Global Defense Spending

Market Growth Projections

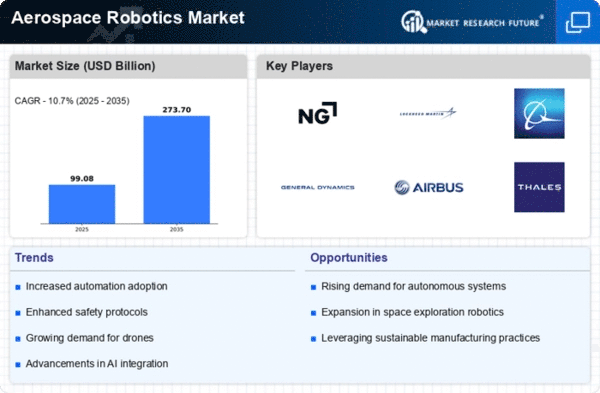

The Global aerospace robotics Market Industry is poised for substantial growth, with projections indicating a market size of 15.0 USD Billion in 2024 and an anticipated increase to 54.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 12.49% from 2025 to 2035. Such figures reflect the increasing integration of robotics in aerospace applications, driven by technological advancements and rising demand for automation. The market's expansion is likely to be supported by investments in research and development, as well as government initiatives aimed at fostering innovation in aerospace technologies.

Sustainability Initiatives

Sustainability initiatives are increasingly influencing the Global Aerospace Robotics Market Industry. As environmental concerns gain prominence, aerospace companies are seeking ways to reduce their carbon footprint and enhance energy efficiency. Robotics plays a crucial role in this transition by optimizing manufacturing processes and minimizing waste. For example, robotic systems can be programmed to use materials more efficiently, thereby reducing excess and promoting recycling. The emphasis on sustainability is likely to drive innovation in aerospace robotics, aligning with global efforts to achieve greener manufacturing practices. This trend may contribute to sustained growth in the market as companies prioritize eco-friendly solutions.

Technological Advancements

The Global Aerospace Robotics Market Industry is experiencing rapid technological advancements that enhance the capabilities of robotic systems. Innovations in artificial intelligence, machine learning, and sensor technologies are enabling robots to perform complex tasks with greater precision and efficiency. For instance, the integration of AI-driven analytics allows for predictive maintenance, reducing downtime and operational costs. As a result, the market is projected to reach 15.0 USD Billion in 2024, reflecting the growing demand for sophisticated robotic solutions in aerospace manufacturing and maintenance. These advancements not only improve productivity but also contribute to the overall safety and reliability of aerospace operations.

Increased Demand for Automation

The Global Aerospace Robotics Market Industry is witnessing a surge in demand for automation across various aerospace sectors. As manufacturers strive to enhance productivity and reduce labor costs, the adoption of robotic systems becomes increasingly appealing. Automation facilitates faster production cycles and minimizes human error, which is crucial in the highly regulated aerospace environment. This trend is expected to drive the market's growth significantly, with projections indicating a rise to 54.9 USD Billion by 2035. The shift towards automation is further supported by government initiatives promoting advanced manufacturing technologies, thereby fostering a conducive environment for robotics integration.

Regulatory Compliance and Safety Standards

Regulatory compliance and stringent safety standards are pivotal drivers in the Global Aerospace Robotics Market Industry. Aerospace manufacturers are mandated to adhere to rigorous safety protocols, which necessitate the use of advanced robotic systems that can ensure compliance. Robotics not only enhances the accuracy of manufacturing processes but also aids in maintaining high safety standards during assembly and maintenance operations. As the industry evolves, the need for compliance with international regulations is likely to propel the adoption of robotics, thereby contributing to the market's growth. This focus on safety and compliance is expected to be a key factor in the industry's trajectory.