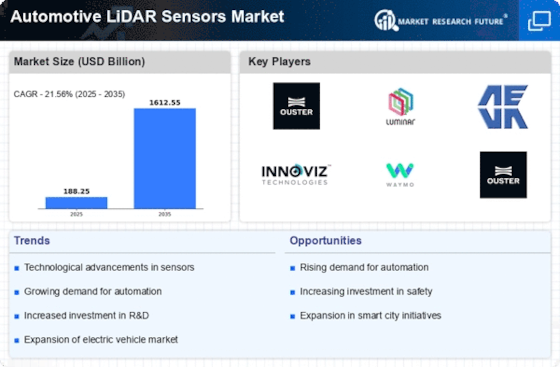

Top Industry Leaders in the Automotive LIDAR Sensors Market

*Disclaimer: List of key companies in no particular order

Exploring the Competitive Landscape: Analyzing the Automotive LiDAR Sensors Market

The automotive LiDAR sensor market, envisioned as the eyes for future autonomous driving, is experiencing accelerated growth, drawing the attention of established contenders and ambitious newcomers, all vying for a substantial share. Let's delve into the strategies, trends, and influential factors shaping this dynamic landscape, illuminating the path for potential frontrunners.

Key Player Strategies:

Product Diversification: Pioneering entities like Valeo and Velodyne are diversifying their LiDAR offerings, tailoring them to different price ranges and performance levels. This variety caters to the diverse needs within the ADAS and autonomous driving sectors, broadening their customer base.

Technological Advancements: Innovators such as Luminar and Quanergy are driving the market forward by exploring solid-state LiDAR technology, promising more compact sizes, higher resolution, and reduced costs. This technological leap has the potential to disrupt the market dynamics.

Vertical Integration: To fortify supply chain resilience and cost management, leading players like Continental and Bosch are venturing into chip design and manufacturing. This vertical integration ensures greater control over vital components, potentially enabling competitive pricing.

Partnership Ecosystem: Acknowledging the complexities of autonomous driving, leading players are forging strategic partnerships. For instance, Velodyne collaborates with NVIDIA for software optimization, and Innoviz partners with BMW for sensor integration, accelerating development and market penetration.

Factors for Market Share Analysis:

Technology Performance: LiDAR sensors vary in range, resolution, and field of view. Players like AEye, with their high-resolution 4D LiDAR, cater to the demanding requirements of Level 4 and 5 autonomy, while Quanergy targets Level 2 and 3 ADAS features with its lower-cost options. Aligning technology with market demand is crucial for gaining market share.

Cost Competitiveness: Despite offering superior perception capabilities, the initial cost of LiDAR remains a barrier. Leaders like Hesai are spearheading the charge with cost-effective solutions, making LiDAR more accessible across broader segments of the automotive market.

Regional Focus: Demand patterns for LiDAR sensors vary across regions. Velodyne thrives in North America, whereas Ouster caters to the burgeoning Chinese market. Understanding and aligning with regional dynamics are pivotal for successful market penetration.

Tier-1 Collaboration: Tier-1 automotive suppliers wield significant influence over vehicle design and technology adoption. Establishing robust relationships with these key players, as seen with Valeo and Continental, provides a substantial advantage in securing contracts and market share.

New and Emerging Trends:

Software Intelligence: Leveraging AI-powered perception software, companies like Innoviz are investing significantly to enable accurate object detection and classification, unlocking the true potential of LiDAR data, thereby enhancing its value for autonomous driving.

Sensor Fusion: Integrating LiDAR data with other sensors such as cameras and radar results in a more robust and reliable perception system. Leaders like Continental and Bosch are at the forefront of multi-sensor fusion technology, paving the way for safer and more advanced autonomous driving solutions.

Regulation and Standardization: Clear regulatory guidelines on LiDAR performance and safety standards are crucial for widespread adoption. Key industry players like Valeo actively participate in shaping these regulations to ensure compliance and market acceptance.

Overall Competitive Scenario:

The automotive LiDAR sensor market is a dynamic and intensely competitive landscape. Established players equipped with diverse product portfolios, technological advancements, and strong partnerships hold a competitive edge. However, disruptive innovations such as solid-state LiDAR and cost-effective solutions are reshaping the landscape. To thrive in this evolving market, companies must focus not only on cutting-edge technology but also on delivering reliable, affordable solutions tailored to specific market segments. Collaboration, software intelligence, and sensor fusion will be key differentiators. Those who swiftly adapt, navigate regulatory complexities, and offer dependable yet economical solutions will solidify their position in this race to redefine the future of automotive mobility.

Industry Developments and Latest Updates:

Delphi Automotive (U.K.):

-

Date: December 15, 2023 -

Source: Delphi press release -

Update: Announced a partnership with Luminar Technologies to integrate Luminar's Iris LiDAR sensors into their automated driving platforms, aiming to expedite the development and deployment of Level 3 and Level 4 autonomous vehicles.

Continental AG (Germany):

-

Date: December 22, 2023 -

Source: Continental blog post -

Update: Showcased their progress in LiDAR technology, highlighting their High-Resolution LiDAR (HDL) and Solid-State LiDAR (SSL) sensors, emphasizing scalability, affordability, and performance optimization for mass production.

ZF Friedrichshafen (Germany):

-

Date: November 30, 2023 -

Source: ZF press release -

Update: Announced plans to invest €4 billion in LiDAR and radar technology over the next five years, collaborating with various partners, including Innoviz Technologies, to develop and manufacture LiDAR sensors for ADAS and autonomous driving applications.

Infineon Technologies (Germany):

-

Date: December 05, 2023 -

Source: Infineon investor presentation -

Update: Showcased their LiDAR Time-of-Flight (ToF) chipsets, highlighting advancements in miniaturization and cost reduction, targeting partnerships with LiDAR sensor manufacturers to introduce affordable solutions to the market.

Velodyne LiDAR (U.S.):

-

Date: December 19, 2023 -

Source: Velodyne press release -

Update: Launched the Alpha Prime LiDAR sensor, boasting the industry's longest range and highest resolution, tailored for high-end autonomous vehicles and robotics applications.

Top Companies in the Automotive LiDAR Sensors Industry: Delphi Automotive (U.K.), Continental AG (Germany), ZF Friedrichshafen (Germany), Infineon Technologies (Germany), Velodyne LiDAR (U.S.), Texas Instruments Incorporated (U.S.), First Sensor AG (Germany), Robert Bosch (Germany), Ibeo Automotive (Germany), Quanergy Systems (U.S.), Valeo S.A. (France), Denso (Japan), PulsedLight (U.S.), and others.