Increased Focus on Customer Experience

In the Retail Analytics Market, there is an increasing emphasis on enhancing customer experience. Retailers are utilizing analytics to understand customer preferences and behaviors, which allows them to create personalized shopping experiences. Data indicates that businesses that prioritize customer experience can see revenue increases of up to 10% or more. By analyzing customer data, retailers can identify trends and tailor their offerings accordingly, leading to improved customer loyalty and retention. Furthermore, the integration of customer feedback into analytics platforms enables retailers to adapt their strategies in real-time, ensuring they meet evolving consumer expectations. This focus on customer experience is likely to drive further investment in retail analytics solutions, as companies seek to differentiate themselves in a crowded market.

Rising Importance of Inventory Management

Effective inventory management is becoming increasingly critical within the Retail Analytics Market. Retailers are recognizing that optimizing inventory levels can lead to significant cost savings and improved customer satisfaction. Data suggests that retailers with advanced inventory analytics can reduce excess inventory by up to 25%, thereby minimizing holding costs. By utilizing analytics to monitor inventory turnover rates and demand forecasting, retailers can ensure they have the right products available at the right time. This focus on inventory management is likely to drive the adoption of retail analytics solutions, as businesses seek to enhance their operational efficiency and responsiveness to market demands. As the retail landscape continues to evolve, the importance of effective inventory management within the Retail Analytics Market cannot be overstated.

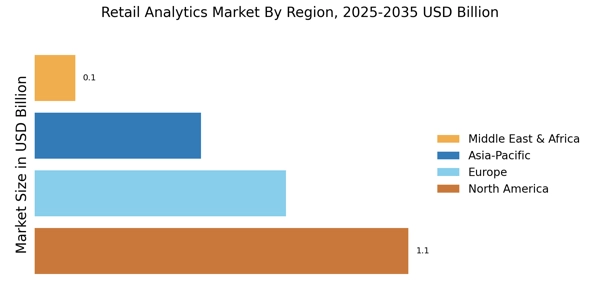

Adoption of Omnichannel Retailing Strategies

The Retail Analytics Market is witnessing a significant shift towards omnichannel retailing strategies. Retailers are increasingly adopting a seamless approach to engage customers across multiple channels, including online, mobile, and in-store. This trend is supported by data showing that omnichannel customers tend to spend 10% more than single-channel customers. Retail analytics plays a crucial role in this transformation by providing insights into customer interactions across various touchpoints. By analyzing data from different channels, retailers can optimize their inventory, enhance marketing efforts, and improve overall customer satisfaction. As the demand for a cohesive shopping experience continues to rise, the Retail Analytics Market is expected to expand, driven by the need for sophisticated analytics solutions that support omnichannel strategies.

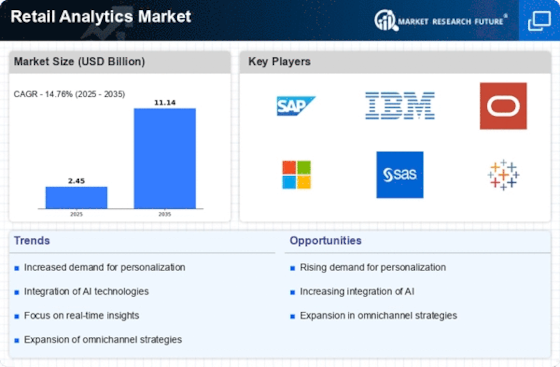

Growing Demand for Data-Driven Decision Making

The Retail Analytics Market is experiencing a surge in demand for data-driven decision making. Retailers are increasingly recognizing the value of leveraging analytics to enhance operational efficiency and improve customer satisfaction. According to recent estimates, the retail analytics market is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the need for retailers to analyze vast amounts of data generated from various sources, including point-of-sale systems, online transactions, and customer interactions. By utilizing advanced analytics, retailers can gain insights into consumer behavior, optimize inventory management, and tailor marketing strategies. As a result, the Retail Analytics Market is becoming an essential component for retailers aiming to remain competitive in a rapidly evolving marketplace.

Emergence of Artificial Intelligence and Machine Learning

The Retail Analytics Market is increasingly influenced by the emergence of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies enable retailers to analyze large datasets more efficiently and derive actionable insights. AI and ML can identify patterns and trends that may not be immediately apparent through traditional analytics methods. For instance, predictive analytics powered by AI can forecast demand, optimize pricing strategies, and enhance supply chain management. As retailers seek to leverage these technologies, the retail analytics market is projected to experience substantial growth. Reports suggest that the integration of AI and ML in retail analytics could lead to cost reductions of up to 30% in operational expenses, further incentivizing retailers to invest in these innovative solutions.