Enhanced Safety Features

The integration of enhanced safety features in vehicles is significantly influencing the Big Data in Automotive Industry Market. Advanced driver-assistance systems (ADAS) utilize real-time data to improve vehicle safety, potentially reducing accident rates. For example, the implementation of predictive analytics can identify potential hazards and alert drivers, thereby enhancing road safety. The market for ADAS is anticipated to grow substantially, with estimates suggesting it could reach 60 billion dollars by 2025. This growth is driven by consumer demand for safer vehicles and regulatory pressures for improved safety standards. Consequently, the emphasis on safety features is likely to propel the adoption of Big Data technologies within the automotive sector.

Connected Vehicle Ecosystem

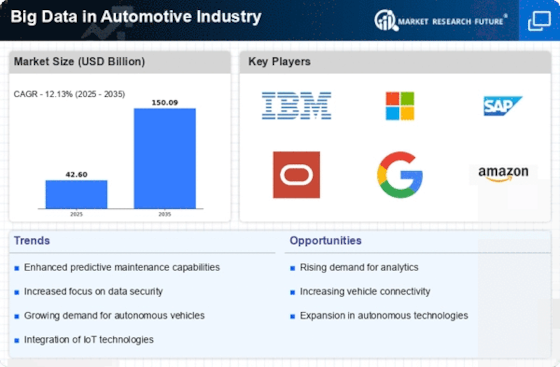

The emergence of a connected vehicle ecosystem is a crucial driver for the Big Data in Automotive Industry Market. Vehicles are increasingly equipped with Internet of Things (IoT) technologies, enabling them to communicate with each other and with infrastructure. This connectivity generates vast amounts of data, which can be analyzed to improve traffic management and enhance user experiences. The connected car market is projected to grow to over 200 billion dollars by 2025, indicating a robust demand for data analytics solutions. As automotive manufacturers invest in connectivity features, the need for sophisticated Big Data analytics tools becomes paramount to harness the potential of this data-rich environment.

Data-Driven Decision Making

The increasing reliance on data-driven decision making is a pivotal driver in the Big Data in Automotive Industry Market. Companies are leveraging vast amounts of data to enhance operational efficiency and improve product offerings. For instance, data analytics enables manufacturers to optimize supply chain processes, reducing costs by up to 20%. Furthermore, the ability to analyze consumer behavior through data insights allows automotive companies to tailor their marketing strategies effectively. This trend is expected to continue, with the market for data analytics in the automotive sector projected to reach approximately 10 billion dollars by 2026. As organizations increasingly adopt data-centric approaches, the demand for Big Data solutions in the automotive industry is likely to surge.

Consumer Demand for Sustainability

The rising consumer demand for sustainability is a significant driver in the Big Data in Automotive Industry Market. As environmental concerns grow, consumers are increasingly seeking eco-friendly vehicles and sustainable practices from manufacturers. This shift is prompting automotive companies to utilize data analytics to assess and improve their environmental impact. For instance, data can be used to optimize production processes, reducing waste and energy consumption. The market for electric vehicles, which heavily relies on data for performance optimization, is projected to exceed 800 billion dollars by 2027. Consequently, the focus on sustainability is likely to enhance the adoption of Big Data technologies in the automotive industry.

Regulatory Compliance and Standards

Regulatory compliance and standards are becoming increasingly stringent in the automotive sector, driving the demand for Big Data solutions. Governments are implementing regulations that require manufacturers to monitor and report on various performance metrics, including emissions and safety data. This necessitates the collection and analysis of large datasets to ensure compliance. The market for compliance-related analytics is expected to grow, with estimates suggesting it could reach 5 billion dollars by 2026. As automotive companies strive to meet these regulatory requirements, the integration of Big Data technologies will be essential for efficient data management and reporting, thereby influencing the overall market landscape.