Research Methodology on Drone Package Delivery System Market

Abstract

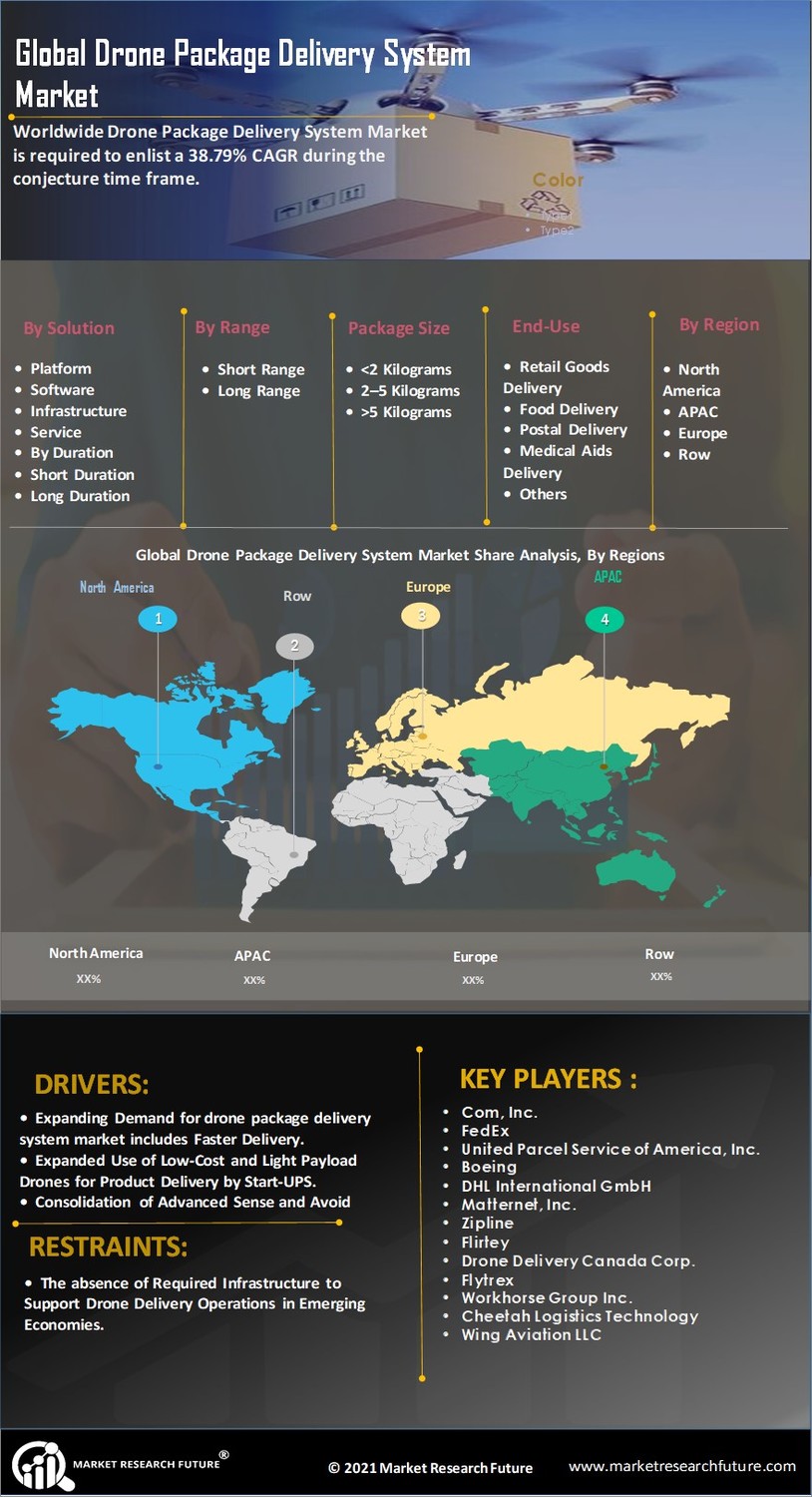

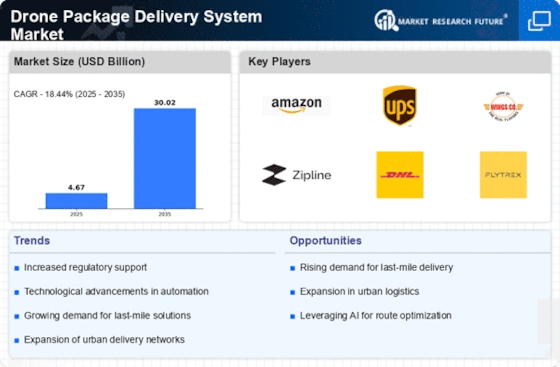

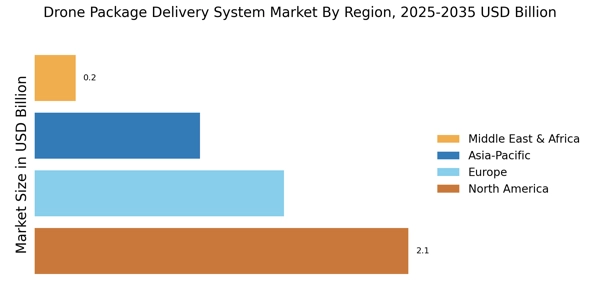

The primary aim of this research is to explore the Drone Package Delivery System market and its pivotal factors that are expected to have an impact on the overall market development. The market analysis comprising value and volume, year-on-year growth and yearly development forecast is delivered in this market report. An in-depth analysis of all the market segments and regional analysis is provided on a regional and global level. Moreover, the market segmentation based on the major product types, regional presence, and application has been highlighted in this research report.

Introduction

The advent of drone technology has revolutionized the way we view the delivery of goods from one place to another. Drones that can deliver packages, referred to as package delivery systems (PDSs), are becoming increasingly popular. Over the past decade, developments in the autonomous drone market have seen an unprecedented rise, and today, this technology is being employed for the delivery of a variety of goods, including food, medicines, documents, retail and electronic items, and others. The widespread adoption of this technology has encouraged a plethora of companies and organizations from the e-commerce, healthcare, and logistics sectors to join in the fray to understand the fundamentals and develop comprehensive solutions that can take advantage of drones in package delivery.

This research report is designed to analyze every factor that is expected to have an impact on the Drone Package Delivery System market and its development in the coming years. Moreover, in-depth market segmentation based on product types and applications, year-on-year growth, overall development forecast, regional presence, and other important factors is discussed in detail in this report.

Research Methodology

The primary objective of the research report is to examine the market and understand the key factors that are expected to have an impact on the growth of the Drone Package Delivery System market. To attain this objective, the research includes a combination of different primary as well as secondary sources of information that were collected from a wide array of journals and credible websites. The collected data is analyzed and thoroughly inspected for any flaws before concluding.

A combination of quantitative as well as qualitative research methodologies and techniques has been used for data collection. Observing market developments, and analyzing recent trends and technological advancements were some of the other steps that were taken in the research process. Significant industry developments and news items were taken into consideration while assessing the development of the Drone Package Delivery System market. The research report offers a coherent analysis of the Drone Package Delivery System market, backed by exhaustive primary and secondary research.

