Research Methodology on Pharmaceutical Desiccant Market

Abstract

The current study aims to provide a detailed overview of the pharmaceutical desiccant market. By focusing on drivers, challenges, and segmentation, the research provides insights into overall market dynamics as well as market size and estimations from 2023 to 2030. Moreover, the data and information collected using qualitative and quantitative approaches are accurately presented in a market research report.

Introduction

Pharmaceutical desiccants are substances which are capable of absorbing moisture from the atmosphere and are used to extend the shelf life of medicines. These desiccants are packed along with the drugs in order to ensure the stability of drugs and lessen the harmful effects caused due to moisture. The rising use of pharmaceutical desiccants is mainly attributed to their properties such as cost-effectiveness, longer shelf life, and limited amount of packaging space requirement.

Market Dynamics

This research report provides an in-depth analysis of the pharmaceutical desiccant market on the basis of drivers, challenges, and market segmentation. The market is driven by factors such as rising global demand for drug safety compliance, growth in the pharmaceutical industry, and increasing need for accurate and safe products. The pharmaceutical desiccant market shows immense growth potential due to the cost efficiency and reliable performance of desiccants for the protection and preservation of drugs. The market is further driven by growing capital investments and technological advancement in the global pharmaceutical industry.

On the other hand, market growth might be restrained by the presence of competitors and the reluctance of pharmaceutical companies to adopt new products. Key challenges identified in the market include high production costs and limited availability of absorption capability in certain desiccants.

Market Segmentation

The pharmaceutical desiccant market has been segmented on the basis of type, function, application, and region. On the basis of type, the market has been categorized into silica gel desiccants, activated alumina, molecular sieve desiccants, clay desiccants, and others. Among these desiccants, silica gel desiccant appears to be the most favourable type in terms of application and revenue generation. Furthermore, silica gel desiccants are gaining prominence in the market due to their applications for inert packaging of food items, drugs, and others.

On the basis of function, the market is divided into absorbed and adsorbed types of pharmaceutical desiccants. Adsorbed desiccants are mainly gaining popularity because of their ability to adsorb large amounts of water and their ability to reduce the impact of foreign impurities in drugs. The market is further categorized based on applications such as pharmaceuticals, electronics, food and beverages, and others. Pharmaceutical desiccant is primarily employed in the pharmaceutical sector for the preservation and protection of drugs and medical devices.

Regional Analysis

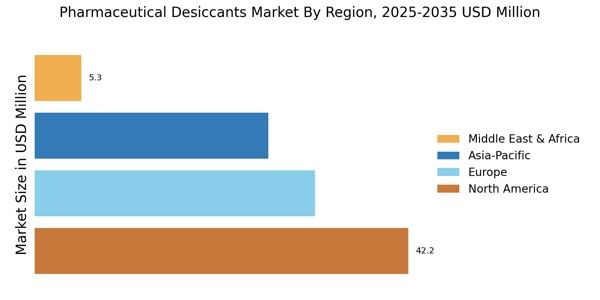

Geographically, the global pharmaceutical desiccant market has been split into five major regions – North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. The North American market appears to be the leading region in terms of both application and revenue. The highest growth rate in the region is mainly associated with the presence of a highly developed pharmaceutical industry in the U.S. and Canada. In addition, the presence of numerous key players and various technological advancements further contribute to the growth of the region.

The rising population in emerging countries, growing drug safety compliance, and rising demand for medical devices are expected to drive the Asia-Pacific market considerably. The presence of a large number of pharmaceutical companies in this region is also one of the key factors driving the growth of the market.

Research Methodology

The data and information gathered for this market research report have been collected using a comprehensive research methodology. To begin with, a detailed market knowledge structure was derived through secondary research. This includes secondary sources such as company websites, government associations, industry reports, and important regulatory texts. These sources were extensively used to identify and collect information such as market trends, potential opportunities, key players in the market, drivers, restraints, and product/service segmentation.

The secondary research was accompanied by primary research. For the primary research, numerous communication and interview sessions were used to gather first-hand information regarding market trends, product/service offerings, key players’ profiles, SWOT analysis, potential customers, opinions of the major stakeholders, and other factors.

The primary and secondary data collected were further analyzed using various data triangulation techniques. The bottom-up approach, top-down approach, factor analysis, time-series analysis, demand-side data analysis, and supply-side data analysis were some of the approaches used for triangulating the data.

Competitive Landscape

The market research report further provides information about the key companies and their strategies operating in the pharmaceutical desiccant market. It includes extensive information about the financials, recent developments, and other strategic initiatives taken by these companies and their performance. Some of the key players operating in the pharmaceutical desiccant market are Siyaram Corporation, Alnor Inc., COS Sachet Technologies Pvt. Ltd., Ecosorb Desiccants, Clay Dry Desiccants, Damco Solutions, Desiccare Inc., Digi-Key Corporation, Amcor Limited, and Desicca Technologies BV.

Conclusion

The pharmaceutical desiccant market is projected to witness substantial growth over the years 2023 to 2030, in terms of value and volume. Factors such as the increasing need for drug safety compliance, rising global demand for longer shelf-life drugs, and technological maturity in the pharmaceutical industry are some of the key drivers contributing to the growth of the market. The rising demand from developing countries due to the presence of a large number of pharmaceutical companies as well as supportive government policies are likely to provide a boost to the market in the upcoming years.