Rising Demand for Software Updates

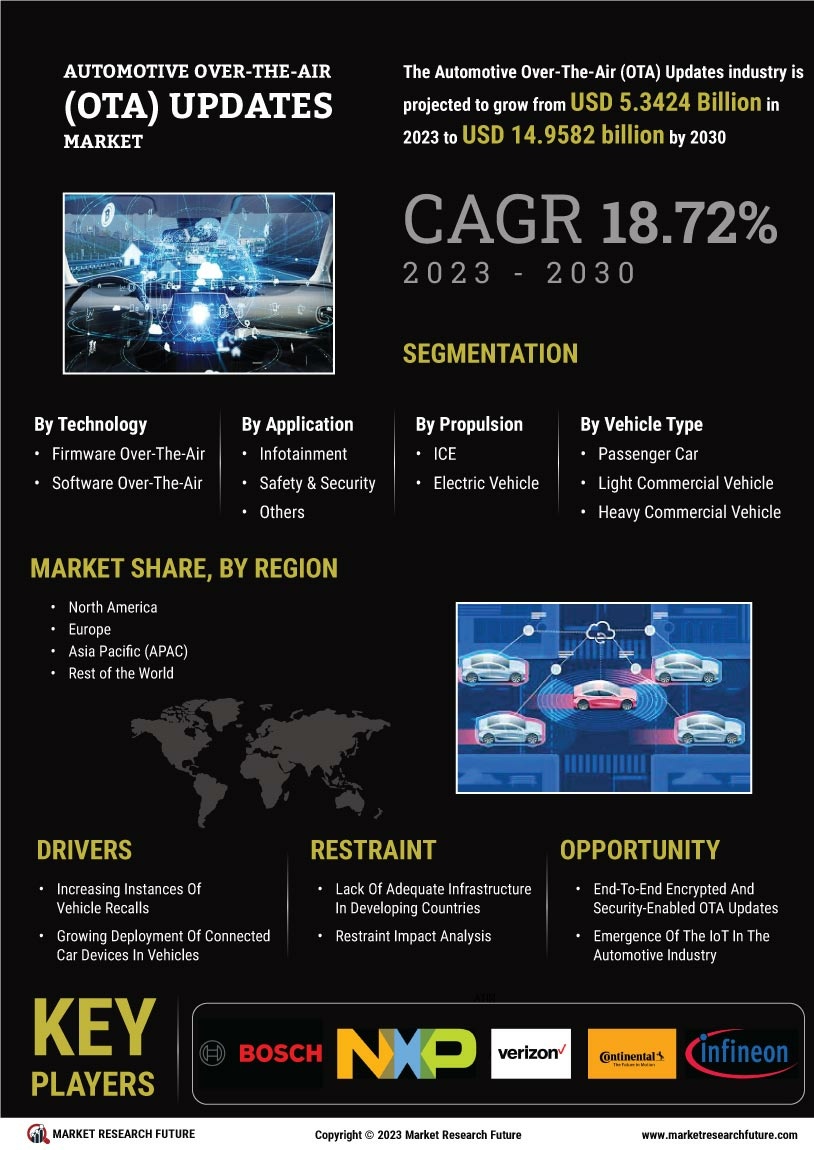

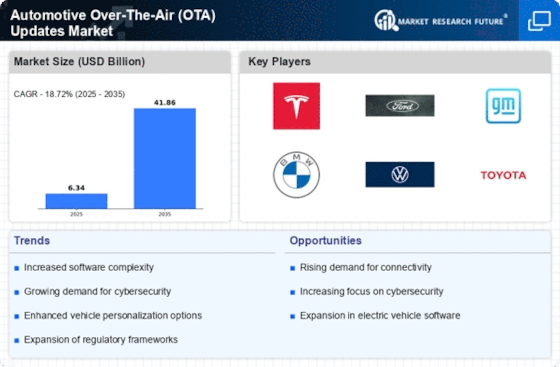

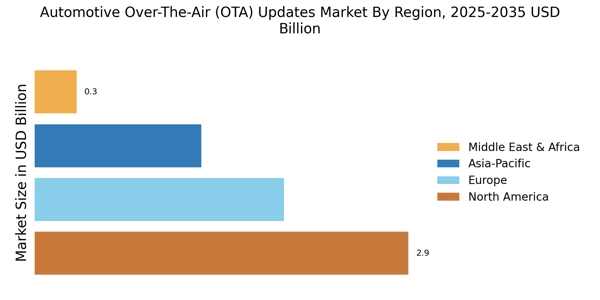

The Automotive Over-The-Air (OTA) Updates Market experiences a notable surge in demand for software updates as vehicles become increasingly reliant on advanced technologies. Consumers expect their vehicles to receive regular updates that enhance performance, fix bugs, and introduce new features. This trend is driven by the growing integration of infotainment systems, navigation, and driver assistance technologies. According to industry estimates, the OTA updates market is projected to reach a valuation of approximately 30 billion dollars by 2026, reflecting a compound annual growth rate of around 20%. This demand for continuous improvement in vehicle software is reshaping the Automotive Over-The-Air (OTA) Updates Market, compelling manufacturers to adopt OTA capabilities to meet consumer expectations.

Cost Efficiency in Vehicle Maintenance

Cost efficiency emerges as a critical driver in the Automotive Over-The-Air (OTA) Updates Market. By enabling manufacturers to deploy updates remotely, OTA technology significantly reduces the need for physical service visits, which can be both time-consuming and expensive. This shift not only lowers operational costs for manufacturers but also enhances customer satisfaction by minimizing vehicle downtime. Reports indicate that OTA updates can save manufacturers up to 50% in service costs compared to traditional methods. As a result, the Automotive Over-The-Air (OTA) Updates Market is witnessing a growing inclination towards adopting OTA solutions, as they provide a more economical approach to vehicle maintenance and software management.

Consumer Preference for Enhanced Features

