Increased Military Applications

The rising demand for military applications is emerging as a key driver in The Global Turboprop Engine Industry. Turboprop engines are favored for their versatility, reliability, and ability to operate in diverse environments, making them suitable for various military aircraft, including transport and surveillance planes. Governments are increasingly investing in upgrading their military fleets, which often includes the procurement of turboprop-powered aircraft. Recent defense budgets indicate a growing allocation for modernization programs, which is likely to bolster the demand for turboprop engines. This trend not only supports the defense sector but also stimulates technological advancements within the industry, as manufacturers strive to meet the specific requirements of military applications.

Emerging Markets and Economic Growth

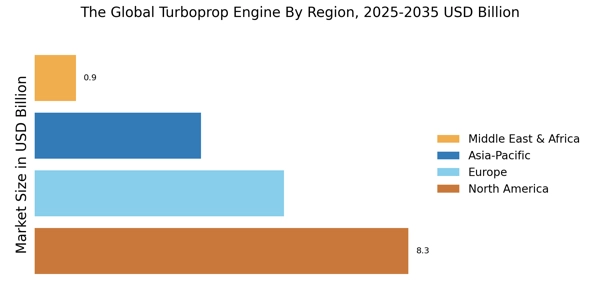

The expansion of emerging markets is significantly impacting The Global Turboprop Engine Industry. As economies in regions such as Asia-Pacific and Latin America continue to grow, there is a corresponding increase in air travel demand. This growth is prompting airlines in these regions to invest in new aircraft, including turboprop models, to cater to both domestic and international routes. Data suggests that air traffic in emerging markets is expected to grow at a rate of approximately 6% annually over the next decade. Consequently, manufacturers are likely to focus on these regions, tailoring their offerings to meet local needs. This trend not only enhances market opportunities but also fosters competition among manufacturers, driving innovation and efficiency in turboprop engine design.

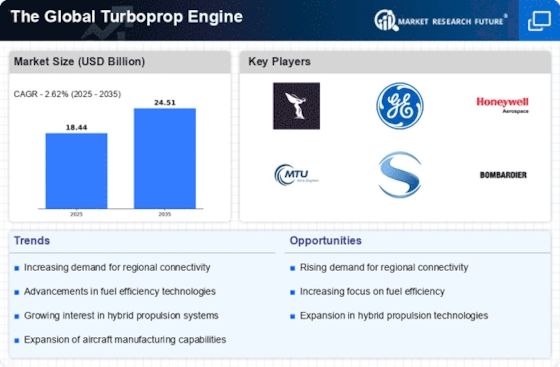

Growing Demand for Regional Air Travel

The increasing preference for regional air travel is significantly influencing The Global Turboprop Engine Industry. As urbanization continues to rise, more passengers are seeking convenient and cost-effective travel options for short-haul routes. Turboprop aircraft, known for their efficiency and ability to operate from shorter runways, are becoming the aircraft of choice for regional airlines. According to recent data, the regional aviation sector is projected to grow at a compound annual growth rate of over 5% in the coming years. This growth is likely to drive the demand for turboprop engines, as airlines look to expand their fleets to meet passenger needs. Consequently, manufacturers are expected to ramp up production to cater to this burgeoning market segment.

Technological Advancements in Engine Design

The evolution of turboprop engine technology plays a pivotal role in shaping The Global Turboprop Engine Industry. Innovations such as advanced materials, improved aerodynamics, and enhanced fuel efficiency are driving demand. For instance, the introduction of composite materials has led to lighter engines, which in turn improves performance and reduces operational costs. Furthermore, the integration of digital technologies, including predictive maintenance and real-time monitoring, enhances reliability and operational efficiency. As manufacturers continue to invest in research and development, the market is likely to witness a surge in next-generation turboprop engines that offer superior performance metrics. This trend not only attracts new customers but also encourages existing operators to upgrade their fleets, thereby expanding the market landscape.

Focus on Fuel Efficiency and Environmental Regulations

The emphasis on fuel efficiency and adherence to environmental regulations is reshaping The Global Turboprop Engine Industry. With rising fuel costs and stringent emissions standards, operators are increasingly seeking engines that offer lower fuel consumption and reduced carbon footprints. Turboprop engines, which are generally more fuel-efficient than their jet counterparts, are well-positioned to meet these demands. Recent studies indicate that modern turboprop engines can achieve fuel savings of up to 40% compared to older models. This focus on sustainability not only aligns with global environmental goals but also appeals to airlines looking to enhance their operational efficiency. As regulatory frameworks become more stringent, the market is likely to see a shift towards more eco-friendly turboprop solutions.