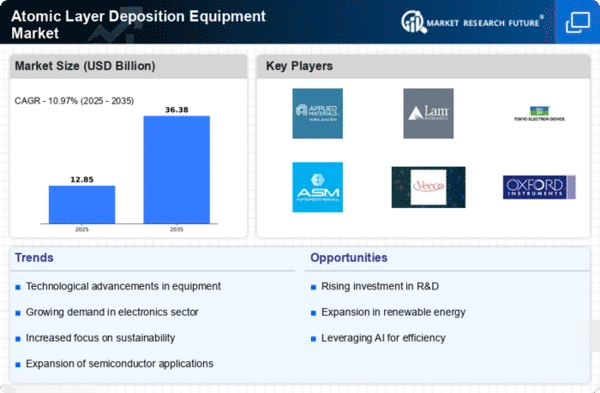

Market Growth Projections

The Global Atomic Layer Deposition Equipment Market Industry is projected to experience substantial growth, with estimates suggesting a market size of 11.6 USD Billion in 2024 and a remarkable increase to 36.4 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 10.97% from 2025 to 2035. Such projections highlight the increasing reliance on atomic layer deposition technology across various sectors, including electronics, renewable energy, and nanotechnology. The market's expansion reflects broader trends in advanced manufacturing and innovation, positioning the Global Atomic Layer Deposition Equipment Market Industry as a key player in the future of technology development.

Technological Advancements in ALD

Technological advancements in atomic layer deposition are significantly influencing the Global Atomic Layer Deposition Equipment Market Industry. Innovations such as spatial ALD and plasma-enhanced ALD are enhancing deposition rates and material versatility. These advancements enable manufacturers to explore new applications across various sectors, including nanotechnology and biotechnology. As the industry embraces these cutting-edge technologies, the market is likely to witness a compound annual growth rate of 10.97% from 2025 to 2035. This growth reflects the increasing reliance on ALD for producing high-quality materials, thereby solidifying the Global Atomic Layer Deposition Equipment Market Industry's position in the broader manufacturing landscape.

Rising Demand for Advanced Electronics

The Global Atomic Layer Deposition Equipment Market Industry experiences a surge in demand driven by the increasing complexity of electronic devices. As manufacturers strive to produce smaller, more efficient components, atomic layer deposition (ALD) technology becomes essential for achieving precise thin films. This trend is particularly evident in the semiconductor sector, where ALD is utilized for high-k dielectrics and metal gate applications. The market is projected to reach 11.6 USD Billion in 2024, reflecting the industry's adaptation to advanced manufacturing techniques. As the demand for miniaturization and enhanced performance continues, the Global Atomic Layer Deposition Equipment Market Industry is likely to expand significantly.

Emerging Applications in Nanotechnology

Emerging applications in nanotechnology are driving the Global Atomic Layer Deposition Equipment Market Industry forward. ALD is increasingly utilized in the production of nanoscale materials and devices, which are essential for various high-tech applications. The precision and control offered by ALD make it ideal for fabricating nanostructures with specific properties. As industries such as healthcare, electronics, and materials science explore the potential of nanotechnology, the demand for ALD equipment is expected to grow. This trend underscores the versatility of ALD and its critical role in advancing technological innovations, further solidifying the Global Atomic Layer Deposition Equipment Market Industry's relevance in the global market.

Growth in Renewable Energy Technologies

The Global Atomic Layer Deposition Equipment Market Industry is poised for growth due to the increasing adoption of renewable energy technologies. ALD plays a crucial role in the fabrication of thin-film solar cells and other energy-efficient devices. The technology enables the deposition of uniform layers, which enhances the performance and longevity of solar panels. As countries invest in sustainable energy solutions, the demand for ALD equipment is expected to rise. This trend aligns with global efforts to transition towards greener energy sources, potentially contributing to the market's expansion to 36.4 USD Billion by 2035. The Global Atomic Layer Deposition Equipment Market Industry is thus positioned to benefit from this shift.

Increasing Investment in Research and Development

The Global Atomic Layer Deposition Equipment Market Industry benefits from heightened investment in research and development across multiple sectors. As industries seek to innovate and improve product performance, funding for advanced manufacturing techniques, including ALD, is on the rise. This investment facilitates the exploration of new materials and applications, particularly in the fields of electronics and energy. With governments and private entities recognizing the potential of ALD technology, the market is likely to experience substantial growth. The emphasis on R&D not only enhances the capabilities of ALD equipment but also drives the overall expansion of the Global Atomic Layer Deposition Equipment Market Industry.