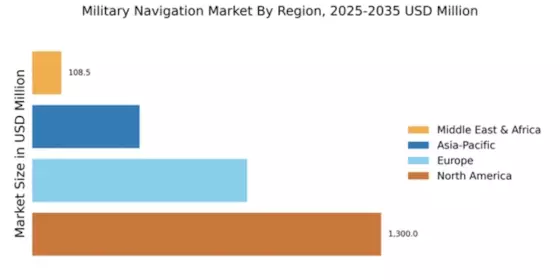

North America : Market Leader in Military Tech

North America is poised to maintain its leadership in the Military Navigation Market, holding a significant share of 1300.0M in 2025. The region's growth is driven by increasing defense budgets, technological advancements, and a focus on enhancing military capabilities. Regulatory support and government initiatives further catalyze demand for advanced navigation systems, ensuring that North America remains at the forefront of military innovation.

The United States is the primary player in this market, with key companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies leading the charge. The competitive landscape is characterized by continuous innovation and strategic partnerships among these firms. As military operations become more complex, the demand for sophisticated navigation solutions is expected to rise, solidifying North America's position as a global leader.

Europe : Growing Defense Investments

Europe is witnessing a robust growth trajectory in the Military Navigation Market, with a market size of 800.0M in 2025. The region's growth is fueled by increasing defense expenditures and a collaborative approach to military modernization among EU nations. Regulatory frameworks are evolving to support the integration of advanced navigation technologies, enhancing operational efficiency and effectiveness in military operations.

Leading countries such as the UK, France, and Germany are at the forefront of this market, with companies like Thales Group and BAE Systems playing pivotal roles. The competitive landscape is marked by innovation and strategic alliances, as European nations seek to bolster their defense capabilities. The emphasis on interoperability and joint operations among NATO allies further drives demand for advanced military navigation systems.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is emerging as a significant player in the Military Navigation Market, with a projected size of 400.0M in 2025. The region's growth is driven by increasing military budgets, geopolitical tensions, and a focus on modernization of defense systems. Governments are investing in advanced navigation technologies to enhance operational readiness and effectiveness, supported by favorable regulatory environments that encourage innovation.

Countries like China, India, and Japan are leading the charge, with a growing presence of key players such as Elbit Systems and L3 Technologies. The competitive landscape is evolving, with local firms also entering the market, creating a dynamic environment. As regional tensions rise, the demand for reliable military navigation solutions is expected to surge, positioning Asia-Pacific as a critical market for future growth.

Middle East and Africa : Strategic Defense Developments

The Middle East and Africa region is gradually expanding its Military Navigation Market, with a size of 108.54M in 2025. The growth is driven by increasing defense spending, regional conflicts, and a focus on enhancing military capabilities. Governments are prioritizing investments in advanced navigation systems to improve operational efficiency, supported by regulatory frameworks that promote defense modernization initiatives.

Countries like the UAE and South Africa are leading the market, with a growing interest in partnerships with global defense firms. The competitive landscape is characterized by collaborations and technology transfers, as local players seek to enhance their capabilities. As security challenges persist, the demand for sophisticated military navigation solutions is expected to rise, making this region a focal point for defense investments.