Market Analysis

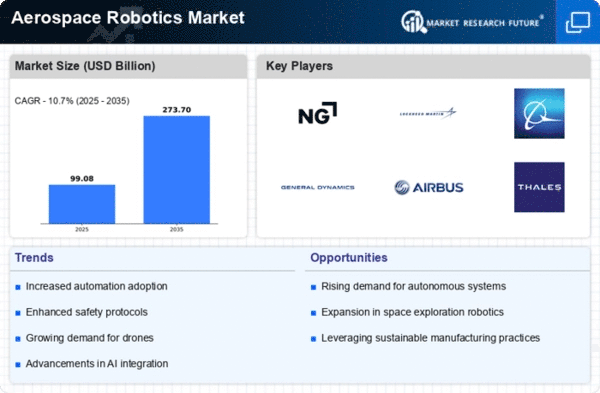

Aerospace Robotics (Global, 2024)

Introduction

The Aerospace Robotics market is poised to undergo significant transformation as advancements in technology and increasing demand for automation reshape the landscape of the aerospace industry. With the integration of artificial intelligence, machine learning, and advanced materials, aerospace robotics is becoming a critical component in enhancing operational efficiency, safety, and precision in various applications, including manufacturing, maintenance, and exploration. The growing emphasis on reducing human error and improving productivity is driving the adoption of robotic systems in both commercial and military aerospace sectors. As companies strive to innovate and remain competitive, the role of robotics in streamlining processes, optimizing supply chains, and enabling complex tasks in challenging environments is becoming increasingly vital. This report delves into the current trends, challenges, and opportunities within the Aerospace Robotics market, providing a comprehensive analysis of the factors influencing its evolution and the strategic initiatives undertaken by key players in the industry.

PESTLE Analysis

- Political

- In 2024, the aerospace robotics market is heavily influenced by government policies aimed at enhancing national security and technological advancement. The U.S. government has allocated approximately $1.5 billion for research and development in aerospace technologies, which includes robotics, as part of its defense budget. Additionally, international collaborations, such as the European Union's Horizon Europe program, have earmarked €95 billion for research and innovation, with a focus on sustainable aerospace technologies, further driving political support for the sector.

- Economic

- The economic landscape for aerospace robotics in 2024 is characterized by increased investment in automation and robotics technologies. The global aerospace sector is projected to spend around $3.2 billion on robotics solutions, reflecting a growing trend towards automation in manufacturing and maintenance processes. Furthermore, the labor market is expected to see a demand for approximately 50,000 skilled workers in robotics and automation within the aerospace industry, highlighting the economic shift towards high-tech job creation.

- Social

- Social factors are increasingly shaping the aerospace robotics market, particularly in terms of public perception and workforce dynamics. A survey conducted in early 2024 indicated that 68% of respondents believe that robotics will enhance safety and efficiency in air travel. Additionally, educational institutions are responding to this trend, with over 200 universities worldwide offering specialized programs in aerospace robotics, aiming to prepare the next generation of engineers and technicians for this evolving field.

- Technological

- Technological advancements are at the forefront of the aerospace robotics market in 2024, with significant innovations in artificial intelligence and machine learning. The integration of AI in robotics is expected to improve operational efficiency by up to 30%, particularly in predictive maintenance and autonomous flight systems. Moreover, the development of advanced materials, such as lightweight composites, is projected to reduce the weight of robotic systems by 15%, enhancing their performance and fuel efficiency.

- Legal

- Legal frameworks governing the aerospace robotics market are becoming more stringent, particularly concerning safety and compliance standards. In 2024, the Federal Aviation Administration (FAA) has implemented new regulations requiring all autonomous drones used in commercial aerospace applications to comply with a set of 12 safety standards. This regulatory environment is designed to ensure the safe integration of robotics into airspace, impacting manufacturers and operators alike.

- Environmental

- Environmental considerations are increasingly influencing the aerospace robotics market, with a strong emphasis on sustainability. In 2024, the International Air Transport Association (IATA) has set a target for the aviation industry to reduce carbon emissions by 50% by 2050, prompting the adoption of eco-friendly robotic technologies. Additionally, the use of robotics in manufacturing processes is expected to decrease waste by approximately 20%, aligning with global sustainability goals and reducing the environmental footprint of the aerospace sector.

Porter's Five Forces

- Threat of New Entrants

- Medium - The aerospace robotics market has significant barriers to entry, including high capital requirements, advanced technological expertise, and stringent regulatory standards. However, advancements in technology and increasing interest from startups may lower these barriers slightly, allowing new entrants to emerge.

- Bargaining Power of Suppliers

- Low - The suppliers in the aerospace robotics market are relatively numerous, and many components can be sourced from multiple vendors. This abundance reduces the bargaining power of suppliers, as manufacturers can switch suppliers without significant cost or disruption.

- Bargaining Power of Buyers

- High - Buyers in the aerospace sector, including large aerospace manufacturers and government agencies, hold substantial bargaining power due to their size and the volume of purchases. They can negotiate favorable terms and prices, especially as competition among suppliers increases.

- Threat of Substitutes

- Medium - While there are alternative technologies that can perform similar functions, such as traditional automation and manual processes, the unique capabilities of aerospace robotics, such as precision and efficiency, limit the threat of substitutes. However, advancements in alternative technologies could pose a risk.

- Competitive Rivalry

- High - The aerospace robotics market is characterized by intense competition among established players and new entrants. Companies are constantly innovating and investing in R&D to gain a competitive edge, leading to a highly dynamic and competitive environment.

SWOT Analysis

Strengths

- High precision and reliability in manufacturing and maintenance processes.

- Increased automation leading to reduced labor costs and improved efficiency.

- Strong investment from both government and private sectors in aerospace technology.

- Advancements in AI and machine learning enhancing robotic capabilities.

Weaknesses

- High initial investment costs for robotics integration.

- Limited availability of skilled workforce to operate and maintain advanced robotics.

- Potential resistance to change from traditional manufacturing practices.

- Complexity in integrating robotics with existing aerospace systems.

Opportunities

- Growing demand for unmanned aerial vehicles (UAVs) and drones in various sectors.

- Expansion of aerospace markets in emerging economies.

- Potential for partnerships with tech companies to innovate new robotic solutions.

- Increased focus on sustainability and eco-friendly technologies in aerospace.

Threats

- Rapid technological advancements leading to obsolescence of current systems.

- Intense competition from global players in the aerospace robotics sector.

- Regulatory challenges and compliance issues in different regions.

- Economic downturns affecting funding and investment in aerospace projects.

Summary

The Aerospace Robotics Market in 2024 is characterized by significant strengths such as high precision and strong investment, but it also faces challenges like high costs and a skilled labor shortage. Opportunities abound in the growing UAV sector and emerging markets, while threats from competition and regulatory hurdles could impact growth. Strategic partnerships and a focus on innovation will be crucial for companies to navigate this dynamic landscape.

Leave a Comment