Technological Advancements in Data Acquisition

Technological advancements in data acquisition systems significantly influence the automotive data-logger market. Innovations such as high-speed data transfer, enhanced sensor technologies, and improved data storage solutions are driving the adoption of data-loggers in vehicles. In the US, the market for automotive data-loggers is expected to reach approximately $1.2 billion by 2026, reflecting a growing recognition of the importance of accurate data collection for vehicle diagnostics and performance analysis. These advancements enable manufacturers to develop more sophisticated data-loggers that can capture a wider array of parameters, thereby enhancing the overall functionality and appeal of these devices in the automotive data-logger market.

Increased Investment in Research and Development

The automotive data-logger market benefits from increased investment in research and development (R&D) by automotive manufacturers and technology firms. This investment is primarily aimed at developing innovative data-logging solutions that can cater to the evolving needs of the automotive industry. In the US, R&D spending in the automotive sector is projected to exceed $20 billion annually by 2026, indicating a robust commitment to technological advancement. As manufacturers strive to improve vehicle safety, efficiency, and performance, the demand for advanced data-loggers is likely to rise, further propelling growth in the automotive data-logger market.

Rising Demand for Vehicle Performance Monitoring

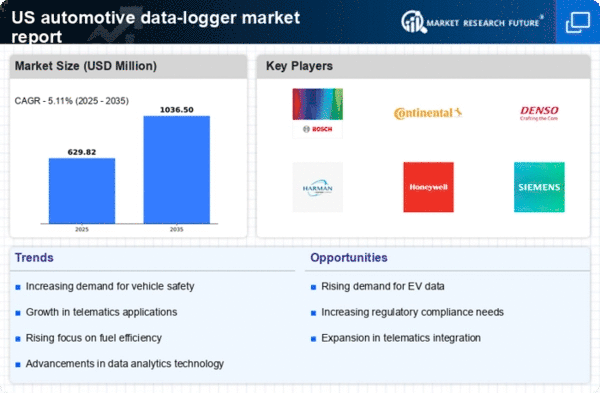

The automotive data-logger market is experiencing a notable surge in demand due to the increasing emphasis on vehicle performance monitoring. As consumers and manufacturers alike seek to enhance vehicle efficiency and reliability, data-loggers play a crucial role in capturing real-time performance metrics. This trend is particularly evident in the US, where the automotive sector is projected to grow at a CAGR of approximately 4.5% from 2025 to 2030. The ability to analyze data related to fuel consumption, engine performance, and driving behavior is becoming indispensable for manufacturers aiming to meet consumer expectations. Consequently, the automotive data-logger market is likely to expand as more companies invest in advanced data-logging technologies to gain a competitive edge.

Regulatory Compliance and Environmental Standards

Regulatory compliance and environmental standards are pivotal factors influencing the automotive data-logger market. As governments in the US implement stricter emissions regulations and safety standards, manufacturers are compelled to adopt data-logging technologies to ensure compliance. The automotive sector is facing increasing pressure to reduce carbon footprints, with regulations mandating the monitoring of emissions and fuel efficiency. This trend is likely to propel the automotive data-logger market, as companies invest in data-loggers that can provide accurate and reliable data for compliance purposes. The market is expected to see a steady growth trajectory as manufacturers prioritize adherence to these regulations.

Growing Importance of Data Analytics in Automotive

The growing importance of data analytics in the automotive sector is a key driver for the automotive data-logger market. As vehicles become increasingly connected, the ability to analyze data collected from various sources is paramount for optimizing performance and enhancing user experience. In the US, the automotive data analytics market is anticipated to grow at a CAGR of around 15% through 2027, which directly correlates with the rising demand for data-loggers that facilitate this analytical process. Manufacturers are increasingly leveraging data analytics to inform design decisions, improve maintenance schedules, and enhance overall vehicle functionality, thereby driving the automotive data-logger market.

.png)