Regulatory Support

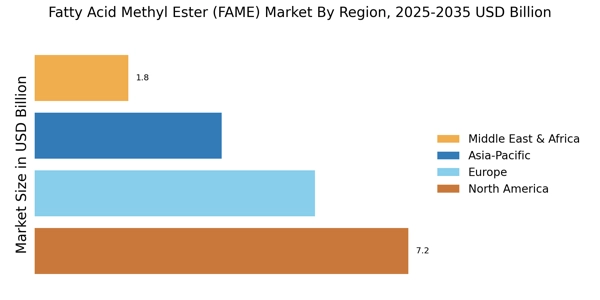

Regulatory support plays a crucial role in shaping the Fatty Acid Methyl Ester Market. Governments worldwide are implementing stringent regulations aimed at reducing greenhouse gas emissions, which in turn fosters the adoption of biofuels. For example, the Renewable Fuel Standard in the United States mandates the blending of renewable fuels, including FAME, into the transportation fuel supply. This regulatory framework not only encourages the production of FAME but also stimulates investment in related technologies. As of 2025, the market is likely to benefit from enhanced regulatory frameworks that promote the use of FAME, thereby driving its growth and acceptance in various sectors.

Technological Innovations

Technological innovations are transforming the Fatty Acid Methyl Ester Market by enhancing production efficiency and reducing costs. Advances in processing technologies, such as transesterification, are enabling manufacturers to produce FAME more efficiently. Furthermore, the development of new catalysts and methods for feedstock conversion is likely to improve yield and reduce waste. As these technologies continue to evolve, they may lead to a decrease in production costs, making FAME more competitive against fossil fuels. By 2025, the impact of these innovations is expected to be profound, potentially reshaping the landscape of the Fatty Acid Methyl Ester Market.

Sustainability Initiatives

The increasing emphasis on sustainability initiatives is a pivotal driver for the Fatty Acid Methyl Ester Market. As industries strive to reduce their carbon footprints, the demand for biofuels derived from renewable resources, such as FAME, is on the rise. This shift is supported by various governmental policies promoting the use of renewable energy sources. For instance, the European Union has set ambitious targets for renewable energy usage, which includes biofuels like FAME. In 2025, the market is projected to witness a substantial increase in demand as more companies adopt sustainable practices, thereby enhancing the growth trajectory of the Fatty Acid Methyl Ester Market.

Rising Demand for Biodiesel

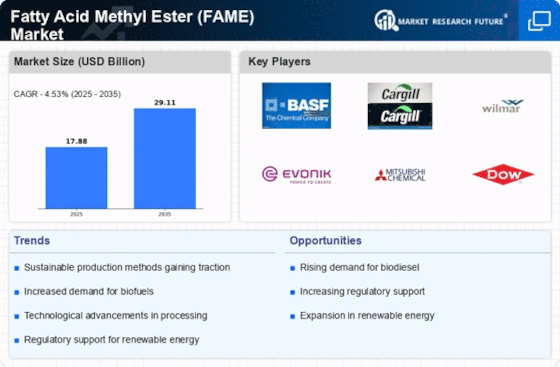

The rising demand for biodiesel is a significant driver for the Fatty Acid Methyl Ester Market. Biodiesel, primarily produced from FAME, is gaining traction as a cleaner alternative to conventional diesel. The Fatty Acid Methyl Ester Market (FAME) is expected to grow substantially, with projections indicating a compound annual growth rate of over 5% through 2025. This growth is attributed to the increasing awareness of environmental issues and the need for cleaner fuel options. Consequently, the Fatty Acid Methyl Ester Market is poised to expand as biodiesel production ramps up to meet this burgeoning demand, thereby enhancing its market presence.

Diverse End-Use Applications

The diverse end-use applications of Fatty Acid Methyl Ester Market (FAME) are driving its market growth. FAME is utilized in various sectors, including automotive, cosmetics, and pharmaceuticals, due to its favorable properties. In the automotive sector, FAME is primarily used as a biodiesel component, while in cosmetics, it serves as an emollient and surfactant. The versatility of FAME allows it to cater to a wide range of industries, which is likely to bolster its demand. As of 2025, the Fatty Acid Methyl Ester Market is expected to benefit from this diversity, as manufacturers explore new applications and expand their product offerings.