Expansion in Automotive Applications

The AMOLED Display Market Growth is witnessing a significant expansion in automotive applications, as manufacturers increasingly integrate advanced display technologies into vehicles. The automotive sector is evolving, with a growing emphasis on digital dashboards and infotainment systems that utilize AMOLED displays for their superior image quality and flexibility. According to recent data, the automotive display market is expected to grow at a compound annual growth rate of approximately 10% through 2025. This trend is driven by consumer preferences for enhanced connectivity and interactive features in vehicles. Furthermore, the integration of AMOLED displays in head-up displays (HUDs) is gaining traction, providing drivers with critical information without diverting attention from the road. As a result, the AMOLED Display Industry is poised for growth as it adapts to the evolving needs of the automotive sector.

Rising Demand for High-Quality Displays

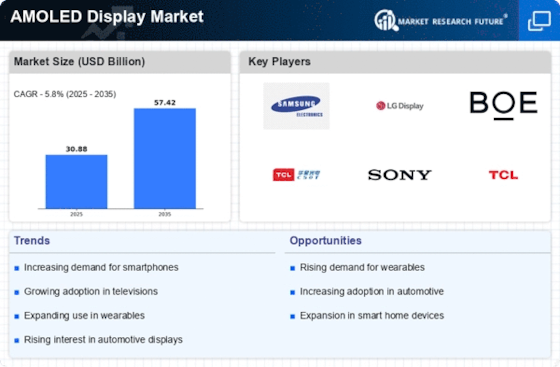

The AMOLED Display Market experiences a notable surge in demand for high-quality displays, particularly in consumer electronics. As consumers increasingly seek superior visual experiences, manufacturers are compelled to adopt AMOLED technology, which offers vibrant colors and deeper blacks. This trend is evident in the smartphone sector, where AMOLED displays are projected to account for over 50% of the market share by 2025. Additionally, the growing popularity of smart TVs and wearables further fuels this demand, as these devices increasingly incorporate AMOLED technology to enhance user experience. The shift towards high-definition content consumption also plays a crucial role, as consumers prefer devices that can deliver exceptional picture quality. Consequently, the AMOLED Display Industry is likely to witness sustained growth driven by this rising demand.

Increased Adoption in Wearable Technology

The AMOLED Display Market is experiencing increased adoption in wearable technology, driven by the demand for compact and efficient displays. Wearable devices, such as smartwatches and fitness trackers, benefit from AMOLED technology due to its low power consumption and high contrast ratios. This is particularly relevant as consumers seek devices that can provide extended battery life while maintaining visual appeal. Market data indicates that the wearable technology sector is projected to grow significantly, with AMOLED displays expected to capture a substantial share of this market. The lightweight and flexible nature of AMOLED displays also allows for innovative designs, further enhancing their appeal in the wearable segment. Consequently, the AMOLED Display Industry is likely to thrive as it aligns with the trends in wearable technology.

Shift Towards Energy-Efficient Technologies

The AMOLED Display Market is witnessing a shift towards energy-efficient technologies, as consumers and manufacturers alike prioritize sustainability. AMOLED displays are known for their energy efficiency, particularly when displaying darker images, as they consume less power compared to traditional LCDs. This characteristic aligns with the growing emphasis on reducing carbon footprints and promoting environmentally friendly products. Market analysis reveals that energy-efficient display technologies are becoming increasingly important in consumer electronics, with a projected increase in demand for AMOLED displays in devices such as smartphones and tablets. As OLED display manufacturers strive to meet regulatory standards and consumer expectations regarding energy consumption, the AMOLED Display Industry is likely to see a rise in adoption rates, further solidifying its position in the market.

Growing Interest in Augmented and Virtual Reality

The AMOLED Display Market is poised for growth due to the increasing interest in augmented reality (AR) and virtual reality (VR) applications. These technologies require high-resolution displays that can deliver immersive experiences, making AMOLED displays an ideal choice. The ability of AMOLED technology to provide vibrant colors and fast refresh rates enhances the overall user experience in AR and VR environments. Market forecasts suggest that the AR and VR market will expand rapidly, with AMOLED displays playing a crucial role in this evolution. As developers and manufacturers focus on creating more engaging content, the demand for high-quality displays is expected to rise. This trend indicates that the AMOLED Display industry will likely benefit from the burgeoning AR and VR sectors, positioning itself as a key player in the future of immersive technology.