Supportive Regulatory Frameworks

The microinsurance market in South America is positively influenced by supportive regulatory frameworks that encourage the development of microinsurance products. Governments in several countries have recognized the need for inclusive insurance solutions and have established regulations to facilitate market entry for microinsurance providers. As of 2025, regulatory bodies in South America have introduced guidelines that simplify the licensing process for microinsurance companies, thereby fostering competition and innovation. This supportive environment is likely to enhance the microinsurance market, as more players enter the market, offering diverse products tailored to the needs of low-income consumers.

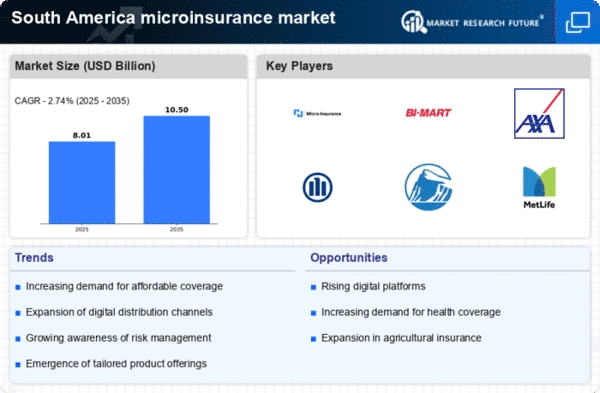

Rising Demand for Affordable Coverage

The microinsurance market in South America experiences a notable increase in demand for affordable insurance products. This trend is driven by a growing awareness among low-income populations regarding the importance of financial protection against unforeseen events. As of 2025, approximately 30% of the population in South America remains uninsured, highlighting a significant market opportunity. The microinsurance market is likely to expand as more individuals seek accessible and cost-effective insurance solutions. Furthermore, the increasing frequency of natural disasters in the region has heightened the urgency for affordable coverage, prompting insurers to innovate and tailor products to meet the specific needs of vulnerable communities.

Increased Financial Literacy Initiatives

The microinsurance market in South America benefits from increased financial literacy initiatives aimed at educating low-income populations about insurance products. Various non-governmental organizations and government programs have been implemented to enhance understanding of financial services. As of 2025, studies indicate that financial literacy rates in South America have improved by approximately 15% over the past five years. This increase in knowledge empowers individuals to make informed decisions regarding their insurance needs. The microinsurance market is likely to see a rise in demand as more people recognize the value of insurance as a risk management tool, ultimately contributing to market growth.

Growing Interest from Traditional Insurers

The microinsurance market in South America is witnessing a growing interest from traditional insurers seeking to diversify their portfolios. Many established insurance companies are recognizing the potential profitability of microinsurance products, particularly in underserved markets. As of 2025, it is estimated that traditional insurers account for approximately 25% of the microinsurance market, indicating a shift in strategy towards inclusivity. This trend may lead to increased investment in product development and distribution channels, ultimately enhancing the availability of microinsurance solutions for low-income populations. The entry of traditional players could also foster innovation and improve the overall quality of offerings in the microinsurance market.

Technological Advancements in Distribution

Technological advancements play a crucial role in shaping the microinsurance market in South America. The proliferation of mobile technology and internet access has enabled insurers to reach underserved populations more effectively. As of 2025, mobile penetration in South America stands at over 90%, facilitating the distribution of microinsurance products through digital platforms. This shift not only reduces operational costs for insurers but also enhances customer engagement and education. The microinsurance market is likely to witness a surge in digital sales channels, allowing for streamlined processes and improved customer experiences. Consequently, this technological evolution may lead to increased uptake of microinsurance products among low-income households.