Growth of the Aerospace Industry

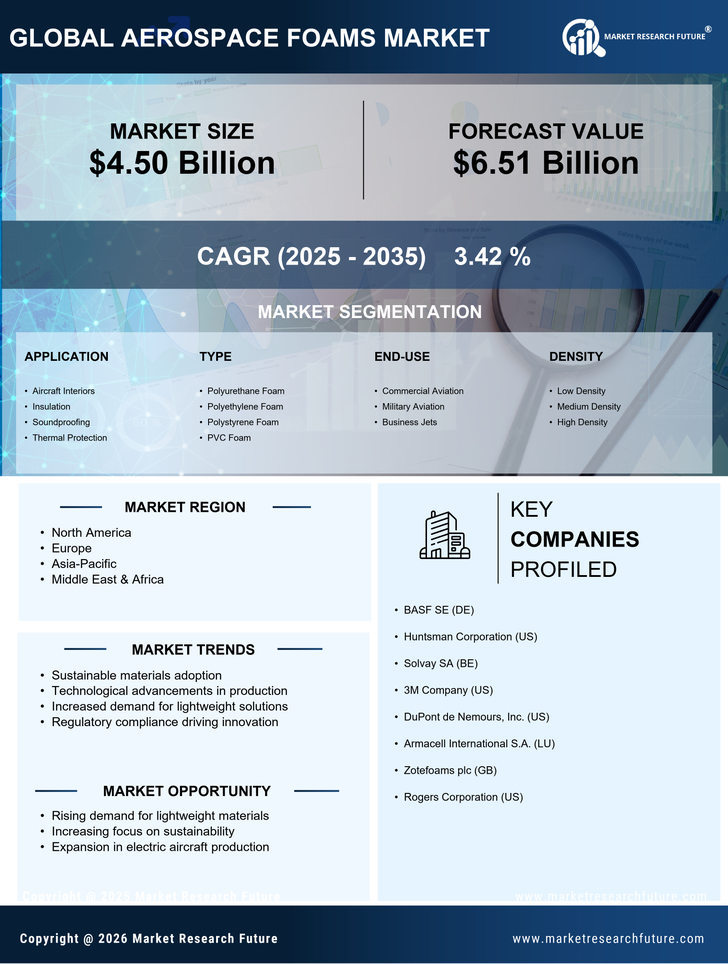

The Aerospace Foams Market is poised for expansion, largely due to the robust growth of the aerospace sector. With increasing air travel demand and the expansion of commercial and military aircraft fleets, the need for high-performance foams is escalating. Recent projections indicate that the commercial aviation market is expected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next decade. This growth is anticipated to drive the demand for lightweight and durable foams used in various applications, including seating, insulation, and soundproofing. As manufacturers respond to this burgeoning demand, the Aerospace Foams Market is likely to witness significant advancements in product offerings and innovations, further solidifying its position within the aerospace supply chain.

Regulatory Compliance and Safety Standards

The Aerospace Foams Market is heavily influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-performance foams that meet specific fire resistance, toxicity, and durability criteria. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have established guidelines that dictate the materials used in aircraft interiors. Compliance with these regulations not only ensures passenger safety but also enhances the marketability of aircraft. As manufacturers strive to meet these evolving standards, the demand for specialized aerospace foams that adhere to safety protocols is expected to rise. This trend underscores the critical role of regulatory frameworks in shaping the Aerospace Foams Market and driving innovation.

Increasing Demand for Lightweight Materials

The Aerospace Foams Market is experiencing a notable surge in demand for lightweight materials, driven by the aerospace sector's ongoing quest for fuel efficiency and performance enhancement. Lightweight foams, such as polyurethane and polyethylene, are increasingly utilized in aircraft interiors and structural components. This shift is largely influenced by regulatory pressures aimed at reducing carbon emissions, which compel manufacturers to adopt materials that contribute to overall weight reduction. According to recent data, the aerospace industry aims to achieve a 20% reduction in weight for new aircraft designs by 2030, thereby propelling the demand for advanced foams. As a result, the Aerospace Foams Market is poised for growth, as manufacturers innovate to meet these stringent requirements while ensuring safety and durability.

Technological Innovations in Foam Production

Technological advancements in foam production processes are significantly impacting the Aerospace Foams Market. Innovations such as 3D printing and advanced molding techniques are enabling manufacturers to create complex geometries and customized foam solutions that cater to specific aerospace applications. These technologies not only enhance the performance characteristics of foams, such as thermal insulation and impact resistance, but also streamline production processes, reducing lead times and costs. The integration of smart materials, which can respond to environmental changes, is also gaining traction within the industry. As these technologies evolve, they are likely to redefine the standards of performance and efficiency in the Aerospace Foams Market, attracting investments and fostering competitive advantages among key players.

Focus on Sustainability and Eco-Friendly Materials

Sustainability is becoming a pivotal focus within the Aerospace Foams Market, as manufacturers increasingly prioritize eco-friendly materials and practices. The aerospace sector is under pressure to reduce its environmental footprint, prompting a shift towards sustainable foam solutions made from renewable resources or recycled materials. This trend is reflected in the growing interest in bio-based foams, which offer comparable performance characteristics to traditional foams while minimizing environmental impact. Additionally, manufacturers are exploring end-of-life solutions for foam products, such as recycling and repurposing, to align with circular economy principles. As sustainability initiatives gain momentum, the Aerospace Foams Market is likely to evolve, with companies that embrace eco-friendly practices potentially gaining a competitive edge in the marketplace.