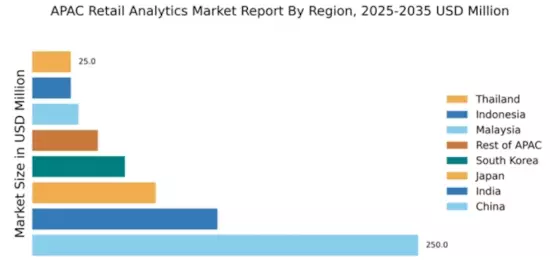

China : Unmatched Growth and Innovation

China holds a commanding market share of 250.0, representing a significant portion of the APAC retail analytics market. Key growth drivers include rapid digital transformation, increasing e-commerce penetration, and a growing emphasis on data-driven decision-making. Government initiatives, such as the Digital China strategy, are fostering innovation and infrastructure development, enhancing the overall business environment. The demand for advanced analytics tools is surging as retailers seek to optimize operations and improve customer experiences.

India : Digital Transformation at Full Speed

Key markets include metropolitan areas like Mumbai, Delhi, and Bengaluru, where competition is fierce among local and international players. Major companies such as SAP, IBM, and Oracle have established a strong presence, contributing to a dynamic competitive landscape. The local business environment is characterized by a mix of traditional retail and modern trade, with significant applications in sectors like fashion, electronics, and groceries.

Japan : Technology Meets Tradition

Tokyo and Osaka are pivotal markets, hosting numerous retail giants and tech startups. The competitive landscape features major players like Microsoft and SAS, who are leveraging advanced analytics to gain market share. The business environment is characterized by a blend of traditional retail practices and cutting-edge technology, with applications spanning various sectors, including electronics, fashion, and food services.

South Korea : Smart Retail Solutions on the Rise

Seoul is the primary market, showcasing a competitive environment with both local and international players. Companies like Tableau and Qlik are making significant inroads, offering innovative solutions tailored to local needs. The business environment is dynamic, with a focus on sectors such as fashion, beauty, and electronics, where analytics play a crucial role in understanding consumer preferences.

Malaysia : Growth Amidst Digital Transformation

Kuala Lumpur is a key market, with a competitive landscape featuring both local and international players. Companies like IBM and Oracle are establishing a presence, contributing to the market's growth. The local business environment is characterized by a mix of traditional retail and modern trade, with significant applications in sectors such as fashion, electronics, and food services.

Thailand : Adapting to Consumer Trends

Bangkok is the primary market, showcasing a competitive environment with both local and international players. Major companies like SAP and Nielsen are making significant inroads, offering innovative solutions tailored to local needs. The business environment is dynamic, with a focus on sectors such as fashion, beauty, and electronics, where analytics play a crucial role in understanding consumer preferences.

Indonesia : Unlocking Market Potential

Jakarta is a key market, with a competitive landscape featuring both local and international players. Companies like Microsoft and SAS are establishing a presence, contributing to the market's growth. The local business environment is characterized by a mix of traditional retail and modern trade, with significant applications in sectors such as fashion, electronics, and food services.

Rest of APAC : Emerging Markets on the Rise

Countries like Vietnam, Philippines, and Singapore are key markets, each with unique competitive landscapes. Major players like Teradata and Qlik are making significant inroads, offering innovative solutions tailored to local needs. The business environment is dynamic, with a focus on sectors such as fashion, electronics, and food services, where analytics play a crucial role in understanding consumer preferences.