Research Design

The research is conducted to study the drone package delivery system market employing a design which is a mix of quantitative and qualitative research. The methodologies employed involve an extensive survey where feedback is received from both industry experts and stakeholders in the sector to assess the market dynamics and the current development scenario. Primary source data collection is also done by conducting interviews with selected supervisors and experts in the field. Statistical analysis and detailed benchmarks were also used to analyze the market landscape.

Secondary research also played an important role in the report. It was employed for data verification, understanding the market trends and the dynamics of the sector, parameters-based analysis and other elements of the drone delivery market. A variety of resources were used for this purpose, such as industry periodicals, industry associations, government statistics, press releases, market reports, and white papers.

Data Collection

Data collection for this research involves both primary and secondary sources. Primary data is obtained through interviews with automotive industry experts, supervisors, and executives. More than fifty people were interviewed for this purpose. Questions focussed on understanding the current market status, present opportunities and challenges, current trends and future development plans related to the drone delivery system market.

Secondary research is done by reviewing and assessing various reports, statistics, and press releases published by industry associations, government bodies, and periodicals. For example, industry reports by Frost & Sullivan; market reports by McKinsey & Company; and academic publications from respected journals were used for this purpose.

Data Analysis

Data analysis for the research report is done in-depth and involves both qualitative and quantitative techniques. Statistical analysis, data mining, array processing, clusters, components analysis and other tools were used for this purpose.

The various data sets obtained from primary and secondary sources were analysed to compare different market scenarios, and understand regional trends and market dynamics in each region. This data is also used to generate insights, profiles, and forecasts related to the growth of the global drone package delivery system market.

Conclusion

This research report aims to shed light on the drone package delivery system market and the various factors that are expected to have an impact on the overall market growth. A comprehensive primary and secondary research process is conducted, which includes interviews with fifty industry experts in addition to an extensive secondary research process. Statistical analysis and data mining were used to analyse the data obtained from both primary and secondary sources. The research report delivers a thorough analysis of the Drone Package Delivery System market and its associated growth forecasts, opportunities and challenges in the coming years.