Rise of Autonomous Vehicles

The Automotive Data Management Market is being propelled by the rise of autonomous vehicles. As the development of self-driving technology advances, the amount of data generated by these vehicles is unprecedented. Autonomous vehicles rely on complex algorithms and vast datasets to navigate and make decisions, necessitating sophisticated data management systems. The market for autonomous vehicles is projected to reach several hundred billion dollars by the end of the decade, which will inevitably increase the demand for effective data management solutions. This trend indicates that automotive companies must prioritize data management strategies to support the operational needs of autonomous vehicles, ensuring safety and efficiency in their deployment.

Increasing Vehicle Connectivity

The Automotive Data Management Market is experiencing a surge in demand due to the increasing connectivity of vehicles. As vehicles become more integrated with the Internet of Things (IoT), the volume of data generated is escalating. This connectivity allows for real-time data collection and analysis, which is essential for enhancing vehicle performance and user experience. According to industry estimates, the number of connected vehicles is projected to reach over 500 million by 2025, driving the need for robust data management solutions. Consequently, automotive manufacturers are investing heavily in data management systems to harness this data effectively, ensuring that they remain competitive in a rapidly evolving market.

Regulatory Compliance and Standards

The Automotive Data Management Market is significantly influenced by the need for compliance with various regulatory standards. Governments and regulatory bodies are increasingly implementing stringent regulations regarding data privacy and security, particularly in the automotive sector. For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe impose strict guidelines on how data is collected, stored, and processed. This regulatory landscape compels automotive companies to adopt comprehensive data management strategies to ensure compliance, thereby driving market growth. It is estimated that the compliance-related expenditures in the automotive sector could reach billions annually, highlighting the critical role of data management in meeting these requirements.

Integration of Cloud-Based Solutions

The Automotive Data Management Market is increasingly adopting cloud-based solutions for data storage and management. Cloud technology offers scalability, flexibility, and cost-effectiveness, making it an attractive option for automotive companies. By leveraging cloud-based platforms, manufacturers can store and process large volumes of data without the need for extensive on-premises infrastructure. This shift is particularly relevant as the automotive industry moves towards more data-driven models, where real-time access to data is crucial. Reports suggest that the cloud segment in automotive data management is expected to grow significantly, with many companies transitioning to cloud solutions to enhance their data management capabilities and streamline operations.

Growing Demand for Advanced Analytics

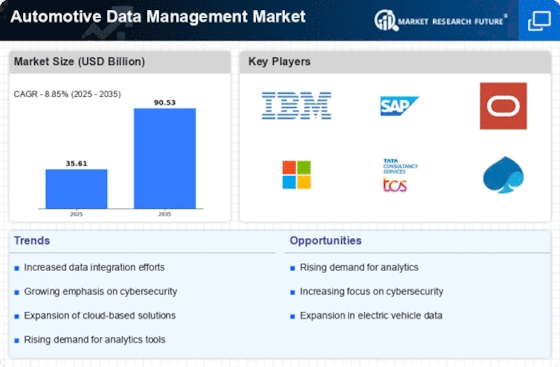

The Automotive Data Management Market is witnessing a growing demand for advanced analytics capabilities. As automotive companies collect vast amounts of data from various sources, the ability to analyze this data effectively becomes paramount. Advanced analytics can provide insights into consumer behavior, vehicle performance, and maintenance needs, which can enhance decision-making processes. Market Research Future indicates that the analytics segment within the automotive data management sector is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This trend underscores the necessity for automotive firms to invest in sophisticated data management solutions that can support advanced analytics, thereby improving operational efficiency and customer satisfaction.