Expansion of Aerospace Industry

The aerospace service robotic Market is poised for growth due to the expansion of the aerospace sector itself. With increasing air travel demand and the rise of new aerospace projects, there is a corresponding need for efficient maintenance and inspection solutions. Service robots are being deployed to meet these demands, facilitating faster turnaround times and improved operational efficiency. As the aerospace industry continues to expand, the reliance on robotic solutions for service tasks is expected to increase, further driving market growth.

Rising Demand for Cost Efficiency

Cost efficiency remains a pivotal driver in the Aerospace Service Robotic Market. Organizations are increasingly seeking ways to minimize operational expenses while maximizing productivity. The deployment of service robots in maintenance and inspection roles can significantly reduce labor costs and downtime. According to recent estimates, companies utilizing robotic solutions have reported up to a 30% reduction in maintenance costs. This trend is likely to continue as more aerospace firms recognize the financial benefits of integrating robotics into their operations, thereby propelling market growth.

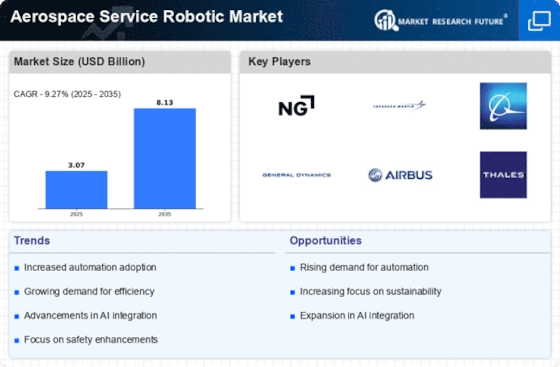

Technological Advancements in Robotics

The Aerospace Service Robotic Market is experiencing a surge in technological advancements, particularly in artificial intelligence and machine learning. These innovations enhance the capabilities of service robots, allowing for more efficient and precise operations in maintenance and inspection tasks. For instance, the integration of AI algorithms enables robots to analyze vast amounts of data, leading to improved decision-making processes. As a result, the market is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is driven by the increasing demand for automation in aerospace operations, which reduces human error and operational costs.

Growing Focus on Predictive Maintenance

Predictive maintenance is becoming a cornerstone of operational strategies within the Aerospace Service Robotic Market. By leveraging advanced analytics and robotics, companies can anticipate equipment failures before they occur, thereby minimizing unplanned downtime. This proactive approach not only enhances safety but also optimizes maintenance schedules, leading to improved asset utilization. The market for predictive maintenance solutions is projected to expand significantly, as organizations increasingly recognize the value of integrating robotics into their maintenance frameworks.

Regulatory Compliance and Safety Standards

The Aerospace Service Robotic Market is heavily influenced by stringent regulatory compliance and safety standards. As the aerospace sector evolves, regulatory bodies are implementing more rigorous safety protocols to ensure the reliability of aircraft operations. Service robots play a crucial role in adhering to these standards by conducting thorough inspections and maintenance tasks that enhance safety. The increasing emphasis on compliance is expected to drive the adoption of robotic solutions, as companies strive to meet regulatory requirements while maintaining operational efficiency.