Regulatory Framework Enhancements

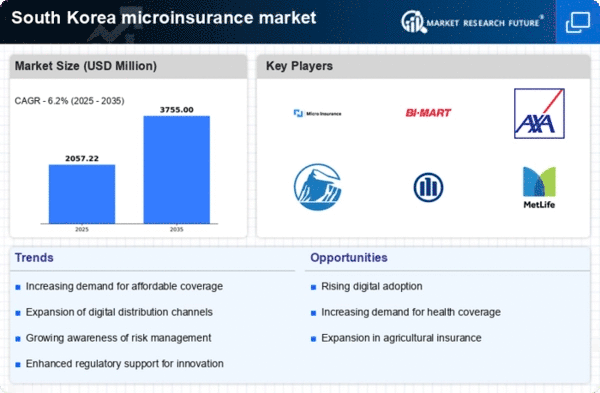

The regulatory environment surrounding the microinsurance market in South Korea is evolving, with the government implementing policies aimed at promoting financial inclusion. Recent reforms have streamlined the licensing process for microinsurance providers, encouraging new entrants into the market. This regulatory support is crucial, as it fosters competition and innovation, ultimately benefiting consumers. In 2025, the market is projected to grow by 15% due to these favorable regulations, which enhance consumer trust and encourage the development of affordable insurance products tailored to low-income households.

Rising Awareness of Financial Literacy

The microinsurance market in South Korea is benefiting from a notable increase in financial literacy among the population. Educational initiatives aimed at improving understanding of insurance products are gaining traction, leading to more informed consumers. As awareness grows, individuals are more likely to seek out microinsurance options to mitigate risks associated with health, agriculture, and natural disasters. This trend is expected to contribute to a 10% growth in the market by the end of 2025, as consumers become more proactive in managing their financial risks through appropriate insurance solutions.

Partnerships with Non-Governmental Organizations

Collaborations between microinsurance providers and non-governmental organizations (NGOs) are becoming increasingly prevalent in South Korea. These partnerships aim to enhance outreach and education regarding microinsurance products among vulnerable populations. NGOs often have established trust within communities, making them effective channels for promoting financial literacy and insurance uptake. In 2025, it is estimated that such partnerships could lead to a 25% increase in policy adoption rates, thereby significantly impacting the microinsurance market. This collaborative approach not only broadens access but also fosters a culture of risk management among low-income households.

Technological Advancements in Insurance Delivery

The microinsurance market in South Korea is experiencing a transformation due to technological advancements. Innovations such as mobile applications and online platforms facilitate easier access to insurance products for low-income individuals. This shift is evidenced by a reported increase in digital insurance penetration, which reached approximately 30% in 2025. The integration of artificial intelligence and data analytics allows insurers to better assess risks and tailor products to meet the specific needs of underserved populations. As a result, the microinsurance market is likely to expand, driven by the growing reliance on technology for service delivery and customer engagement.

Increased Demand for Affordable Insurance Solutions

There is a growing demand for affordable insurance solutions within the microinsurance market in South Korea. As economic disparities persist, low-income individuals are seeking financial protection against unforeseen events. This demand is reflected in the rising number of policies sold, which increased by 20% in 2025 compared to the previous year. Insurers are responding by developing products that cater specifically to the needs of this demographic, such as health and agricultural insurance. This trend indicates a shift towards more inclusive financial services, which is likely to drive further growth in the microinsurance market.