Shift Towards Electric Vehicles (EVs)

The shift towards electric vehicles (EVs) plays a crucial role in shaping the Automotive Ethernet Market. As the automotive sector transitions to electrification, the demand for efficient communication networks that can support the unique requirements of EVs rises. Automotive Ethernet Market offers a scalable and flexible solution that can handle the data needs of electric powertrains, battery management systems, and charging infrastructure. Market forecasts suggest that the EV segment is expected to account for a substantial share of the automotive market in the coming years, further driving the adoption of Automotive Ethernet Market. This technology not only supports the operational efficiency of EVs but also enhances their connectivity features, making it an essential component in the development of next-generation electric vehicles.

Enhanced Vehicle Safety and Security Features

The Automotive Ethernet Market is significantly impacted by the growing emphasis on vehicle safety and security features. As regulatory bodies and consumers alike prioritize safety, automotive manufacturers are compelled to incorporate advanced safety systems into their vehicles. Automotive Ethernet Market facilitates the integration of these systems, such as collision avoidance and lane-keeping assistance, by providing a reliable and high-speed communication network. Recent data indicates that the market for automotive safety systems is projected to grow substantially, with a significant portion of this growth attributed to the adoption of Automotive Ethernet Market. This technology not only enhances the performance of safety features but also ensures that they operate seamlessly, thereby improving overall vehicle safety. As a result, manufacturers are increasingly investing in Automotive Ethernet Market solutions to meet safety standards and consumer expectations.

Rising Demand for High-Speed Data Transmission

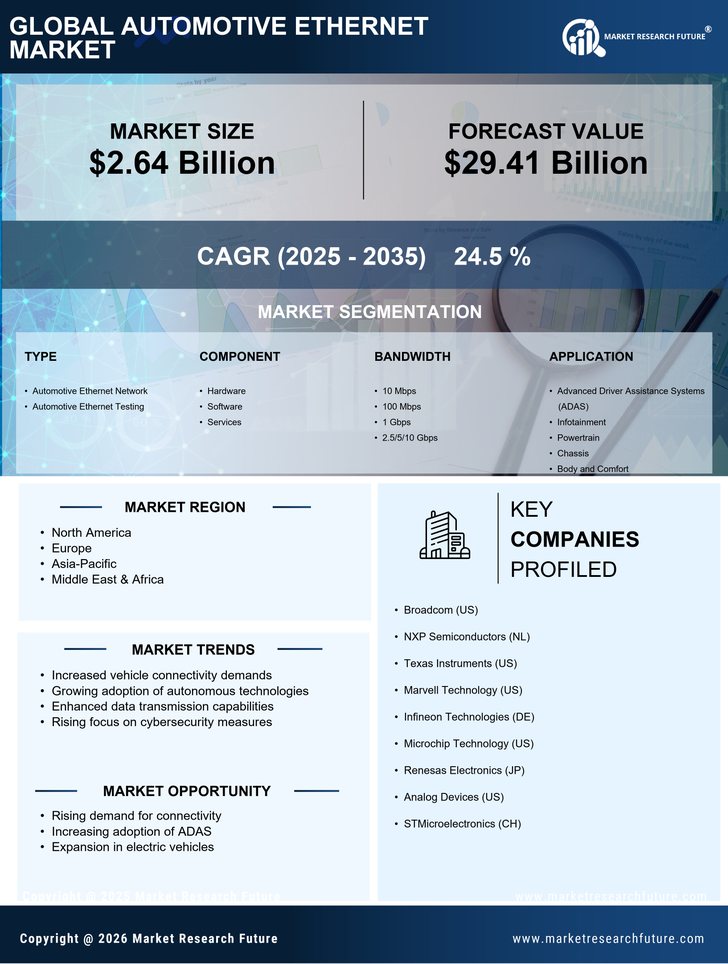

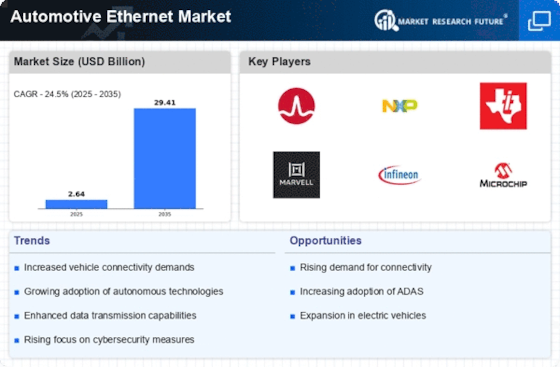

The Automotive Ethernet Market experiences a notable surge in demand for high-speed data transmission, driven by the increasing complexity of in-vehicle networks. As vehicles integrate more advanced technologies, such as infotainment systems and driver assistance features, the need for efficient data communication becomes paramount. Automotive Ethernet Market, with its capability to support high bandwidth, is well-positioned to meet these requirements. Recent estimates suggest that the market for Automotive Ethernet Market is projected to grow at a compound annual growth rate (CAGR) of approximately 25% over the next few years. This growth is indicative of the industry's shift towards more connected vehicles, where seamless data exchange is essential for enhancing user experience and safety. Consequently, manufacturers are increasingly adopting Automotive Ethernet Market solutions to ensure their vehicles remain competitive in a rapidly evolving market.

Integration of Internet of Things (IoT) in Vehicles

The integration of Internet of Things (IoT) technologies into vehicles significantly influences the Automotive Ethernet Market. As vehicles become more connected, the demand for robust communication protocols that can handle vast amounts of data increases. Automotive Ethernet Market provides a reliable framework for IoT applications, enabling real-time data exchange between vehicles and external systems. This integration facilitates various functionalities, such as remote diagnostics, over-the-air updates, and enhanced navigation services. Market analyses indicate that the IoT in automotive applications is expected to reach a valuation of several billion dollars in the coming years, further propelling the adoption of Automotive Ethernet Market. The ability to support multiple IoT devices within a vehicle ecosystem positions Automotive Ethernet Market as a critical enabler of future automotive innovations.

Growing Focus on Vehicle-to-Everything (V2X) Communication

The Automotive Ethernet Industry is increasingly influenced by the growing focus on Vehicle-to-Everything (V2X) communication technologies. V2X encompasses communication between vehicles, infrastructure, and other road users, aiming to enhance traffic safety and efficiency. Automotive Ethernet Market serves as a foundational technology for V2X applications, providing the necessary bandwidth and reliability for real-time data exchange. As cities and governments invest in smart infrastructure, the demand for V2X solutions is expected to rise significantly. Recent projections indicate that the V2X market could reach a multi-billion dollar valuation in the near future, underscoring the importance of Automotive Ethernet Market in facilitating these advancements. The ability to support V2X communication positions Automotive Ethernet Market as a vital component in the evolution of smart transportation systems.