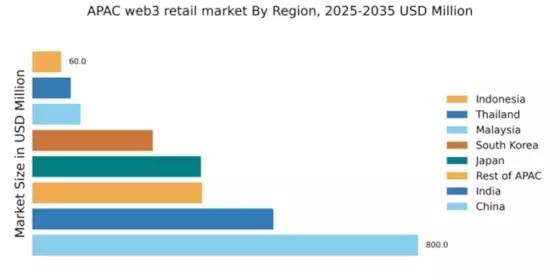

China : Unmatched Growth and Innovation

China holds a commanding market share of 800.0, representing a significant portion of the APAC web3 retail market. Key growth drivers include rapid digitalization, a tech-savvy consumer base, and strong government support for blockchain initiatives. Demand trends show a shift towards decentralized finance and NFT marketplaces, while regulatory policies are increasingly favorable, promoting innovation. Infrastructure development, particularly in urban centers, supports this growth trajectory.

India : Rapid Growth and Diverse Market

Key markets include metropolitan areas like Bangalore, Mumbai, and Delhi, where tech startups thrive. The competitive landscape features major players like Flipkart and Paytm, alongside international entrants. Local dynamics are characterized by a vibrant startup ecosystem, with significant investments in fintech and e-commerce sectors, enhancing the overall business environment.

Japan : Tech-Driven Consumer Engagement

Tokyo and Osaka are pivotal markets, showcasing a competitive landscape with players like Rakuten and Amazon Japan. The business environment is characterized by a blend of established retail giants and innovative startups. Local dynamics favor tech integration in retail, with applications in sectors like fashion and electronics, enhancing consumer engagement.

South Korea : Leading in Digital Retail Trends

Seoul is the primary market, with a competitive landscape featuring major players like Coupang and Naver. The local business environment is dynamic, with a focus on innovation and customer experience. Sector-specific applications are evident in beauty and fashion, where digital platforms are reshaping consumer interactions.

Malaysia : Emerging Trends and Opportunities

Kuala Lumpur and Penang are key markets, with a competitive landscape featuring local players like Lazada and international entrants. The business environment is evolving, with a focus on enhancing digital payment systems and e-commerce platforms. Sector-specific applications are emerging in retail and logistics, driving innovation.

Thailand : Adapting to New Consumer Behaviors

Bangkok is the central market, with a competitive landscape featuring players like Shopee and Lazada. The local business environment is characterized by a mix of traditional retail and emerging e-commerce platforms. Sector-specific applications are evident in tourism and hospitality, where digital solutions are enhancing customer experiences.

Indonesia : Digital Transformation in Retail

Jakarta is the primary market, with a competitive landscape featuring local players like Tokopedia and Bukalapak. The business environment is rapidly evolving, with a focus on enhancing digital infrastructure and e-commerce capabilities. Sector-specific applications are emerging in fashion and electronics, driving innovation and consumer engagement.

Rest of APAC : Varied Growth Across Sub-Regions

Key markets include Vietnam and the Philippines, where local players are emerging alongside international giants. The competitive landscape is characterized by a mix of established retailers and innovative startups. Local dynamics vary significantly, with sector-specific applications in agriculture and logistics, enhancing overall market potential.