Advancements in Medical Research

Recent advancements in medical research have illuminated the potential therapeutic benefits of arachidonic acid, particularly in the context of inflammatory diseases and neurological disorders. The Arachidonic Acid Market is likely to benefit from these findings, as healthcare professionals increasingly recognize the importance of omega-6 fatty acids in managing various health conditions. Research indicates that arachidonic acid may play a crucial role in modulating inflammation, which could lead to its incorporation into treatment protocols. As a result, the demand for arachidonic acid in pharmaceutical applications is expected to rise, further propelling the growth of the Arachidonic Acid Market.

Regulatory Support for Nutraceuticals

The Arachidonic Acid Market is benefiting from favorable regulatory frameworks that support the development and marketing of nutraceuticals. Governments and health organizations are increasingly recognizing the importance of dietary supplements in promoting public health. This regulatory support is likely to encourage investment in research and development, leading to innovative products that incorporate arachidonic acid. As a result, the Arachidonic Acid Market may experience accelerated growth as companies capitalize on these opportunities to introduce new formulations that meet consumer demands for health-enhancing products.

Rising Popularity of Sports Nutrition

The Arachidonic Acid Market is witnessing a significant uptick in interest from the sports nutrition sector. Athletes and fitness enthusiasts are increasingly turning to arachidonic acid supplements to enhance performance and recovery. This trend is supported by market data, which suggests that the sports nutrition market is anticipated to grow at a CAGR of around 7% in the coming years. As more individuals engage in rigorous training regimens, the demand for products containing arachidonic acid is likely to increase, positioning the Arachidonic Acid Market favorably within the broader nutritional landscape.

Growing Awareness of Omega Fatty Acids

There is a rising awareness among consumers regarding the health benefits associated with omega fatty acids, particularly arachidonic acid. The Arachidonic Acid Market is poised to capitalize on this trend as educational campaigns and health initiatives promote the importance of these essential fatty acids in maintaining overall health. Market data suggests that the demand for omega-6 fatty acids is on the rise, with consumers increasingly seeking products that contain arachidonic acid for its potential benefits in cardiovascular health and inflammation management. This growing awareness is likely to drive the expansion of the Arachidonic Acid Market in the foreseeable future.

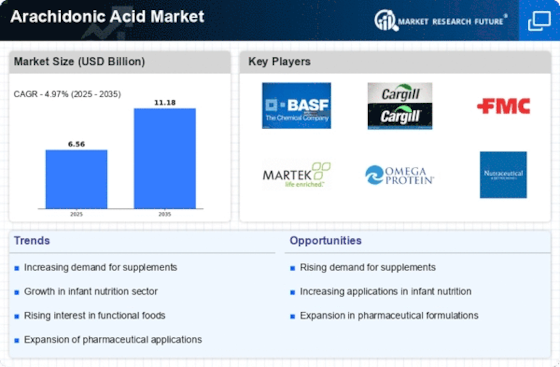

Increasing Demand for Nutritional Supplements

The Arachidonic Acid Market is experiencing a notable surge in demand for nutritional supplements, driven by a growing awareness of health and wellness among consumers. As individuals increasingly seek to enhance their dietary intake with essential fatty acids, arachidonic acid has gained prominence due to its role in muscle growth and recovery. Market data indicates that the dietary supplement sector is projected to expand at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend suggests that the Arachidonic Acid Market could see substantial growth as manufacturers innovate and introduce new formulations that cater to health-conscious consumers.