Research Methodology on Polyurethane Foam Market

Introduction:

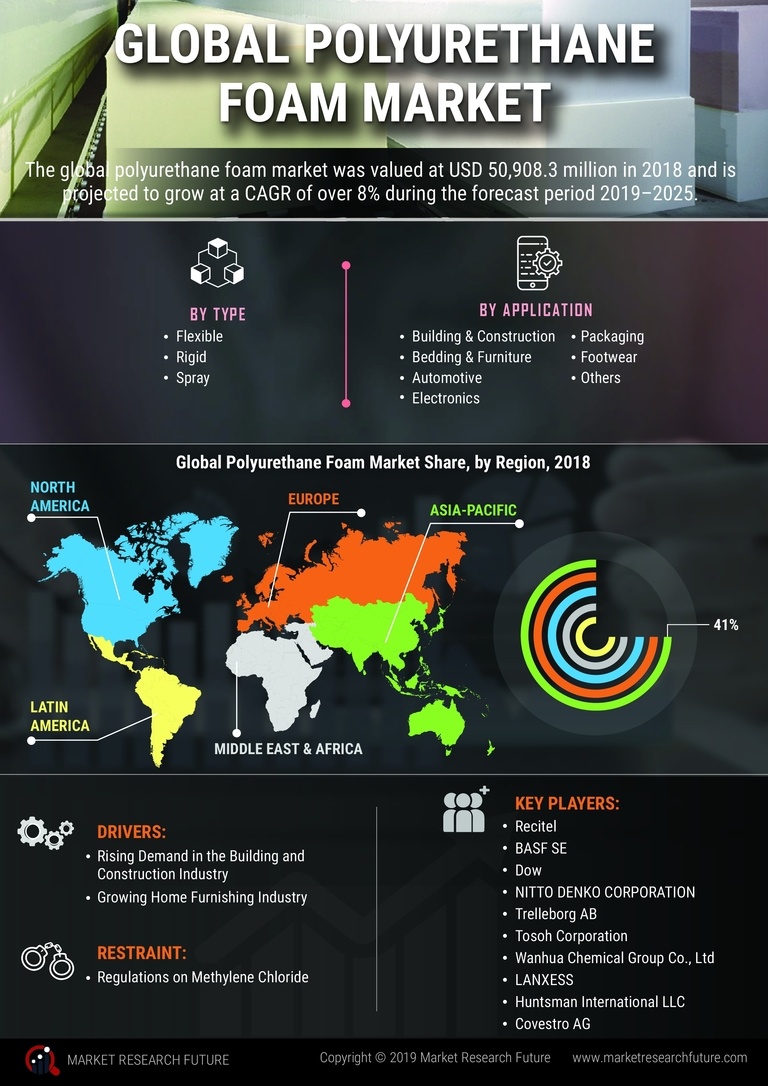

Polyurethane foam is a type of plastic foam that is widely used in a variety of industries. It is extremely versatile and is often used to manufacture furniture, upholstery, insulation, car interiors, and more. It is also a popular material in the automotive and medical industries. The global polyurethane foam market has been largely driven by the increasing demand for comfort and safety in luxury vehicles and medical equipment, which are now replacing traditional materials such as steel and wood. This research is aimed at studying the global polyurethane foam market and investigating factors such as size, growth, competitive landscape, trends, and product segmentation.

Objectives:

The primary objective of this research is to understand the global polyurethane foam market. This includes understanding the size of the market, analyzing the trends that are driving the demand for polyurethane foam, product segmentation, identifying the leading players in the market, and analyzing the competitive landscape.

Research Methodology:

This research involves the collection and analysis of data and information related to the global polyurethane foam market. The data will be collected from both primary and secondary sources. Primary sources of data include published research reports and interviews with industry experts, while secondary sources include online databases such as Bloomberg, Business Wire, Factiva, and Hoovers.

Data Collection:

The data for this research will be collected using two primary methods: secondary data from published reports and interviews with industry experts. The secondary data will include published research reports related to the global polyurethane foam market. These reports will provide information on size, market trends, industry forecasts, product segmentation, competitive analysis, and other market parameters.

Data Analysis:

Once the data has been collected, it will be analyzed using a variety of methods. First, the data will be analyzed quantitatively using Excel and other analytics tools. This will include the calculation of market size, market growth, market trends, and product segmentation. The qualitative portion of the data analysis will involve the assessment of factors such as competitive landscape, industry trends, and company performance.

Market Forecast:

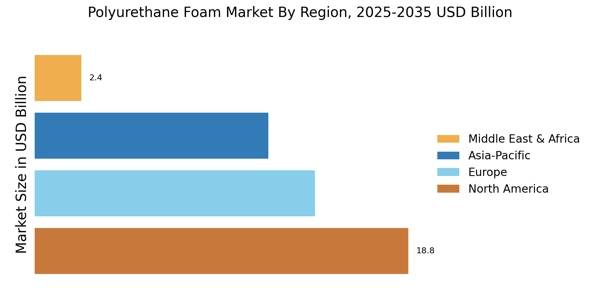

The data and information collected and analyzed will be used to generate a market forecast for 2023 to 2030. The forecast will include a market overview, size, growth rate, trends, market drivers, and competitive analysis. It will also provide a profile of the top companies in the market, their products, and their contribution to the overall market size.

Conclusion:

The above research methodology will provide a thorough understanding of the global polyurethane foam market. Data from both primary and secondary sources will be collected, analyzed, and used to generate a market forecast. The data and information from this research will provide a comprehensive picture of the market, enabling stakeholders to make informed decisions.