Market Trends

Introduction

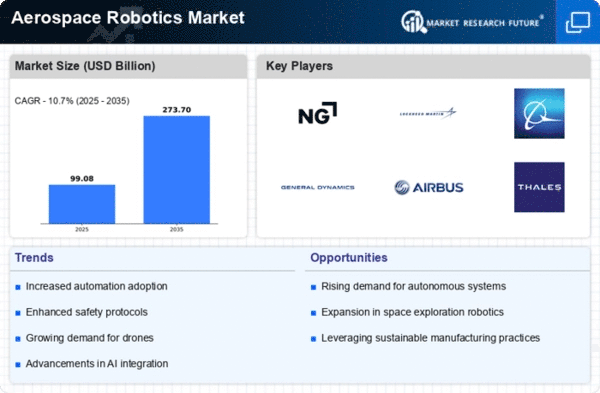

As we enter 2024, the Aerospace Robotics market is poised for significant transformation driven by a confluence of macro factors. Technological advancements, particularly in artificial intelligence and machine learning, are enhancing the capabilities of robotic systems, enabling greater precision and efficiency in aerospace manufacturing and maintenance. Concurrently, regulatory pressures aimed at improving safety and sustainability are compelling stakeholders to adopt innovative robotic solutions that comply with evolving standards. Additionally, shifts in consumer behavior, characterized by a growing demand for customized and rapid production, are pushing aerospace companies to integrate more flexible and adaptive robotic systems. Understanding these trends is crucial for stakeholders, as they not only shape competitive strategies but also influence investment decisions and operational efficiencies in the aerospace sector.

Top Trends

-

Increased Automation in Manufacturing

Aerospace manufacturers are increasingly adopting automation to enhance production efficiency. Companies like Boeing have reported a 30% reduction in assembly time through robotic integration. This trend is driven by the need for precision and consistency in manufacturing processes. As automation technology advances, we can expect further reductions in labor costs and increased output. Future developments may include fully automated assembly lines, minimizing human intervention. -

Collaborative Robotics

The rise of collaborative robots (cobots) is transforming aerospace operations, allowing human workers and robots to work side by side. For instance, Airbus has implemented cobots in its assembly lines, improving safety and productivity. Statistics show that cobots can increase efficiency by up to 85% in certain tasks. This trend is expected to grow as technology improves, leading to more flexible and adaptive manufacturing environments. -

Advanced AI Integration

Artificial intelligence is becoming integral to aerospace robotics, enhancing decision-making and operational efficiency. Companies like Lockheed Martin are utilizing AI for predictive maintenance, reducing downtime by 20%. The integration of AI allows for smarter robots that can learn and adapt to new tasks. Future implications include the development of fully autonomous systems capable of complex problem-solving in real-time. -

Enhanced Safety Protocols

Safety remains a top priority in aerospace robotics, with new protocols being developed to protect workers and equipment. The FAA has mandated stricter safety regulations, prompting companies to invest in advanced safety features for robots. Data indicates that implementing these protocols can reduce workplace accidents by up to 40%. Future advancements may lead to robots equipped with real-time hazard detection systems. -

Sustainability Initiatives

Sustainability is becoming a key focus in aerospace robotics, with companies aiming to reduce their carbon footprint. For example, Boeing has committed to using eco-friendly materials in its robotic systems. Research shows that sustainable practices can lead to a 25% reduction in energy consumption. The future may see the development of robots powered by renewable energy sources, further enhancing sustainability efforts. -

3D Printing Integration

The integration of 3D printing with robotics is revolutionizing aerospace manufacturing, allowing for rapid prototyping and production. Companies like GE Aviation are leveraging this technology to produce complex parts more efficiently. Statistics indicate that 3D printing can reduce production time by 70%. Future developments may include fully automated 3D printing systems that operate alongside traditional manufacturing processes. -

Remote Operation Capabilities

The ability to operate robots remotely is gaining traction in aerospace applications, especially in hazardous environments. NASA has successfully utilized remote-controlled robots for space exploration tasks. Data shows that remote operation can increase operational efficiency by 50% in challenging conditions. Future advancements may lead to more sophisticated remote control systems, enabling real-time adjustments and monitoring. -

Data Analytics for Performance Optimization

Data analytics is playing a crucial role in optimizing the performance of aerospace robotics. Companies are using big data to analyze robot performance and maintenance needs, leading to a 15% increase in operational efficiency. This trend is expected to grow as more data is collected and analyzed. Future implications include the development of predictive analytics tools that can foresee maintenance issues before they arise. -

Modular Robotics Systems

The trend towards modular robotics systems is gaining momentum, allowing for customizable and scalable solutions in aerospace. Companies like Kuka AG are developing modular robots that can be easily reconfigured for different tasks. This flexibility can lead to a 20% reduction in setup time for new projects. Future developments may see the rise of fully modular systems that can adapt to various manufacturing needs on-the-fly. -

Focus on Cybersecurity

As aerospace robotics become more interconnected, cybersecurity is becoming a critical concern. Recent incidents have highlighted vulnerabilities in robotic systems, prompting companies to invest in robust cybersecurity measures. Data indicates that 60% of aerospace firms are prioritizing cybersecurity in their robotics strategies. Future developments may include advanced encryption and security protocols to safeguard against cyber threats.

Conclusion: Navigating the Aerospace Robotics Landscape

The competitive dynamics within the Aerospace Robotics market are increasingly characterized by fragmentation, with both legacy and emerging players vying for dominance. Established companies are leveraging their extensive experience and resources to enhance capabilities in AI and automation, while new entrants are focusing on innovative solutions that emphasize sustainability and flexibility. Regional trends indicate a growing emphasis on localized production and supply chain resilience, prompting vendors to adapt their strategies accordingly. As the market evolves, the ability to integrate advanced technologies such as AI and automation will be crucial for leadership, alongside a commitment to sustainable practices. Decision-makers must prioritize partnerships and investments that enhance these capabilities to secure a competitive edge in this rapidly changing landscape.

Leave a Comment