Market Analysis

Automotive Fuel Delivery System Market (Global, 2023)

Introduction

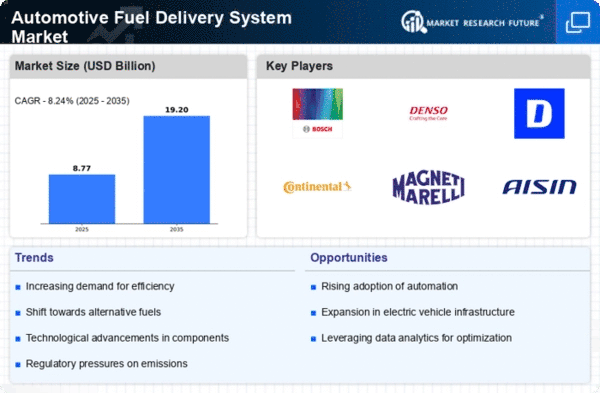

The market for car fuel systems plays a crucial role in the overall performance and efficiency of vehicles. It is the vital link between the fuel tank and the engine. The fuel system comprises a number of components, including fuel pumps, injectors and filters, all of which are designed to ensure that the engine receives the fuel it needs in the most effective way possible, whatever the conditions of use. The evolution of the car industry, driven by technological progress and increasingly stringent regulations, has increased the demand for more reliable and efficient fuel systems. In addition, the trend towards alternative fuels, the growing importance of fuel economy and the increasing use of direct injection and electronic control systems are all reshaping the market. The emergence of hybrid and electric vehicles is also a major factor influencing the evolution of the market. It is essential for all those who want to understand the complexities of the market for car fuel systems to understand these trends and the competition.

PESTLE Analysis

- Political

- In 2023, the market for automobile fuel-delivery systems is influenced by many political factors, including government regulations aimed at reducing carbon emissions. For example, the European Union has set a target of a minimum 55 percent reduction in greenhouse gas emissions by 2030, compared with 1990 levels.1 Fuel-delivery systems must therefore adapt to these stricter emissions standards. In addition, the U.S. government has allotted $7.5 billion for the construction of an electric-vehicle charging network.2 This may lead to a shift away from traditional fuel-delivery systems.

- Economic

- The economic conditions of the market for car fuel injection systems are influenced by the prices of fuel and the spending of consumers. In 2023, the average price of petrol in the United States is $3.50 per gallon. This influences the behaviour of consumers and their decision to buy a car. In addition, the auto industry in the United States alone employs over a million people, which demonstrates the strength of the labour market. The post-pandemic economic recovery has also led to a rise in car sales, and this also has an effect on the market for fuel injection systems.

- Social

- In 2023, the market for the delivery of fuel to motor vehicles is influenced by the growing demand for vehicles that are more friendly to the environment. A study of the public shows that about seventy percent of consumers are willing to pay more for sustainable products, such as cars with fuel systems that minimize emissions. Also, the rise in urbanization, which currently accounts for more than 55 percent of the world's population, is increasing the demand for fuel systems that are more adapted to city traffic.

- Technological

- The evolution of the automobile fuel-delivery system is a rapidly developing industry. In 2023, the smart fuel-delivery system, which combines the Internet of Things technology, is becoming increasingly popular. Among them, a new fuel-delivery system, which can reduce fuel consumption by up to 20%, is expected to be developed. The R & D investment of this new system is more than a billion yuan. In addition, the use of alternative energy sources such as hydrogen and biofuels is also becoming more and more popular, and by the end of 2025, there will be more than 500 hydrogen filling stations in the United States.

- Legal

- The legal framework is of paramount importance for the development of the market for fuel delivery systems. In 2023, the U.S. Environmental Protection Agency (EPA) introduced a new rule for the car industry. It stipulates that the average fuel consumption of cars must be 49 mpg by 2026. This legal requirement obliges manufacturers to improve and develop their fuel delivery systems in order to meet this target. Moreover, various states have enacted laws on the use of cleaner fuels, which have an effect on the market.

- Environmental

- The car fuel supply system market is becoming more and more concerned with the environment. By 2023, the global automobile industry will account for about 15% of global greenhouse gas emissions, which will lead to a shift in the direction of sustainable development. Regulations on reducing emissions have led to a 10% increase in the adoption of clean fuel systems. The emergence of electric vehicles will reduce the carbon footprint of the automobile industry. By 2030, the reduction of carbon dioxide emissions is expected to reach 30.

Porter's Five Forces

- Threat of New Entrants

- Barriers to entry: Moderate, because of the need for considerable investment in technology and manufacturing capabilities. The established companies benefit from economies of scale and brand loyalty, which makes it difficult for new entrants to gain a foothold. But technological change and the growing importance of electric vehicles may create opportunities for innovators.

- Bargaining Power of Suppliers

- The bargaining power of suppliers in the market for the production of fuel injection systems is relatively low. There are a large number of suppliers of components such as pumps, injectors and sensors, resulting in a highly competitive market. The manufacturers are able to easily change suppliers or to negotiate better terms, thus reducing the power of suppliers.

- Bargaining Power of Buyers

- High—In the automobile fuel-delivery systems market, buyers have high bargaining power because of the large number of choices and the ability to compare products. Moreover, because of the increasing emphasis on fuel economy and emissions standards, buyers are more informed and demanding about quality and cost, which gives them a lot of power over manufacturers.

- Threat of Substitutes

- The threat of substitutes in the automobile fuel-delivery system market is moderate. The traditional fuel-delivery systems are well established, but the increasing popularity of electric vehicles and alternative fuels pose a potential substitute threat. However, the transition to these alternatives is gradual, so the traditional systems remain relevant for the time being.

- Competitive Rivalry

- Competition is strong in the fuel-delivery-systems market, with several important players competing for market share. In order to keep up with changing customer needs and regulatory requirements, companies must constantly develop new products and refine existing ones. The fierce competition pushes prices down, and this in turn drives up the need for differentiation among the different manufacturers.

SWOT Analysis

Strengths

- Increasing demand for fuel-efficient vehicles driving innovation in fuel delivery systems.

- Technological advancements leading to improved performance and reliability of fuel delivery systems.

- Strong presence of established manufacturers with extensive distribution networks.

Weaknesses

- High initial costs associated with advanced fuel delivery technologies.

- Dependence on fluctuating fuel prices impacting consumer purchasing decisions.

- Limited awareness and understanding of advanced fuel delivery systems among consumers.

Opportunities

- Growing trend towards electric and hybrid vehicles creating a shift in fuel delivery system requirements.

- Potential for expansion in emerging markets with increasing vehicle ownership.

- Government regulations promoting cleaner fuel technologies can drive innovation and investment.

Threats

- Intense competition among manufacturers leading to price wars and reduced profit margins.

- Rapid technological changes may render existing systems obsolete.

- Economic downturns affecting consumer spending on automotive products.

Summary

The market for automobile fuel-delivery systems in 2023 is characterized by strong demand for efficient and reliable products, driven by technological advancements and a growing focus on fuel efficiency. However, challenges such as high costs and market competition present considerable risks. Opportunities are available in the transition to electric and hybrid vehicles and in emerging markets. The market must be carefully navigated so as to capitalize on the opportunities and manage the risks for sustained growth.

Leave a Comment