Growth in Personal Care Products

The Benzoic Acid Market is significantly influenced by the growth of the personal care and cosmetics sector. Benzoic acid is commonly used as a preservative in various personal care products, including lotions, shampoos, and creams, due to its ability to prevent microbial growth. The personal care industry has been experiencing robust growth, with an increasing consumer preference for products that are both effective and safe. Market data suggests that the demand for benzoic acid in personal care formulations is projected to rise by approximately 5% annually. This trend is driven by the growing awareness of product safety and the desire for longer-lasting personal care items. Consequently, the expanding applications of benzoic acid in personal care products serve as a vital driver for the Benzoic Acid Market, fostering innovation and product development.

Rising Demand in Food Preservation

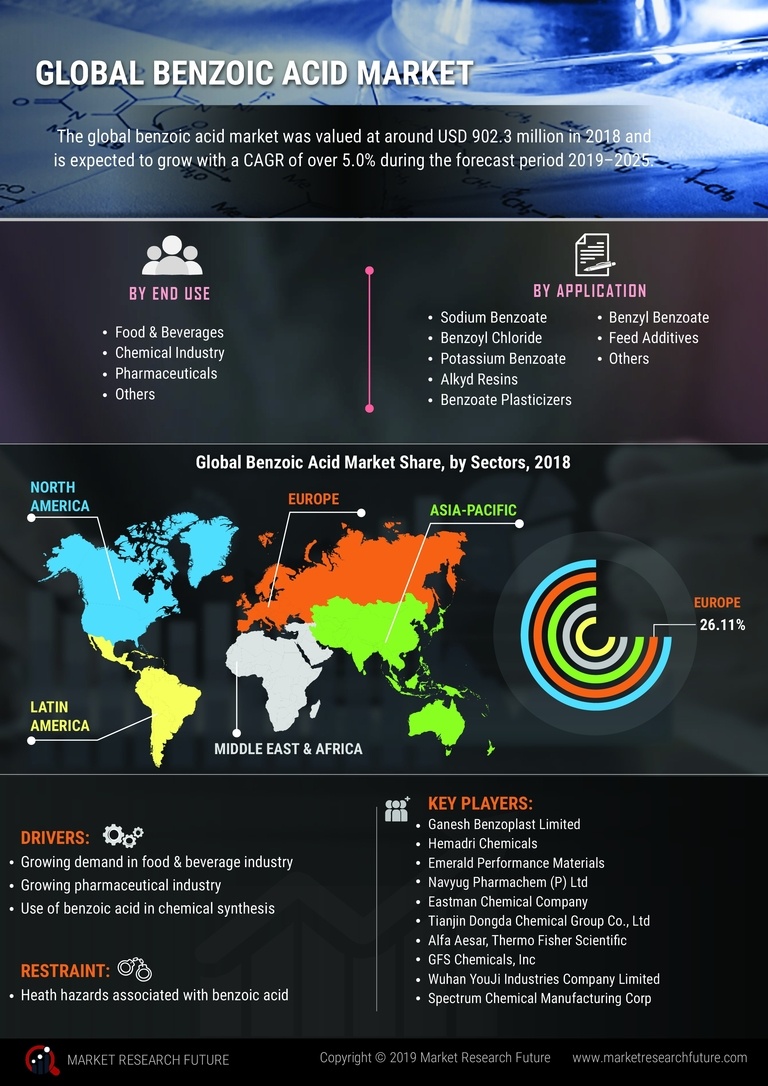

The Benzoic Acid Market is experiencing a notable increase in demand due to its widespread application in food preservation. As consumers become more health-conscious, the need for natural preservatives has surged. Benzoic acid, recognized for its antimicrobial properties, is utilized in various food products to inhibit the growth of harmful bacteria and fungi. According to recent data, the food and beverage sector accounts for a substantial portion of benzoic acid consumption, with projections indicating a growth rate of approximately 4% annually. This trend is likely to continue as manufacturers seek to enhance product shelf life while adhering to safety standards. Consequently, the rising demand for preserved foods is a significant driver for the Benzoic Acid Market, influencing production and innovation in preservation techniques.

Regulatory Support for Chemical Safety

The Benzoic Acid Market is positively impacted by regulatory support aimed at ensuring chemical safety. Governments and regulatory bodies are implementing stringent guidelines regarding the use of chemicals in food, pharmaceuticals, and personal care products. Benzoic acid, being recognized for its safety profile when used within established limits, is likely to benefit from these regulations. The increasing emphasis on consumer safety and environmental protection is driving manufacturers to adopt safer alternatives, thereby enhancing the market for benzoic acid. Market data suggests that compliance with these regulations could lead to a 2% increase in demand for benzoic acid in various sectors. As regulatory frameworks evolve, the Benzoic Acid Market is expected to adapt and thrive, ensuring the continued relevance of benzoic acid in diverse applications.

Expanding Applications in Pharmaceuticals

The Benzoic Acid Market is witnessing an expansion in its applications within the pharmaceutical sector. Benzoic acid and its derivatives are increasingly utilized in the formulation of various medications, particularly as a pH adjuster and preservative. The pharmaceutical industry has shown a consistent growth trajectory, with an estimated increase in demand for benzoic acid-based products. This growth is attributed to the rising prevalence of chronic diseases and the need for effective drug formulations. Furthermore, the increasing focus on research and development in pharmaceuticals is likely to drive innovation in benzoic acid applications, thereby enhancing its market presence. As a result, the pharmaceutical sector is becoming a crucial driver for the Benzoic Acid Market, contributing to its overall expansion and diversification.

Increasing Use in Industrial Applications

The Benzoic Acid Market is benefiting from the increasing use of benzoic acid in various industrial applications. It is utilized as a key ingredient in the production of plastics, resins, and dyes, which are essential components in numerous manufacturing processes. The industrial sector has shown resilience and growth, with a rising demand for high-performance materials. Recent statistics indicate that the demand for benzoic acid in industrial applications is expected to grow at a rate of 3% per year. This growth is likely fueled by advancements in manufacturing technologies and the need for sustainable materials. As industries continue to innovate and seek efficient solutions, the role of benzoic acid in industrial applications is becoming increasingly prominent, thus driving the Benzoic Acid Market forward.