China : Unmatched Growth and Innovation

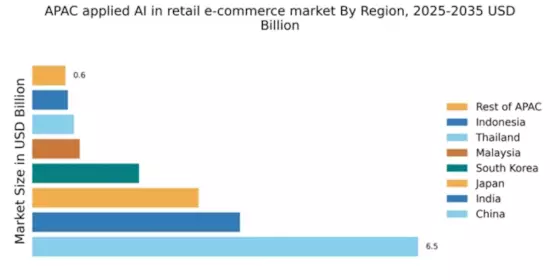

China holds a commanding 6.5% market share in the APAC AI-in-retail-e-commerce sector, driven by rapid digital transformation and a tech-savvy consumer base. Key growth drivers include government support for AI initiatives, increasing internet penetration, and a shift towards online shopping. Regulatory policies favoring e-commerce and investments in logistics infrastructure further bolster market demand, while urbanization accelerates consumption patterns.

India : Diverse Market with High Potential

India's market share stands at 3.5%, reflecting a burgeoning e-commerce landscape fueled by rising disposable incomes and smartphone penetration. The government's Digital India initiative promotes digital transactions, while increasing internet access drives online shopping. Local consumption trends show a preference for personalized shopping experiences, pushing retailers to adopt AI technologies for better customer engagement.

Japan : Blending Tradition with Innovation

Japan captures a 2.8% market share in the AI-in-retail-e-commerce sector, characterized by a unique blend of traditional retail and cutting-edge technology. The aging population drives demand for AI solutions that enhance customer service and operational efficiency. Government initiatives supporting digital transformation and smart city projects are pivotal in shaping the market landscape, fostering innovation in retail.

South Korea : AI Adoption at the Forefront

South Korea holds a 1.8% market share, with a strong emphasis on smart retail solutions. The country's advanced technological infrastructure and high internet penetration facilitate rapid AI adoption in e-commerce. Government policies promoting innovation and digital economy initiatives are key growth drivers. Consumer preferences lean towards seamless online shopping experiences, pushing retailers to integrate AI for personalized services.

Malaysia : AI Adoption Gaining Momentum

Malaysia's market share is at 0.8%, with a growing interest in AI applications within retail. The government’s initiatives to boost digital economy and e-commerce are pivotal in driving market growth. Increasing smartphone usage and internet access are reshaping consumer behavior, leading to a rise in online shopping. Local retailers are beginning to explore AI for inventory management and customer insights.

Thailand : Transforming Consumer Experiences

Thailand's market share stands at 0.7%, with a notable shift towards digital retail solutions. The government’s support for e-commerce and digital payment systems is fostering growth in the sector. Consumer trends indicate a rising demand for convenience and personalized shopping experiences, prompting retailers to adopt AI technologies. Key urban centers like Bangkok are leading this transformation.

Indonesia : AI Adoption on the Rise

Indonesia's market share is 0.6%, reflecting a rapidly growing e-commerce sector. The increasing smartphone penetration and internet access are driving online shopping trends. Government initiatives aimed at enhancing digital infrastructure and promoting e-commerce are crucial for market growth. Local players are beginning to leverage AI for customer engagement and operational efficiency, particularly in urban areas like Jakarta.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC holds a market share of 0.56%, showcasing diverse opportunities in AI-in-retail-e-commerce. Each country presents unique growth drivers, from government initiatives to local consumer preferences. The competitive landscape varies significantly, with local players adapting to regional demands. Emerging markets are increasingly exploring AI applications to enhance retail experiences and operational efficiencies.