Advancements in UAV Technology

The UAV LiDAR Market is significantly influenced by advancements in UAV technology, which enhance the capabilities and applications of LiDAR systems. Innovations such as improved battery life, increased payload capacity, and enhanced flight stability allow UAVs to operate more effectively in diverse environments. These technological improvements enable longer flight times and the ability to cover larger areas, making UAV LiDAR Market solutions more attractive to industries such as construction and environmental monitoring. Furthermore, the integration of artificial intelligence and machine learning algorithms into UAV systems is expected to streamline data processing and analysis, thereby increasing the efficiency of LiDAR data utilization. As these advancements continue to evolve, they are likely to expand the market's reach, attracting new users and applications that require high-quality geospatial data.

Regulatory Support for UAV Operations

The UAV LiDAR Market benefits from regulatory support that facilitates the integration of UAV technology into various sectors. Governments are increasingly recognizing the potential of UAVs for applications such as infrastructure inspection, land surveying, and disaster management. As regulations evolve to accommodate the safe operation of UAVs, more businesses are likely to adopt UAV LiDAR Market systems to enhance their operational capabilities. This regulatory environment not only promotes innovation but also encourages investment in UAV technology, as companies seek to comply with safety and operational standards. The establishment of clear guidelines and frameworks for UAV operations is expected to drive market growth, as stakeholders gain confidence in the reliability and safety of UAV LiDAR Market applications.

Growing Environmental Monitoring Needs

The UAV LiDAR Market is witnessing a surge in demand driven by the growing need for environmental monitoring and management. As concerns regarding climate change and natural resource depletion intensify, organizations are increasingly utilizing UAV LiDAR Market technology to conduct detailed assessments of ecosystems, forests, and water bodies. This technology allows for the collection of critical data on vegetation structure, biomass estimation, and habitat mapping, which are essential for effective environmental conservation efforts. The market is expected to expand as regulatory bodies and environmental agencies adopt UAV LiDAR Market solutions to enhance their monitoring capabilities. Additionally, the ability to conduct non-invasive surveys with minimal ecological impact positions UAV LiDAR Market as a preferred choice for environmental studies, further solidifying its role in sustainable development initiatives.

Increased Demand for Precision Mapping

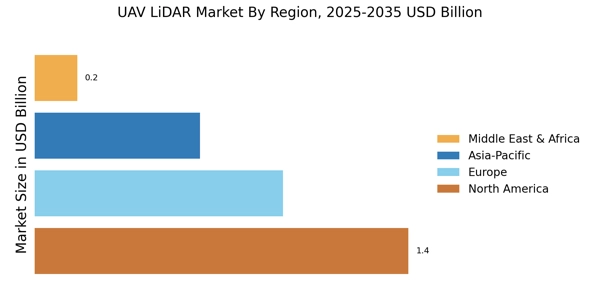

The UAV LiDAR Market experiences heightened demand for precision mapping solutions across various sectors, including agriculture, forestry, and urban planning. As industries increasingly rely on accurate geospatial data, UAV LiDAR Market technology provides high-resolution topographic information that enhances decision-making processes. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is driven by the need for detailed terrain analysis and the ability to capture complex landscapes efficiently. Consequently, organizations are investing in UAV LiDAR Market systems to improve operational efficiency and reduce costs associated with traditional surveying methods. The integration of UAV LiDAR Market technology into existing workflows is likely to further propel the market, as stakeholders recognize the value of precise data in optimizing resource management.

Rising Adoption in Infrastructure Development

The UAV LiDAR Market is experiencing a notable increase in adoption within the infrastructure development sector. As urbanization accelerates, the demand for efficient and accurate surveying methods becomes paramount. UAV LiDAR Market technology offers a rapid and cost-effective solution for capturing detailed topographic data, which is essential for planning and executing infrastructure projects. The ability to generate high-resolution 3D models facilitates better project visualization and risk assessment, thereby improving overall project outcomes. Market analysts project that the infrastructure sector will continue to be a key driver of UAV LiDAR Market adoption, particularly in road construction, bridge inspection, and utility management. This trend indicates a robust future for UAV LiDAR Market technology as it becomes integral to modern infrastructure development practices.