Government Initiatives and Support

The Chinese government has been actively promoting the microinsurance market through various initiatives aimed at enhancing financial inclusion. Policies encouraging the development of microinsurance products have been implemented, with a focus on protecting vulnerable populations. In 2025, the government has allocated approximately $500 million to support microinsurance schemes, particularly in rural areas. This financial backing is expected to stimulate innovation within the microinsurance market, as insurers are incentivized to develop new products that cater to the needs of low-income households. Additionally, regulatory frameworks are being established to ensure consumer protection and promote sustainable growth within the sector. Such government support is likely to foster a conducive environment for the expansion of microinsurance offerings.

Rising Demand for Affordable Coverage

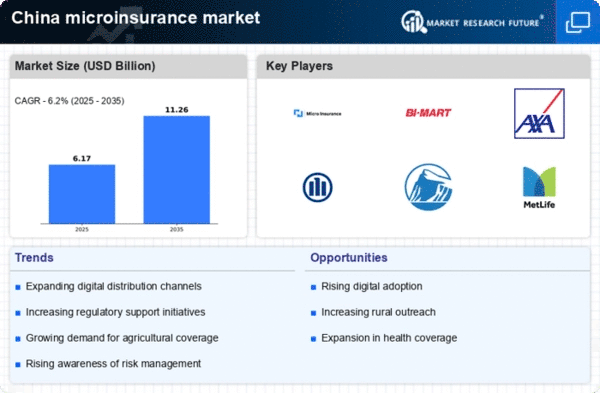

The microinsurance market in China is experiencing a notable increase in demand for affordable insurance products. This trend is largely driven by the growing awareness among low-income populations regarding the importance of financial protection against unforeseen events. As of 2025, approximately 70% of the rural population remains uninsured, indicating a substantial market opportunity. The microinsurance market is responding by offering tailored products that cater to the specific needs of these underserved communities. Furthermore, the Chinese government has been promoting financial inclusion initiatives, which further supports the expansion of affordable microinsurance solutions. This rising demand is likely to propel the growth of the microinsurance market, as more individuals seek to mitigate risks associated with health, agriculture, and natural disasters.

Increased Awareness of Risk Management

There is a growing awareness of risk management among the Chinese population, which is positively impacting the microinsurance market. As individuals become more cognizant of the potential financial repercussions of health issues, accidents, and natural disasters, the demand for microinsurance products is expected to rise. Educational campaigns and community outreach programs have been instrumental in informing the public about the benefits of microinsurance. In 2025, surveys indicate that approximately 60% of the population recognizes the value of having insurance coverage for unexpected events. This heightened awareness is likely to drive growth in the microinsurance market, as more individuals seek to protect themselves and their families from financial hardships.

Emergence of Innovative Product Offerings

The microinsurance market in China is witnessing the emergence of innovative product offerings designed to meet the diverse needs of consumers. Insurers are increasingly developing customized solutions that address specific risks faced by low-income individuals, such as crop failure, health emergencies, and natural disasters. As of 2025, the market has seen a rise in products that combine insurance with savings components, appealing to consumers' desire for both protection and financial growth. This trend towards innovation is likely to enhance the attractiveness of microinsurance products, thereby expanding the customer base. The microinsurance market is expected to benefit from these developments, as insurers strive to create value-added offerings that resonate with the target demographic.

Technological Advancements in Distribution

Technological advancements are playing a crucial role in shaping the microinsurance market in China. The proliferation of mobile technology and internet access has enabled insurers to reach previously inaccessible populations. As of 2025, over 90% of the population has access to mobile phones, facilitating the distribution of microinsurance products through digital platforms. This shift towards technology-driven solutions allows for lower operational costs and improved customer engagement. Insurers are increasingly leveraging data analytics to assess risks and tailor products to meet the specific needs of consumers. Consequently, the microinsurance market is likely to witness enhanced efficiency and customer satisfaction, as technology streamlines the purchasing process and claims management.