Supportive Regulatory Frameworks

Supportive regulatory frameworks are emerging as a critical driver for the Microinsurance Market. Policymakers are increasingly recognizing the need to create conducive environments for microinsurance providers to operate effectively. This includes establishing guidelines that simplify product offerings and reduce compliance burdens for insurers. Recent regulatory reforms in various regions have aimed to promote transparency and consumer protection, which are essential for building trust in microinsurance products. For instance, some countries have introduced specific regulations that allow for the development of microinsurance products tailored to the needs of low-income individuals. As these supportive frameworks continue to evolve, they are likely to encourage more insurers to enter the microinsurance Industry, thereby expanding coverage and enhancing financial security for vulnerable populations.

Growing Awareness of Risk Management

There is a growing awareness of risk management within the Microinsurance Market, particularly among low-income households. As communities face increasing vulnerabilities due to economic fluctuations and environmental changes, the understanding of the need for insurance is becoming more pronounced. Educational campaigns and outreach programs are helping to demystify insurance concepts, making them more relatable to potential customers. Data suggests that regions with active awareness initiatives have seen a 30% increase in microinsurance uptake. This heightened awareness is likely to encourage more individuals to consider microinsurance as a viable option for protecting their assets and livelihoods. As the understanding of risk management continues to evolve, the microinsurance sector may witness a surge in demand for innovative products that address specific risks faced by low-income populations.

Increased Focus on Financial Inclusion

The Microinsurance Market is increasingly aligned with the global agenda of financial inclusion. Governments and non-governmental organizations are recognizing the importance of providing financial services to marginalized communities. Initiatives aimed at promoting financial literacy and access to insurance products are gaining traction, as they empower individuals to manage risks effectively. Recent statistics suggest that approximately 1.7 billion adults remain unbanked, highlighting a significant opportunity for microinsurance providers to fill this gap. By offering tailored products that cater to the unique needs of low-income individuals, microinsurance can play a crucial role in enhancing financial resilience. This focus on financial inclusion is likely to drive the growth of the microinsurance Industry, as more stakeholders collaborate to create an enabling environment for underserved populations.

Rising Demand for Affordable Insurance Solutions

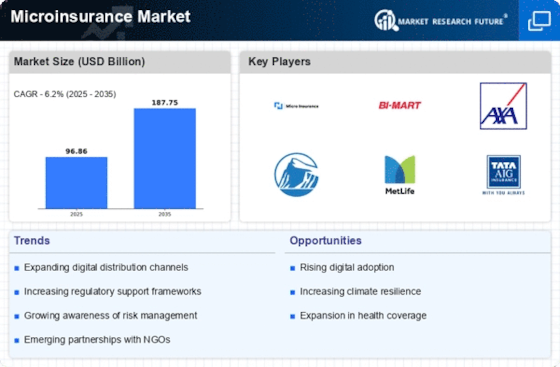

The Microinsurance Market is experiencing a notable increase in demand for affordable insurance solutions, particularly among low-income populations. This demographic often lacks access to traditional insurance products due to high premiums and complex terms. As a result, microinsurance products, which offer lower premiums and simplified coverage, are becoming increasingly attractive. According to recent data, the microinsurance sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for financial protection against unforeseen events, such as health emergencies and natural disasters, which disproportionately affect vulnerable communities. The rising awareness of the benefits of microinsurance is likely to further fuel this demand, as more individuals recognize the importance of safeguarding their financial well-being.

Technological Advancements in Distribution Channels

Technological advancements are playing a pivotal role in shaping the Microinsurance Market by enhancing distribution channels. The proliferation of mobile technology and digital platforms has enabled insurers to reach underserved populations more effectively. For instance, mobile applications and online platforms facilitate the purchase of microinsurance products, making them more accessible to individuals in remote areas. Data indicates that mobile penetration rates in developing regions have surpassed 80%, providing a robust foundation for microinsurance distribution. Furthermore, the integration of data analytics allows insurers to tailor products to meet the specific needs of customers, thereby improving customer engagement and retention. As technology continues to evolve, it is anticipated that the microinsurance sector will leverage these innovations to expand its reach and enhance service delivery.