China : Rapid Growth and Innovation Hub

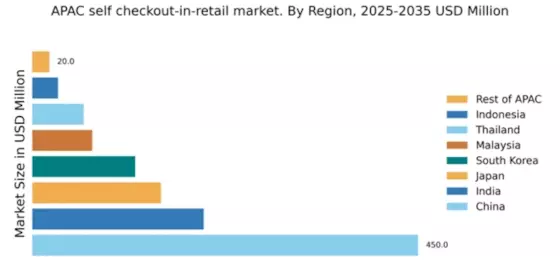

China holds a commanding market share of 45% in the self-checkout sector, valued at $450.0 million. Key growth drivers include a booming retail sector, increasing urbanization, and a tech-savvy consumer base. Demand trends show a shift towards contactless payments and automation, supported by government initiatives promoting digital retail solutions. Infrastructure development, particularly in tier-1 cities, enhances accessibility and efficiency in retail operations.

India : Rapid Adoption of Technology Solutions

India's self-checkout market is valued at $200.0 million, accounting for 20% of the APAC market. The growth is driven by increasing disposable incomes, urbanization, and a shift towards self-service solutions in retail. Government initiatives like Digital India are enhancing digital infrastructure, while consumer preferences are leaning towards convenience and speed in shopping experiences. Regulatory support for foreign investments further boosts market potential.

Japan : Integration of AI and Robotics

Japan's self-checkout market is valued at $150.0 million, representing 15% of the APAC market. The growth is fueled by technological advancements, particularly in AI and robotics, which enhance customer experience. Demand for self-checkout systems is rising in urban areas, driven by busy lifestyles and a preference for efficiency. Government policies promoting automation in retail are also significant growth factors, alongside a robust infrastructure supporting tech integration.

South Korea : Strong Consumer Demand for Automation

South Korea's self-checkout market is valued at $120.0 million, making up 12% of the APAC market. Key growth drivers include high smartphone penetration and a tech-savvy population. The demand for self-checkout systems is increasing in metropolitan areas like Seoul, where convenience is paramount. Major players like NCR and Diebold Nixdorf are well-established, and local regulations support the adoption of automated retail solutions, enhancing the competitive landscape.

Malaysia : Retail Transformation in Urban Areas

Malaysia's self-checkout market is valued at $70.0 million, representing 7% of the APAC market. The growth is driven by urbanization and a rising middle class seeking convenience in shopping. Demand trends indicate a shift towards self-service kiosks in urban centers like Kuala Lumpur. The competitive landscape features both local and international players, with government initiatives supporting digital retail transformation and enhancing infrastructure for better service delivery.

Thailand : Consumer Shift Towards Self-Checkout

Thailand's self-checkout market is valued at $60.0 million, accounting for 6% of the APAC market. The growth is driven by increasing consumer demand for convenience and efficiency in shopping. Urban areas like Bangkok are seeing a rise in self-checkout installations, supported by government policies promoting digital retail. The competitive landscape includes both local and international players, with a focus on enhancing customer experience through technology.

Indonesia : Growth in Retail Technology Adoption

Indonesia's self-checkout market is valued at $30.0 million, representing 3% of the APAC market. The growth is driven by increasing urbanization and a young, tech-savvy population. Demand for self-checkout systems is rising in major cities like Jakarta, where convenience is becoming a priority. The competitive landscape is evolving, with both local and international players entering the market, supported by government initiatives to enhance digital infrastructure.

Rest of APAC : Potential in Emerging Economies

The Rest of APAC self-checkout market is valued at $20.0 million, accounting for 2% of the overall market. Growth is driven by varying levels of retail technology adoption across different countries. Demand trends indicate a gradual shift towards self-service solutions, influenced by urbanization and changing consumer preferences. The competitive landscape is diverse, with local players gaining traction, supported by government initiatives to enhance retail technology adoption.