Rising Demand for High-Quality Imaging

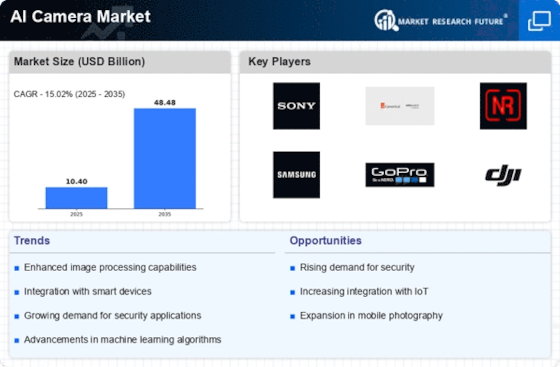

The AI Camera Market is experiencing a notable surge in demand for high-quality imaging solutions. This trend is driven by advancements in AI technology, which enhance image clarity and detail. As consumers increasingly seek superior photography experiences, manufacturers are compelled to innovate. The market for AI cameras is projected to reach approximately 15 billion dollars by 2026, reflecting a compound annual growth rate of around 20%. This growth is indicative of a broader shift towards premium imaging products, as both amateur and professional photographers prioritize quality. Furthermore, the integration of AI capabilities allows for real-time enhancements, making these cameras more appealing to a diverse range of users. As a result, the emphasis on high-quality imaging is likely to remain a pivotal driver in the AI Camera Market.

Expansion of E-commerce and Social Media

The AI Camera Market is significantly influenced by the expansion of e-commerce and social media platforms. As online shopping and social media engagement continue to grow, the demand for high-quality images has intensified. Retailers and influencers increasingly rely on visually appealing content to attract consumers, thereby driving the need for advanced AI cameras. The market is expected to witness a substantial increase, with projections indicating a potential growth rate of 18% annually. This trend suggests that businesses are investing in AI camera technology to enhance their marketing strategies. The ability to produce stunning visuals not only boosts brand visibility but also enhances customer engagement. Consequently, the intersection of e-commerce, social media, and AI camera technology is likely to propel the market forward, creating new opportunities for innovation and growth.

Integration of AI in Consumer Electronics

The AI Camera Market is witnessing a transformative phase due to the integration of AI in consumer electronics. As smart devices become ubiquitous, the demand for AI-enabled cameras is on the rise. This integration allows for seamless connectivity and enhanced functionality, appealing to tech-savvy consumers. The market is anticipated to grow at a rate of approximately 22% annually, driven by the increasing popularity of smart home devices. Consumers are drawn to the convenience and efficiency that AI cameras provide, such as automated image enhancements and intelligent scene recognition. This trend suggests that the convergence of AI technology with consumer electronics is likely to create new avenues for growth within the AI Camera Market, as manufacturers strive to meet evolving consumer expectations.

Technological Advancements in AI Algorithms

The AI Camera Market is being propelled by rapid technological advancements in AI algorithms. These innovations enable cameras to process images more efficiently and accurately, resulting in superior performance. Enhanced object recognition, scene detection, and automated adjustments are just a few capabilities that modern AI cameras offer. As these technologies evolve, they are becoming more accessible to consumers, leading to increased adoption rates. The market is projected to grow significantly, with estimates suggesting a value of over 20 billion dollars by 2027. This growth is indicative of a broader trend where consumers are increasingly seeking smart devices that simplify their photography experience. The continuous improvement of AI algorithms is likely to remain a critical driver in the AI Camera Market, fostering a competitive landscape among manufacturers.

Growing Interest in Smart Surveillance Solutions

The AI Camera Market is significantly impacted by the growing interest in smart surveillance solutions. As security concerns rise, both residential and commercial sectors are increasingly adopting AI cameras for enhanced monitoring capabilities. These cameras offer features such as facial recognition, motion detection, and real-time alerts, making them highly desirable for security applications. The market is projected to expand, with estimates indicating a growth rate of around 19% annually. This trend reflects a broader societal shift towards proactive security measures, where AI cameras play a crucial role. The integration of AI technology into surveillance systems not only improves safety but also provides users with valuable insights. Consequently, the demand for smart surveillance solutions is likely to remain a key driver in the AI Camera Market, shaping its future trajectory.