Rising Food Demand

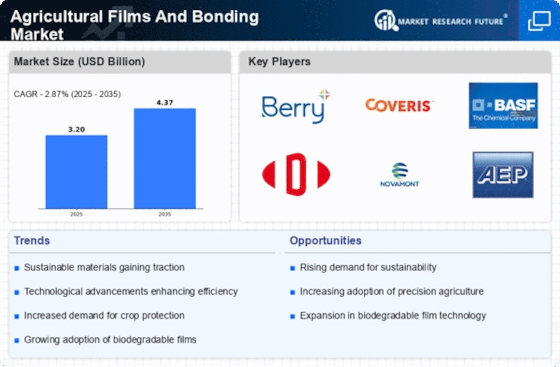

The escalating The Agricultural Films And Bonding Industry. As agricultural productivity becomes paramount, the need for effective crop protection and yield enhancement solutions intensifies. Agricultural films play a crucial role in this context, providing essential benefits such as moisture retention and pest control. Market analysis indicates that the demand for agricultural films is expected to surge, with projections suggesting a market size exceeding several billion dollars by 2026. This trend underscores the critical role of agricultural films in meeting the food security challenges posed by a growing population.

Sustainability Initiatives

The increasing emphasis on sustainability within the Agricultural Films And Bonding Market is driving demand for eco-friendly materials. As consumers and regulatory bodies advocate for reduced environmental impact, manufacturers are compelled to innovate. Biodegradable films and recyclable bonding materials are gaining traction, reflecting a shift towards sustainable agricultural practices. This trend is supported by data indicating that the market for biodegradable agricultural films is projected to grow significantly, potentially reaching a valuation of several billion dollars by 2027. Such initiatives not only align with environmental goals but also enhance the market's appeal to eco-conscious consumers, thereby expanding the customer base.

Technological Advancements

Technological integration within the Agricultural Films And Bonding Market is transforming production processes and product offerings. Innovations such as advanced polymer technology and nanotechnology are enhancing the performance of agricultural films, leading to improved crop yields and resource efficiency. For instance, the introduction of UV-stabilized films has been shown to extend the lifespan of agricultural coverings, thereby reducing replacement costs. Market data suggests that the adoption of these technologies could lead to a compound annual growth rate of over 5% in the sector, as farmers increasingly seek solutions that optimize their operations and enhance productivity.

Government Support and Policies

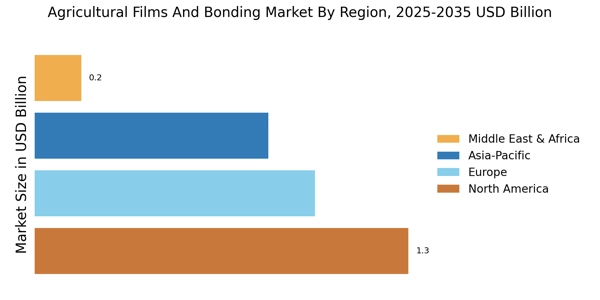

Government initiatives and policies aimed at enhancing agricultural productivity are significantly influencing the Agricultural Films And Bonding Market. Various countries are implementing subsidies and incentives for the adoption of advanced agricultural technologies, including innovative films and bonding solutions. Such support not only encourages farmers to invest in modern practices but also fosters research and development within the industry. Data indicates that regions with robust government backing are witnessing accelerated growth in the agricultural films sector, potentially leading to a market expansion of over 4% annually. This trend highlights the importance of policy frameworks in shaping market dynamics.

Customization and Specialization

The demand for customized solutions within the Agricultural Films And Bonding Market is on the rise, as farmers seek products tailored to specific crop needs and environmental conditions. This trend is prompting manufacturers to develop specialized films that cater to diverse agricultural practices, such as greenhouse cultivation and soil protection. Market data suggests that the customization segment is likely to experience substantial growth, with projections indicating a potential increase in market share by 10% over the next few years. This shift towards specialization not only enhances product efficacy but also strengthens customer loyalty, as farmers increasingly rely on tailored solutions to optimize their agricultural outputs.