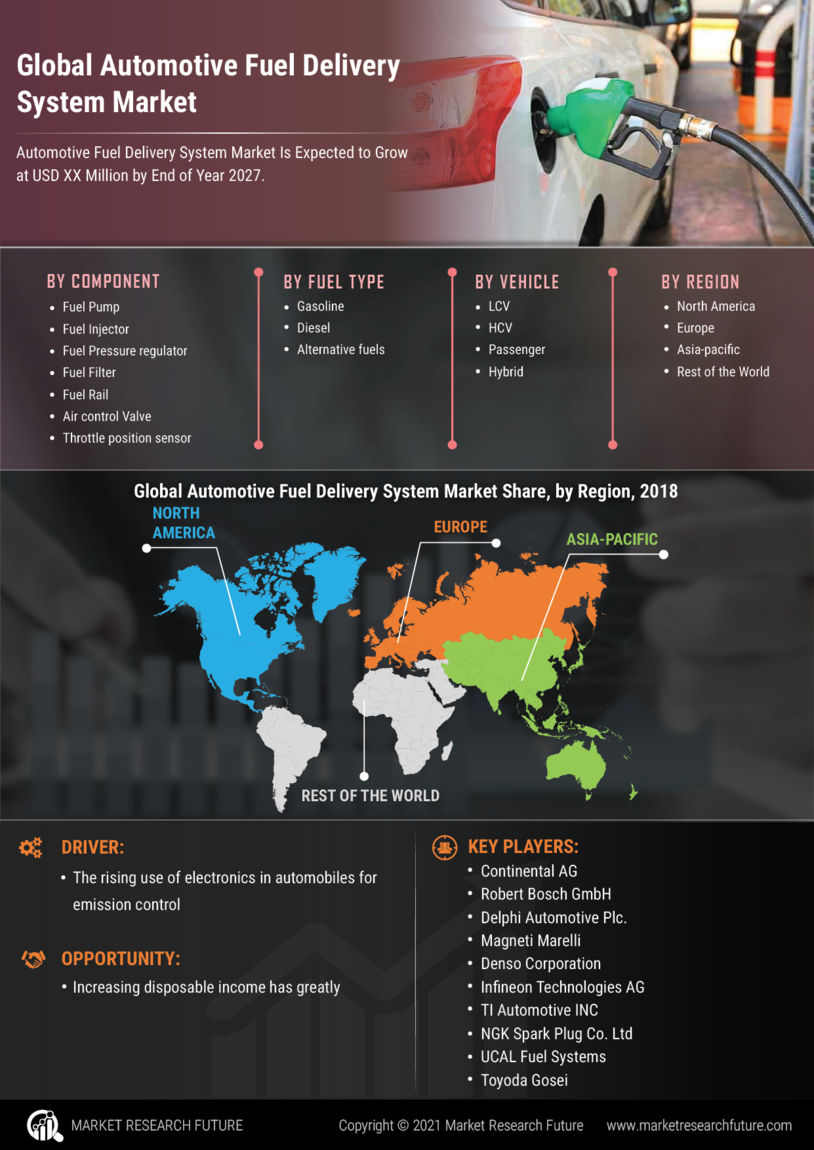

Stringent Emission Regulations

The implementation of stringent emission regulations worldwide significantly influences the Automotive Fuel Delivery System Market Industry. Governments are increasingly mandating lower emissions from vehicles, prompting manufacturers to adopt advanced fuel delivery systems that comply with these regulations. For instance, the European Union's Euro 6 standards necessitate the use of sophisticated fuel injection systems to minimize pollutants. This regulatory landscape is expected to drive the market value to 140.1 USD Billion by 2035, as manufacturers invest in cleaner technologies. Compliance not only helps in meeting legal requirements but also enhances brand reputation among environmentally conscious consumers.

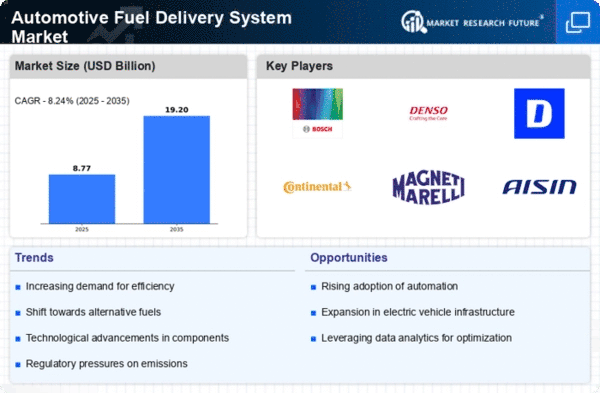

Rising Demand for Fuel Efficiency

The increasing emphasis on fuel efficiency among consumers drives the Automotive Fuel Delivery System Market. As fuel prices fluctuate, consumers are more inclined to invest in vehicles that offer better mileage. This trend is reflected in the projected market value of 90.2 USD Billion in 2024, indicating a robust demand for advanced fuel delivery systems that optimize fuel consumption. Manufacturers are responding by integrating innovative technologies such as direct fuel injection and electronic fuel injection systems, which enhance performance while reducing emissions. This shift not only meets consumer expectations but also aligns with global regulatory standards aimed at reducing carbon footprints.

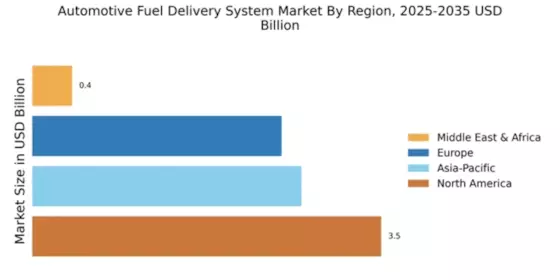

Increasing Global Vehicle Production

The continuous growth in global vehicle production serves as a significant driver for the Automotive Fuel Delivery System Market. As emerging economies expand their automotive sectors, the demand for efficient fuel delivery systems becomes paramount. Countries such as India and China are witnessing a surge in vehicle manufacturing, leading to an increased need for advanced fuel delivery technologies. This trend is expected to bolster the market, with projections indicating a value of 90.2 USD Billion in 2024. The expansion of production facilities and the introduction of new vehicle models necessitate innovative fuel systems that enhance performance and meet consumer expectations.

Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is reshaping the Automotive Fuel Delivery System Industry. As consumers become more environmentally aware, the demand for alternative fuel vehicles is surging. While traditional fuel delivery systems remain essential, the integration of hybrid technologies necessitates the development of advanced fuel management systems that can efficiently handle both electric and conventional fuel sources. This transition is indicative of a broader shift in the automotive landscape, where manufacturers are increasingly focusing on sustainability. Consequently, the market is likely to witness a transformation as it adapts to the evolving needs of consumers and regulatory frameworks.

Technological Advancements in Fuel Delivery Systems

Technological innovation plays a pivotal role in shaping the Automotive Fuel Delivery System Market Industry. The introduction of advanced fuel delivery technologies, such as variable valve timing and turbocharging, enhances engine performance and efficiency. These advancements are likely to contribute to the market's growth, with a projected CAGR of 4.08% from 2025 to 2035. As manufacturers invest in research and development, the integration of smart fuel management systems is becoming commonplace. These systems not only improve fuel efficiency but also provide real-time data analytics, allowing for better vehicle performance monitoring and maintenance, thus appealing to tech-savvy consumers.