Expansion in Aerospace and Defense

The Aerospace and defense sectors are significant contributors to the atomic clock Market, as these industries require highly accurate timing for navigation and communication systems. Atomic clocks are essential for satellite operations, missile guidance, and secure communications. The market is likely to see an increase in demand as countries invest in advanced defense technologies and space exploration initiatives. Recent reports indicate that the aerospace sector alone could account for nearly 30% of the total atomic clock market by 2026. This expansion underscores the critical role of atomic clocks in ensuring operational efficiency and safety in aerospace and defense applications.

Increased Demand in Telecommunications

The telecommunications sector is a major driver for the Atomic Clock Market, as the need for precise timing is paramount for network synchronization. With the rise of 5G technology, the demand for atomic clocks has intensified, as they provide the necessary accuracy for high-speed data transmission. The market for atomic clocks in telecommunications is expected to expand, with projections indicating a potential increase in revenue by approximately 15% over the next five years. This growth is fueled by the need for reliable and synchronized communication networks, making atomic clocks indispensable in the evolving telecommunications landscape.

Growing Adoption in Scientific Research

The Atomic Clock Market is also driven by the growing adoption of atomic clocks in scientific research. Researchers utilize atomic clocks for experiments in fundamental physics, including tests of relativity and quantum mechanics. The precision offered by atomic clocks allows for more accurate measurements, which can lead to groundbreaking discoveries. As research institutions and universities increasingly invest in advanced timekeeping technologies, the market is expected to witness a steady growth trajectory. It is estimated that the scientific research segment could represent a significant portion of the atomic clock market, potentially reaching 20% by 2025.

Emerging Applications in Consumer Electronics

The Atomic Clock Market is witnessing emerging applications in consumer electronics, particularly in devices that require precise timekeeping. Smart devices, wearables, and IoT applications increasingly rely on accurate timing for functionality and performance. As consumer demand for high-tech gadgets grows, manufacturers are exploring the integration of atomic clock technology to enhance device capabilities. This trend may lead to a notable increase in market share for atomic clocks within the consumer electronics sector, with projections suggesting a growth rate of around 12% in this segment over the next few years. The potential for atomic clocks in everyday technology highlights their versatility and importance.

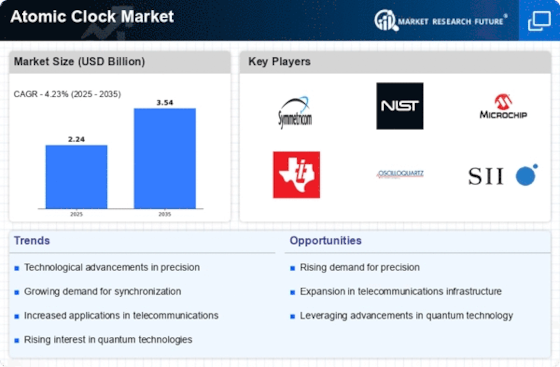

Technological Advancements in Precision Timing

The Atomic Clock Market is experiencing a surge in demand due to rapid technological advancements in precision timing. Innovations in quantum technology and laser cooling techniques have led to the development of more accurate atomic clocks. These advancements enable timekeeping with unprecedented precision, which is crucial for various applications, including GPS systems and telecommunications. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As industries increasingly rely on precise timing for synchronization, the Atomic Clock Market is poised for substantial growth, driven by these technological breakthroughs.