Aerospace Robotics Size

Market Size Snapshot

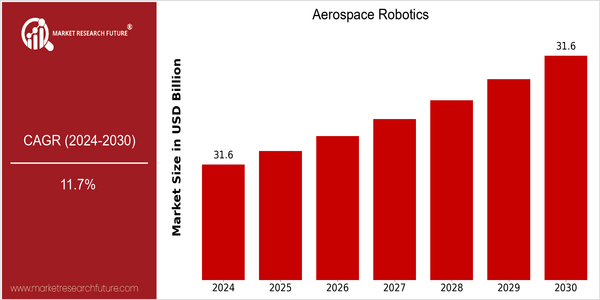

| Year | Value |

|---|---|

| 2024 | USD 31.58 Billion |

| 2030 | USD 31.58 Billion |

| CAGR (2023-2030) | 11.7 % |

Note – Market size depicts the revenue generated over the financial year

The Aerospace Robotics Market is poised for significant growth, with a current market size of USD 31.58 billion in 2024, projected to maintain the same valuation by 2030. This stability, coupled with a robust compound annual growth rate (CAGR) of 11.7% from 2023 to 2030, indicates a dynamic landscape where technological advancements and increased demand for automation in aerospace operations are driving market expansion. The consistent market size reflects a maturation phase where innovation and efficiency are paramount, suggesting that while the market is stabilizing, the underlying growth drivers remain strong.

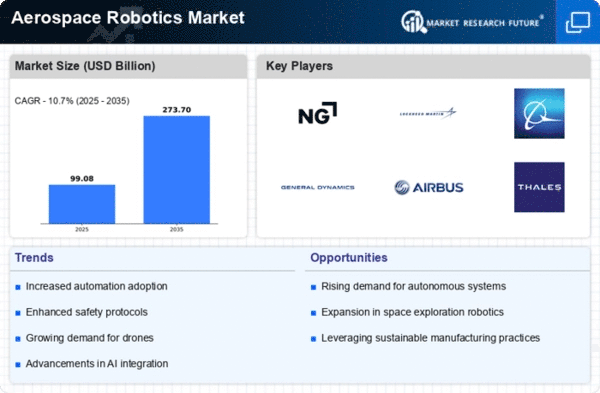

Key factors propelling this market include the rising adoption of automation technologies, advancements in artificial intelligence, and the increasing need for precision in manufacturing processes. These trends are complemented by strategic initiatives from leading companies such as Boeing, Lockheed Martin, and Northrop Grumman, which are investing heavily in robotics to enhance production capabilities and reduce operational costs. Collaborations and partnerships within the industry further amplify innovation, as seen in recent joint ventures aimed at developing next-generation robotic systems tailored for aerospace applications. As the sector evolves, the integration of robotics is expected to redefine operational efficiencies and safety standards, solidifying its critical role in the future of aerospace manufacturing and maintenance.

Regional Market Size

Regional Deep Dive

The Aerospace Robotics Market is experiencing significant growth across various regions, driven by advancements in automation, increasing demand for efficiency, and the need for precision in aerospace manufacturing. Each region exhibits unique characteristics influenced by technological innovation, regulatory frameworks, and economic conditions. North America leads in technological advancements and investment, while Europe focuses on regulatory compliance and sustainability. Asia-Pacific is rapidly expanding due to increasing production capacities and investments in robotics technology. The Middle East and Africa are emerging markets with growing interest in aerospace capabilities, and Latin America is gradually adopting robotics to enhance its aerospace sector.

Europe

- The European Union has introduced the Horizon Europe program, which funds research and innovation in robotics, including projects focused on aerospace applications, promoting collaboration among member states.

- Companies like Airbus are pioneering the use of collaborative robots (cobots) in their production lines, enhancing worker safety and productivity while adhering to stringent EU regulations on workplace safety.

Asia Pacific

- China's government has set ambitious goals for its aerospace sector, including significant investments in robotics technology to boost domestic production capabilities and reduce reliance on foreign technology.

