Technological Advancements

The Digital Camera Market Industry is experiencing rapid technological advancements, which significantly enhance the functionality and performance of digital cameras. Innovations such as improved sensor technology, higher resolution capabilities, and advanced image processing algorithms are driving consumer interest. For instance, the introduction of mirrorless cameras has revolutionized the market by offering compact designs without compromising on image quality. As a result, the market is projected to reach 8.87 USD Billion in 2024, reflecting the growing demand for high-performance imaging devices. These advancements not only cater to professional photographers but also appeal to amateur enthusiasts, thereby broadening the consumer base.

Integration of Smart Features

The integration of smart features into digital cameras is a notable driver within the Digital Camera Industry. Features such as Wi-Fi connectivity, Bluetooth pairing, and mobile app integration enhance user experience by allowing seamless sharing and editing of images. This trend aligns with the growing consumer expectation for convenience and connectivity in technology. As digital cameras become more user-friendly and versatile, they attract a wider audience, including casual users and tech-savvy individuals. This shift is likely to contribute to a compound annual growth rate of 5.32% from 2025 to 2035, indicating a robust growth trajectory for the industry.

Rising Popularity of Photography

The Global Digital Camera Industry is witnessing a surge in the popularity of photography as a hobby and profession. This trend is fueled by social media platforms that encourage users to share high-quality images, thus increasing the demand for advanced digital cameras. The proliferation of photography-related content has led to a growing community of enthusiasts who seek better equipment to enhance their skills. As a result, the market is expected to grow significantly, with projections indicating a value of 15.7 USD Billion by 2035. This increasing interest in photography not only drives sales but also fosters innovation within the industry, as manufacturers strive to meet evolving consumer needs.

Market Trends and Growth Projections

The Global Digital Camera Market Industry is characterized by various trends that indicate a positive growth trajectory. Current projections suggest that the market will reach 8.87 USD Billion in 2024, with a compound annual growth rate of 5.32% anticipated from 2025 to 2035. This growth is driven by factors such as technological advancements, rising photography popularity, and increased demand for content creation. Additionally, the expansion into emerging markets presents new opportunities for manufacturers to tap into a growing consumer base. These trends collectively suggest a robust future for the digital camera market, as it adapts to changing consumer preferences and technological innovations.

Increased Demand for Content Creation

The Global Digital Camera Industry is significantly influenced by the increasing demand for content creation across various platforms. With the rise of influencers, vloggers, and content creators, there is a heightened need for high-quality imaging equipment. Digital cameras are essential tools for producing professional-grade content, which drives consumer investment in advanced models. This trend is expected to sustain market growth, as more individuals and businesses recognize the value of high-quality visuals in digital marketing and social media engagement. Consequently, the market is projected to reach 8.87 USD Billion in 2024, reflecting the growing importance of visual content in communication strategies.

Emerging Markets and Consumer Base Expansion

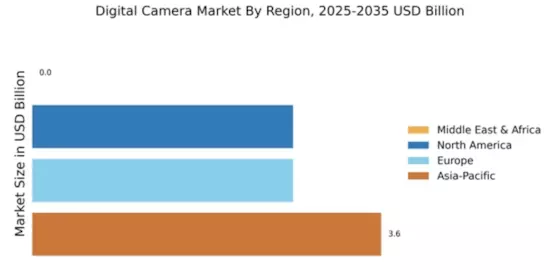

The Global Digital Camera Market Industry is poised for growth due to the expansion of emerging markets. Regions such as Asia-Pacific and Latin America are witnessing an increase in disposable income, leading to greater consumer spending on photography equipment. As more individuals in these regions gain access to digital cameras, the market is likely to experience a significant boost. This trend is further supported by the increasing availability of affordable yet high-quality digital cameras, which cater to a broader audience. The anticipated growth in these markets is expected to contribute to the overall market value, with projections indicating a rise to 15.7 USD Billion by 2035.