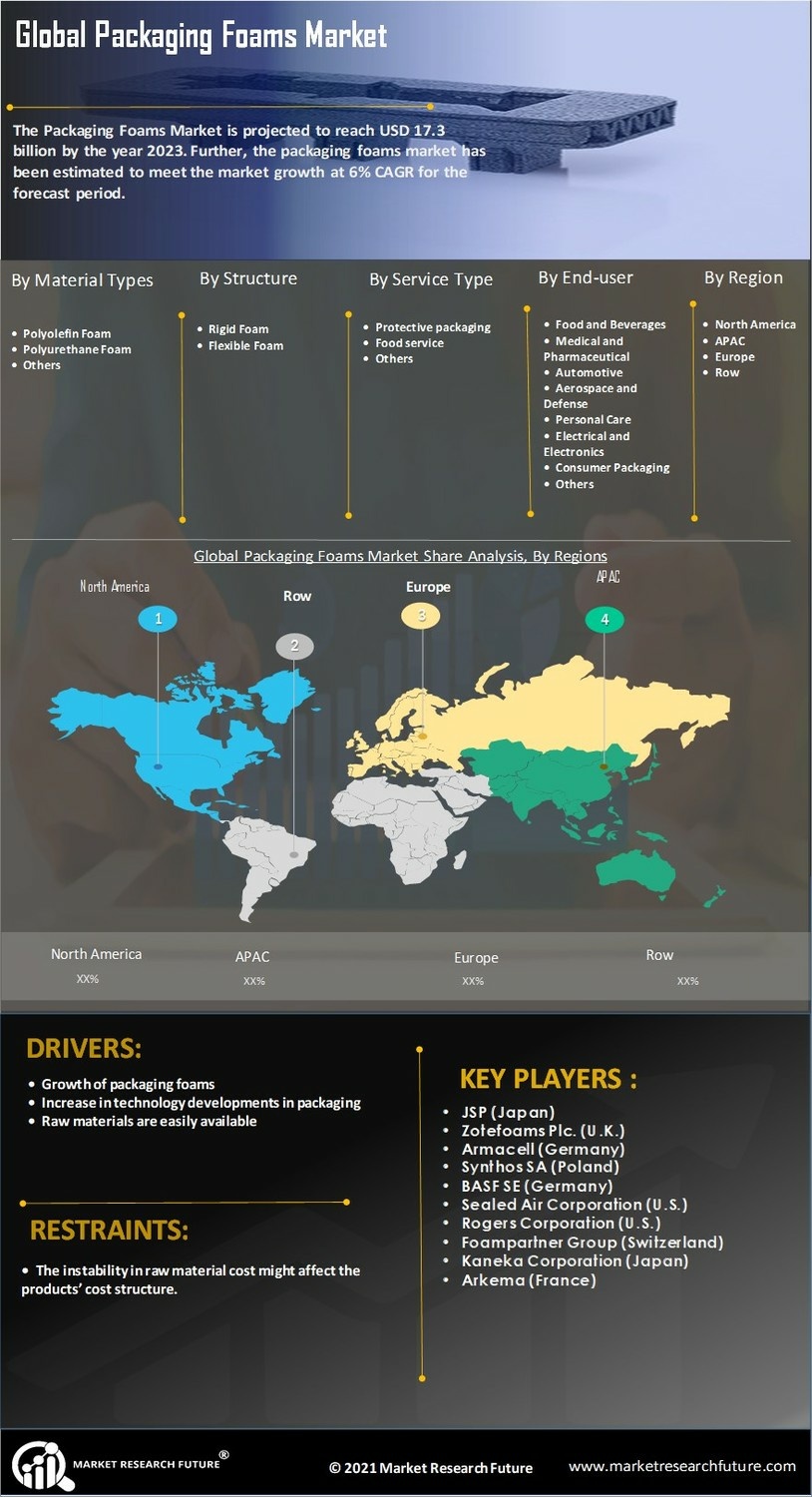

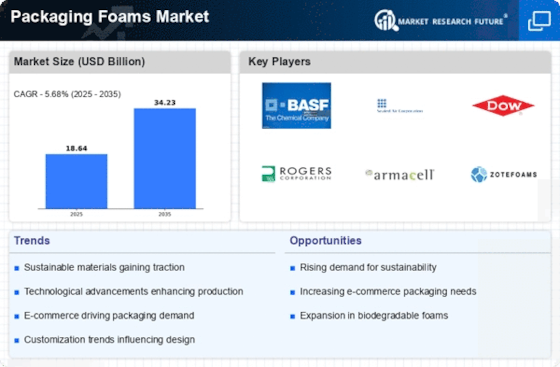

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Packaging Foams Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Packaging Foamsindustry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Packaging Foams industry to benefit clients and increase the market sector. In recent years, the Packaging Foams industry has offered some of the most significant advantages to medicine. Major players in the Packaging Foams Market, including Synthos SA (Poland), Rogers Corporation (U.S.), Kaneka Corporation (Japan), Arkema (France), and Foampartner Group (Switzerland) and others, are attempting to increase market demand by investing in research and development operations. Zotefoams Plc produces closed cell crosslinked foams from polyolefins and engineering polymers for usage in sports, construction, marine, automation, medical equipment, and aerospace around the world. The company's headquarters are in Croydon, London, and it has foam manufacturing operations in Kentucky, the United States, and Brzeg, Poland. The current chairman is Steve Good, the managing director is David Stirling, and the finance director is Gary McGrath. In 1992, the company was spun off from BP Chemicals. It began manufacturing block foam in the 1920s. The majority of the company's sales come from exporting to other countries, and it has a number of registered trademarks. In February 2021, Zoatfoams announced the virtual opening of its new factory in Brzeg, Poland. With a designed capacity of 13,000 metre square, the new plant adds 50,000 metre cubes of annual foam production to the company, expanding worldwide capacity and optimising service level for its European customers. Armacell is a Luxembourg-based manufacturer and provider of industrial foams and flexible insulation materials. It employs about 3,135 people and operates 25 manufacturing sites in 16 countries. Armacell was Armstrong World Industries' insulator manufacturing division until a management buyout in June 2000. When Armstrong World Industries began producing insulated corkboard and brick in 1899, founder Thomas Armstrong established the division. In 1954, the business achieved success with the introduction of Armaflex, a flexible technical insulator for pipe connections. In August 2022, Armacell unveiled the ArmaGel HTL, a non-combustible aerogel blanket developed for industrial applications requiring corrosion under insulation mitigation, thermal performance, and non-combustibility.