- Japan is leading in the development of advanced robotic systems for aerospace applications, with companies like Kawasaki Heavy Industries focusing on automation solutions for aircraft manufacturing.

Latin America

- Brazil is investing in aerospace robotics through initiatives like the Brazilian Aerospace Innovation Program, which aims to modernize its aerospace industry and improve competitiveness.

- Local companies are beginning to adopt robotics for maintenance and repair operations, driven by the need for efficiency and cost reduction in the aerospace sector.

North America

- The U.S. government has launched initiatives like the Advanced Robotics for Manufacturing (ARM) Institute, which aims to accelerate the adoption of robotics in aerospace manufacturing, fostering collaboration between industry and academia.

- Major aerospace companies such as Boeing and Lockheed Martin are investing heavily in robotics for assembly and maintenance processes, leading to increased efficiency and reduced labor costs.

Middle East And Africa

- The UAE has launched the 'Aerospace 2030' strategy, which includes investments in robotics to enhance its aerospace manufacturing capabilities and position itself as a global aerospace hub.

- South Africa is seeing increased interest in aerospace robotics, with local companies exploring partnerships with international firms to develop advanced manufacturing technologies.

Did You Know?

“Did you know that the use of robotics in aerospace manufacturing can reduce production time by up to 30%, significantly enhancing overall efficiency?” — International Federation of Robotics (IFR)

Segmental Market Size

The Aerospace Robotics Market is experiencing robust growth, driven by advancements in automation and the increasing demand for efficiency in manufacturing processes. Key factors propelling this segment include the need for precision in assembly and maintenance tasks, as well as regulatory pressures for enhanced safety and operational efficiency. Companies like Boeing and Airbus are investing heavily in robotic solutions to streamline production lines and reduce human error, reflecting a strong trend towards automation in aerospace manufacturing.

Currently, the adoption of aerospace robotics is in the scaled deployment stage, with notable projects in regions such as North America and Europe leading the way. For instance, the integration of collaborative robots (cobots) in assembly lines has become commonplace, enhancing productivity while ensuring worker safety. Primary applications include automated inspection, assembly, and maintenance of aircraft components. Trends such as sustainability initiatives and the push for greener technologies further catalyze growth, as aerospace companies seek to minimize waste and energy consumption. Technologies like artificial intelligence and machine learning are also shaping the evolution of this segment, enabling smarter, more adaptive robotic systems.

Future Outlook

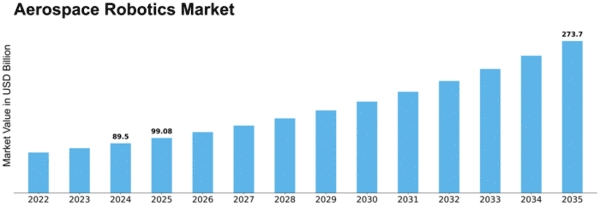

The Aerospace Robotics market is poised for significant growth from 2024 to 2030, with a projected compound annual growth rate (CAGR) of 11.7%. This growth trajectory is expected to elevate the market value from $31.58 billion in 2024 to approximately $61.5 billion by 2030. The increasing demand for automation in manufacturing processes, coupled with the need for enhanced precision and efficiency in aerospace operations, will drive the adoption of robotics technologies across the sector. As aerospace companies strive to meet rising production targets and improve safety standards, the integration of robotics will become essential in streamlining operations and reducing human error.

Key technological advancements, such as artificial intelligence (AI), machine learning, and advanced sensor technologies, will play a pivotal role in shaping the future of aerospace robotics. These innovations will enable more sophisticated robotic systems capable of performing complex tasks, from assembly to maintenance. Additionally, supportive government policies aimed at fostering innovation and investment in aerospace technologies will further accelerate market growth. Emerging trends, including the increasing use of drones for cargo delivery and inspection, as well as the development of autonomous aircraft, will also contribute to the expanding landscape of aerospace robotics, positioning the market for robust expansion through the end of the decade.

Leave a Comment