. For instance, solid-state LiDAR systems are becoming more compact and reliable, making them suitable for mass-market applications. The market for LiDAR sensors is anticipated to grow at a compound annual growth rate (CAGR) of 25% from 2023 to 2030. These innovations not only improve the accuracy and efficiency of LiDAR systems but also expand their applicability across various vehicle types, thereby driving growth in the Automotive LiDAR Sensors Market.

Increasing Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Automotive LiDAR Sensors Market. As competition intensifies among automotive manufacturers and technology providers, there is a concerted effort to innovate and enhance LiDAR technologies. Companies are allocating substantial resources to develop next-generation sensors that offer improved range, resolution, and reliability. This trend is reflected in the increasing number of partnerships and collaborations aimed at advancing LiDAR technology. The R&D expenditure in the automotive sector is projected to reach USD 100 billion by 2025, indicating a robust commitment to innovation that will likely benefit the Automotive LiDAR Sensors Market.

Rising Demand for Advanced Driver Assistance Systems

The Automotive LiDAR Sensors Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). As safety regulations become more stringent, automotive manufacturers are increasingly integrating LiDAR technology to enhance vehicle safety features. This trend is underscored by the projected growth of the ADAS market, which is expected to reach USD 83 billion by 2025. LiDAR sensors provide high-resolution 3D mapping capabilities, enabling vehicles to detect obstacles and navigate complex environments. Consequently, the integration of LiDAR in ADAS not only improves safety but also enhances the overall driving experience, making it a pivotal driver in the Automotive LiDAR Sensors Market.