Top Industry Leaders in the Microinsurance Market

Competitive Landscape of the Microinsurance Market: A Comprehensive Overview

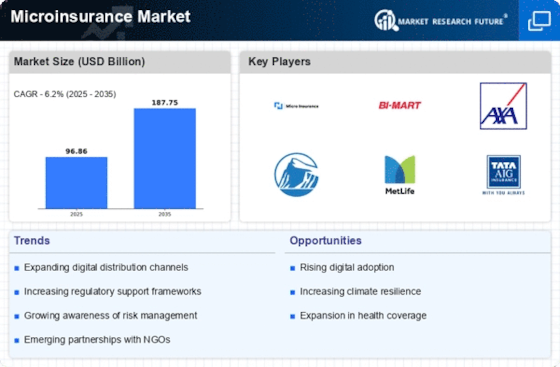

The microinsurance market, catering to low-income individuals and underserved communities, is experiencing a surge in growth. This market presents a compelling opportunity for established players and new entrants alike. This report delves into the competitive landscape, analyzing key players, strategies, and emerging trends.

Key Players:

- HDFC Ergo General Insurance Company Limited

- Hollard

- MicroEnsure Holdings Limited

- National Insurance Commission

- Standard Chartered Bank

- Wells Fargo

- SAC Banco do Nordeste

- MetLife Services and Solutions, LLC

- Bandhan Bank

- ICICI Bank

- Tata AIA Life

Strategies for Success:

-

Product Innovation: Developing microinsurance products relevant to the specific needs and risk profiles of low-income communities. This includes flexible premium payment options, parametric insurance based on weather data or specific events, and micro-savings components. -

Distribution Channel Optimization: Utilizing existing networks like MFIs, telecom operators, and community leaders to reach the target audience effectively. Mobile technology and digital platforms play a crucial role in expanding reach and simplifying distribution. -

Partnerships and Alliances: Collaborating with traditional insurers, NGOs, and other stakeholders leverages expertise, resources, and distribution channels, creating win-win scenarios for all parties involved. -

Tech-Enabled Solutions: Embracing technology like AI, big data, and blockchain to improve risk assessment, claims processing, and fraud detection. Additionally, mobile apps and digital interfaces enhance customer experience and accessibility.

Factors for Market Share Analysis:

-

Geographic Focus: Different regions present unique needs and regulatory landscapes. Dominating players in one region may not necessarily translate to success in another. -

Product Portfolio Diversification: Offering a diverse range of microinsurance products, spanning life, health, property, and agricultural insurance, caters to wider needs and attracts a larger customer base. -

Pricing and Affordability: Designing microinsurance products with low premiums and flexible payment options is crucial for reaching low-income segments. -

Brand Recognition and Trust: Established players with strong brand recognition have an advantage, but smaller companies can build trust through community engagement and transparent communication. -

Technology Adoption: Utilizing technology effectively for product design, distribution, and claims management enhances efficiency and scalability, giving companies a competitive edge.

New and Emerging Companies:

-

Bima (Kenya): Offers affordable health insurance through mobile money platforms, focusing on maternal and child health. -

Pula Advisors (Kenya): Provides crop insurance based on satellite data and weather forecasts, mitigating agricultural risks for smallholder farmers. -

MicroEnsure (Ghana): Partners with MFIs to deliver micro-life insurance and agricultural insurance products. -

Zensurance (Nigeria): Leverages its digital platform to offer flexible and on-demand insurance products, including micro-health and travel insurance.

Current Company Investment Trends:

-

Focus on Technology: Investing in AI, big data, and mobile technology to personalize offerings, improve risk assessment, and streamline operations. -

Distribution Channel Expansion: Building partnerships and exploring alternative distribution channels, like mobile network operators and retailers, to reach new customer segments. -

Product Development: Expanding product portfolios to cater to diverse needs and emerging risks, such as climate change and pandemics. -

Sustainability and Impact Investing: Increasing focus on ESG (environmental, social, and governance) factors, with investors looking for companies that create positive social impact alongside financial returns.

Latest Company Updates:

- October 26, 2023: The Microinsurance Network releases a report on the growing role of microinsurance in financial inclusion.

- December 15, 2023: The International Labour Organization launches a new initiative to promote microinsurance for informal workers.

- January 3, 2024: The World Economic Forum highlights microinsurance as a key tool for building resilience to climate shocks in its 2024 Global Risks Report.