Consumer preference for enhanced features significantly influences the Automotive Over-The-Air (OTA) Updates Market. As technology advances, consumers increasingly seek vehicles equipped with the latest functionalities, such as improved navigation systems, entertainment options, and autonomous driving capabilities. OTA updates allow manufacturers to deliver these enhancements seamlessly, ensuring that vehicles remain competitive in a rapidly evolving market. Surveys indicate that a substantial percentage of consumers prioritize vehicles that can receive regular updates, reflecting a shift in purchasing behavior. Consequently, the Automotive Over-The-Air (OTA) Updates Market is adapting to meet these consumer demands, fostering innovation and continuous improvement in vehicle offerings.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a pivotal role in shaping the Automotive Over-The-Air (OTA) Updates Market. Governments worldwide are increasingly mandating that automotive manufacturers adhere to stringent safety and emissions standards. OTA updates facilitate timely compliance with these regulations by allowing manufacturers to implement necessary changes without requiring physical recalls. This capability is particularly crucial in addressing software-related safety issues, which can be resolved swiftly through OTA updates. As regulatory frameworks evolve, the Automotive Over-The-Air (OTA) Updates Market is likely to expand, driven by the need for manufacturers to maintain compliance and ensure the safety of their vehicles.

Integration of Connected Vehicle Ecosystems

The integration of connected vehicle ecosystems serves as a vital driver for the Automotive Over-The-Air (OTA) Updates Market. As vehicles become more interconnected with smart devices and infrastructure, the need for seamless software updates becomes paramount. This interconnectedness enhances the overall driving experience, allowing for real-time data exchange and improved vehicle performance. Industry analysts project that the connected vehicle market will grow substantially, with OTA updates playing a crucial role in maintaining the functionality and security of these systems. The Automotive Over-The-Air (OTA) Updates Market is thus positioned to benefit from this trend, as manufacturers seek to leverage OTA technology to enhance connectivity and user experience.